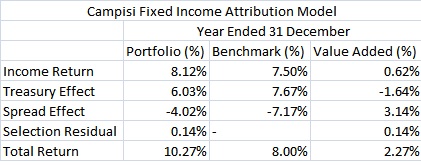

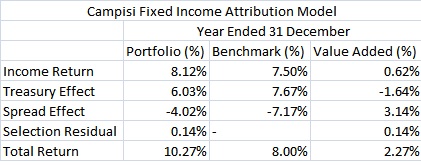

by admin | Oct 5, 2011 | Campisi model, CIPM, CIPM expert, fixed income attribution

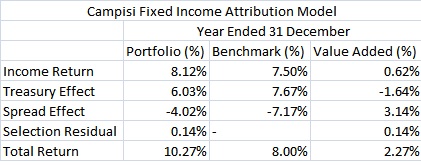

Question #15 from the Expert Level Sample Exam is with respect to the data in the table shown above, and reads:15. Tom Styles, the head of performance measurement at Signal Investment Management, uses a sector allocation/security selection attribution model for both...

by admin | Oct 4, 2011 | Investment Performance Guy, News

TSG’s official October webinar (yesterday’s was actually for September; John Simpson had an extremely busy month, which included a trip to the Middle East to conduct training) will be GIPS(R) (Global Investment Performance Standards) fundamentals, that...

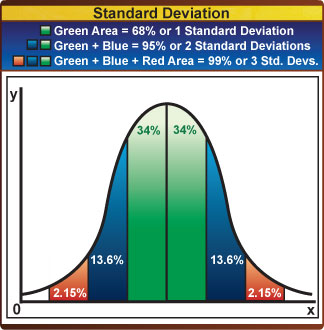

by admin | Oct 4, 2011 | CIPM, CIPM expert, CIPM Principles, composite dispersion, external dispersion, GIPS, internal dispersion, Standard Deviation, TI BA II Plus, tracking error

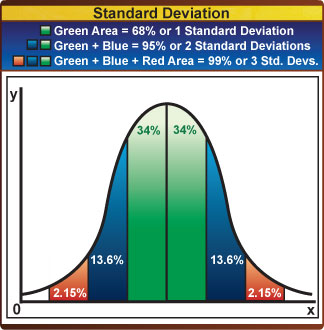

CIPM candidates are required to be able to calculate standard deviations for several purposes, including:the dispersion of annual portfolio returns within a composite (internal dispersion)the variability of a composite’s past 36 months of returns (external...

by admin | Oct 3, 2011 | risk

When Herb Chain (of Deloitte), Matt Forstenhausler (of E&Y), and I used to regularly teach AIMR-PPS(R) and then GIPS(R) courses (first for AIMR, then for the CFA Institute), one thing we could be sure of: Herb would reference former U.S. Supreme Court...

by admin | Oct 2, 2011 | CIPM, CIPM exam prep, CIPM expert, CIPM Principles, GIPS, TSG

On this coming Monday, October 3, 2011, I will be hosting our next webcast, which will be an open Q & A (question and answer) session for candidates preparing for the CIPM exams (both Principles Level and Expert Level).The session is free for CIPM candidates that...