Issue Contents:

The Performance Professional:

Highlights from the 2024 Survey

Summary: Patrick W. Fowler

The Spaulding Group (TSG), with support from Rimes Technologies, has released the results of the 2024 Performance Measurement Professional Survey, the third installment of this industry-wide analysis since its inception in 2000. With responses from over 100 professionals across North America, Europe, and Asia-Pacific, the survey provides a comprehensive view of the evolving roles, challenges, and opportunities in performance measurement.

Key Findings:

1. A Growing and Diverse Workforce

- Teams are becoming more diverse, with women now making up 45.8% of performance measurement staff, compared to 31.5% in 2008.

- Multi-person teams dominate, representing 79.2% of respondents’ organizations, reflecting the increasing specialization within performance and risk roles.

2. Advancing Compensation and Professional Development

- The average base salary and bonuses for heads of performance measurement and performance analysts has risen.

- Certification is a priority, with 44.3% of heads of performance holding the Certificate in Investment Performance Measurement (CIPM).

3. Focused Responsibilities

- Performance teams primarily handle tasks such as account-level measurement (91.5%), composite-level measurement (86.2%), and compliance with the Global Investment Performance Standards (GIPS®) (64.9%).

- Use of advanced tools like Python, SQL, and even AI applications such as ChatGPT highlights the tech-savviness of today’s performance professionals.

4. Benchmarking and Automation

- 88.9% of respondents use custom and blended benchmarks, with 50% employing some level of automation for data aggregation.

5. Persistent Challenges

- Data management remains a critical issue, with firms struggling with data quality, governance, and integration across systems.

Insights from TSG:

David Spaulding, CEO of The Spaulding Group, comments, “This survey reaffirms the essential role of performance measurement in the investment industry. As the field evolves, these insights equip firms with the data they need to benchmark their practices and innovate effectively.”

The Bigger Picture:

This survey provides a rare glimpse into the professional dynamics of performance measurement, offering valuable comparisons for organizations to enhance their operations and invest in their teams.

Download the full report here.

Quote of the Month

“Change can be frightening, and the temptation is often to resist it. But change almost always provides opportunities – to learn new things, to rethink tired processes, and to improve the way we work.”

– Klaus Schwab

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “How Smart is Your COLA” by Craig Israelsen of Utah Valley University, which was published in the Summer 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

How money is withdrawn from a portfolio has a dramatic impact on the survival of the portfolio as well as the amount of money that is withdrawn over time. This paper analyzes four withdrawal methods: (1) RMD, (2) 5% annual withdrawal, (3) 5% initial withdrawal with a subsequent 3% annual COLA, and (4) 5% initial withdrawal with a subsequent “smart” annual COLA that is dependent on the portfolio’s annual performance.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

2025 Dates Announced for

The Performance Measurement Forum & Asset Owner Roundtable

- April 23 – Spring Asset Owner Roundtable (AORT) – North America

- April 24-25 – Spring Meeting of the Performance Measurement Forum – North America

- June 19-20 – Spring EMEA Meeting of the Performance Measurement Forum – Belfast, Northern Ireland

- November 6-7 – Fall EMEA Meeting of the Performance Measurement Forum – Copenhagen, Denmark

- December 3 – Fall Asset Owner Roundtable (AORT) – North America

- December 4-5 – Fall Meeting of the Performance Measurement Forum – North America

The Performance Measurement Forum has met 107 times over the past 26 years.

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

Contact Patrick Fowler if you would like information about how you can be part of this dynamic group.

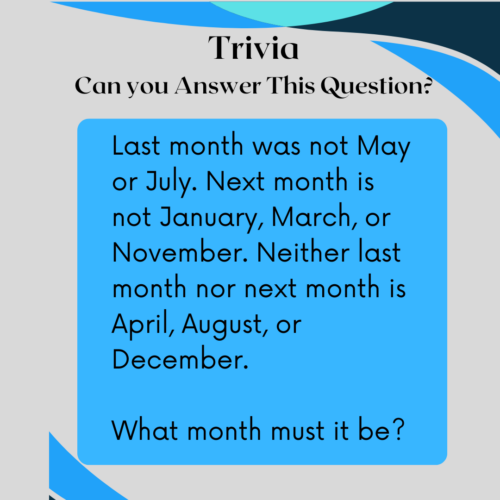

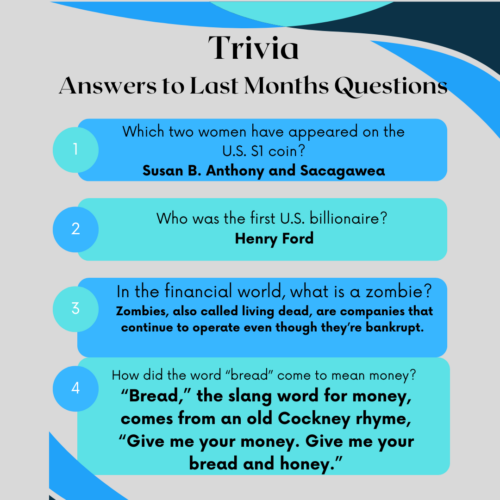

TRIVIA TIME

The Performance Professional:

Highlights from the 2024 Survey

Summary: Patrick W. Fowler

The Spaulding Group (TSG), with support from Rimes Technologies, has released the results of the 2024 Performance Measurement Professional Survey, the third installment of this industry-wide analysis since its inception in 2000. With responses from over 100 professionals across North America, Europe, and Asia-Pacific, the survey provides a comprehensive view of the evolving roles, challenges, and opportunities in performance measurement.

Key Findings:

1. A Growing and Diverse Workforce

- Teams are becoming more diverse, with women now making up 45.8% of performance measurement staff, compared to 31.5% in 2008.

- Multi-person teams dominate, representing 79.2% of respondents’ organizations, reflecting the increasing specialization within performance and risk roles.

2. Advancing Compensation and Professional Development

- The average base salary and bonuses for heads of performance measurement and performance analysts has risen.

- Certification is a priority, with 44.3% of heads of performance holding the Certificate in Investment Performance Measurement (CIPM).

3. Focused Responsibilities

- Performance teams primarily handle tasks such as account-level measurement (91.5%), composite-level measurement (86.2%), and compliance with the Global Investment Performance Standards (GIPS®) (64.9%).

- Use of advanced tools like Python, SQL, and even AI applications such as ChatGPT highlights the tech-savviness of today’s performance professionals.

4. Benchmarking and Automation

- 88.9% of respondents use custom and blended benchmarks, with 50% employing some level of automation for data aggregation.

5. Persistent Challenges

- Data management remains a critical issue, with firms struggling with data quality, governance, and integration across systems.

Insights from TSG:

David Spaulding, CEO of The Spaulding Group, comments, “This survey reaffirms the essential role of performance measurement in the investment industry. As the field evolves, these insights equip firms with the data they need to benchmark their practices and innovate effectively.”

The Bigger Picture:

This survey provides a rare glimpse into the professional dynamics of performance measurement, offering valuable comparisons for organizations to enhance their operations and invest in their teams.

Download the full report here.

Industry Dates and Conferences

2025 Events

- April 23 – Spring Asset Owner Roundtable (AORT) – North America

- April 24-25 – Spring Meeting of the Performance Measurement Forum – North America

- May 20 – Women in Performance Measurement in-person meeting – The Heldrich Hotel, New Brunswick, NJ, U.S.A.

- May 21-22 – PMAR North America – The Heldrich Hotel, New Brunswick, NJ, U.S.A.

- June 19-20 – Spring EMEA Meeting of the Performance Measurement Forum

- September 17-18 – PMAR Europe – London

- November 6-7 – Fall EMEA Meeting of the Performance Measurement Forum

- December 3 – Fall Asset Owner Roundtable (AORT) – North America

- December 4-5 – Fall Meeting of the Performance Measurement Forum – North America

For information on the 2025 events,

please contact Patrick Fowler at 732-873-5700.

Institute / Training

Access TSG’s Online Training

Content With One Pass

That’s a Good Question

I am looking for guidance on how collateral interest for derivatives is handled in terms of performance, but I have not found any reference to it in the GIPS Standards Handbook. Do you know of any document that addresses this topic?

Response:

The person referenced the GIPS standards, but I don’t think the GIPS guidance speaks to this.

If I understand correctly, you are asking about a portfolio that trades derivatives, and thus, has to put up collateral in order to do so.

The total return of a portfolio that puts up collateral to trade derivatives should include income on that collateral. Not sure that I would say it’s a “must,” but it’s what makes sense.

Think of it this way:

- the portfolio is responsible for the collateral

- collateral is typically cash or non-risky fixed income, but could be other assets of value

- If there is a decline in the value of the collateral, the entity enabling the portfolio to trade derivatives will at some point require additional collateral (i.e., a margin call will be made)

-

- Thus, the portfolio is hurt by a loss in value of the collateral

- The portfolio will benefit by an increase in value of the collateral as well.

- Income on the collateral, as well as the collateral’s clean price change, benefit the portfolio

- When the portfolio closes its derivatives trading, collateral will be returned

Different arrangements could be made, and there may be other costs involved, but generally the total return on the futures position can be thought of as the sum of:

- price return

- roll return

- collateral return

Response from John D. Simpson, CIPM, Chief Verification Officer

Please submit your questions to Patrick Fowler.

Potpourri

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: January 13, 2025

Spring Issue: March 10, 2025

Book Review

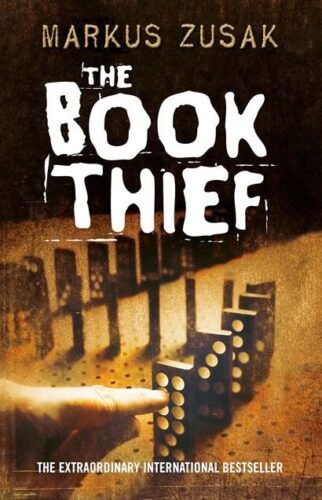

The Book Thief, by Markus Zusak

Review by David D. Spaulding, DPS, CIPM

As is often the case, I cannot say with certainty why I asked for this book for my recent birthday, but I did; and it was purchased for me by my son, Chris, and his family. It’s not a recently published book. My younger son, Doug, told me that his mother, my late wife Betty, read it. I don’t have a recollection of this, but she did read 50-70 books a year, so it would have been impossible to keep up with her.

The book is reportedly a good one. It’s not.

It’s a great one.

And, in many ways.

The story keeps your attention through 552 pages. As with many such stories, as we get closer to the end, it becomes more difficult to put it down. I finished it in just a very few days, but did put a “full court press on” the last two.

The writer’s style is unusual in his use of bolded text to inform the reader of some key information; he does this throughout. He is not hesitant to share what many might consider spoilers (e.g., that Rudy will die, long before he does).

The story takes place in a small town in Germany during World War II. Actually, most of the story takes place on Himmel Street; and, in case you didn’t know, Himmel means Heaven. Its residents are poor, struggling to get by. Markus Zusak questions why anyone would bomb a street named for heaven, but the Allies did.

The story is narrated by Death, and as far as I know, this is the first time this has occurred. Death is quite candid throughout.

Toward the end of the book, I cried: very deeply, and for multiple reasons. One was reading of the deaths of some of the characters. And another, because of how one of these deaths was described: “He was tall in bed and I could see the silver through his eyelids. His soul sat up. It met me. Those kinds of souls always do – the best ones. The ones who rise up and say, ‘I know who you are and I am ready. Not that I want to go, of course, but I will come.’”

This particular statement hit me very personally. I believe Betty had such a soul. She had suffered through nine years of IPF, idiopathic pulmonary fibrosis. In the end, after much prodding, treatments, tests, and invasive procedures, she was ready. We talked about it one night: I asked her if she was ready to die, and she said she was. She would have uttered those very words: that she didn’t want to go, but that she was ready.

I suspect that this story might offer comfort to others who have lost loved ones. To imagine that Death does, in fact, meet them to claim their souls and take them upwards: to where, the author doesn’t say. But the descriptions are often done in a very respectful and touching way.

When I lost my wife, four-plus years ago, I read several grief books. While this isn’t a grief book, it still provides a degree of comfort.

Germany during WWII, of course, also had scenes involving Jews, and the author addresses this, in a manner that provides the reader with some insights into the tragedy that occurred.

Do I recommend this book? What do you think?

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.