Issue Contents:

Guidance Statement for OCIO Portfolios – TSG’s Key Takeaways and Summary

Author: Jennifer Barnette, CIPM

The CFA Institute has introduced a new Guidance Statement specifically for Outsourced Chief Investment Officer (OCIO) firms, providing a tailored framework designed specifically for OCIOs under the broader Global Investment Performance Standards (GIPS®). The customized nature of the framework is intended to address the unique challenges and responsibilities faced by certain OCIO firms in implementing the GIPS standards. The guidance should help OCIO firms understand how to structure composites, report performance in a GIPS report, and classify assets or asset types. All of which results in a seemingly significant step in comparability across OCIO firms.

This guidance becomes effective on December 31, 2025, and will be mandatory for firms providing OCIO services and claiming compliance with the GIPS standards. Firms claiming compliance with the GIPS standards must adhere to all relevant requirements of the GIPS Standards for Firms, as well as the applicable provisions in the Guidance Statement for OCIO Portfolios, when presenting a GIPS Report to a prospective OCIO Portfolio client. In our public comment in response to the exposure draft, we recommended the CFA Institute provide more time for implementing the guidance, but believed an effective date 12 months after the issue date would be the minimum that firms already claiming compliance with the GIPS standards would need to implement any necessary changes.

One of the key changes from the exposure draft to the final guidance is the clarification of who the guidance applies to, which was an area we thought needed clarity. The final version addresses industry feedback by clarifying the scope and specifying who is covered by the guidance, replacing “institutional investor” in the exposure draft with “asset owner” in the final guidance. Asset owner is a clearly defined term in the GIPS standards.1 The document goes a step further by explicitly stating the guidance does not apply to portfolios managed for retail clients. Overall, our concern regarding the uncertainty around the definition of the prospective client in the Exposure Draft has been adequately addressed. An OCIO Portfolio can be held by only asset owners.

An OCIO Portfolio is defined as a pool of assets of an asset owner for which a firm provides both strategic investment advice (e.g., “crafting or refining the portfolio’s long-term asset allocation strategy to align with the client’s objectives and risk tolerance or advising on the development of the Investment Policy Statement”) and investment management services. Essentially, strategic investment advice is about high-level guidance without direct management of assets. Whereas, with investment management service the emphasis is on execution and oversight of the client’s assets in line with the agreed-upon objectives. The guidance statement specifically calls out certain back-office tasks like “raising cash” and/or rebalancing as not falling under investment management services. But it does make room for a firm to classify assets as discretionary even if the firm isn’t allowed to make decisions without prior client approval for each action.

An OCIO Portfolio is not an OCIO Portfolio if the firm does not manage all asset classes representing an asset owner’s investment mandate.

When presenting to UK Pension plans, the Guidance Statement for OCIO Portfolios does not apply as those providers are following the GIPS Standards for FMP.

Composite Structure — Strategic Asset Allocation Focused on Either Liability Obligations or Capital Growth

All discretionary, fee-paying OCIO Portfolios must be included in a “Required OCIO Composite.”

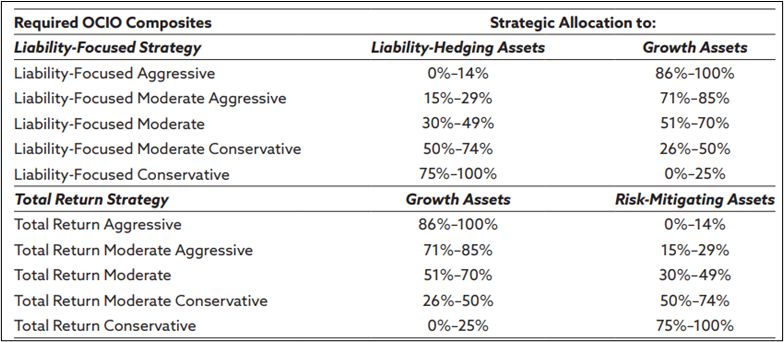

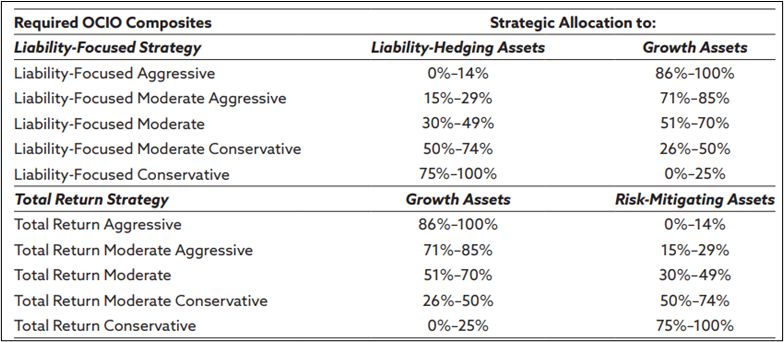

Firms must construct composites that align with the following framework, assigning OCIO Portfolios to composites based on strategic asset allocation:

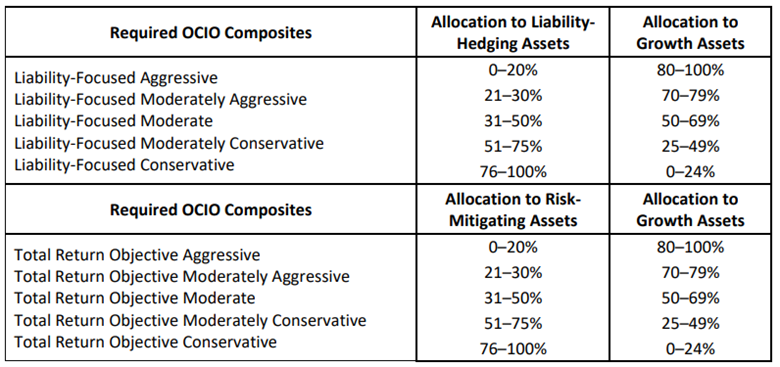

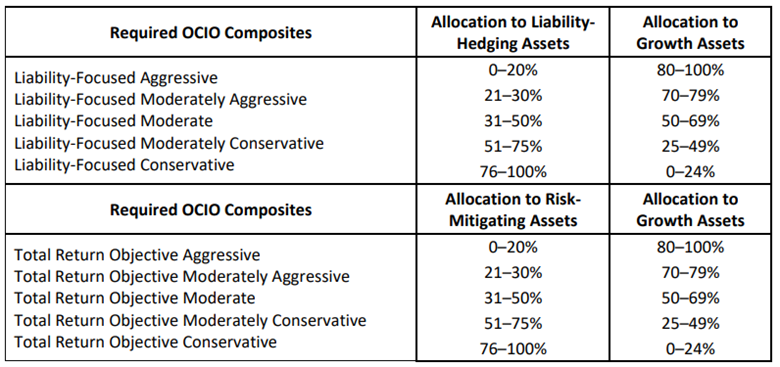

A comparison of the final strategic allocations in the table above to the ones in the Exposure Draft show meaningful changes to the ranges for Aggressive and Moderately Aggressive:

Source: CFA Institute’s EXPOSURE DRAFT GUIDANCE STATEMENT FOR OCIO STRATEGIES

In our response to the Exposure Draft, we voiced concern that firms may find this structure too prescriptive and not reflective of their actual strategies. This could lead to a scenario where firms create and maintain two sets of composites, one that the firm is required to create to be compliant, and one that reflects the firm’s actual strategies and marketing efforts.

Asset Classification – Growth, Liability-Hedging, or Risk-Mitigating

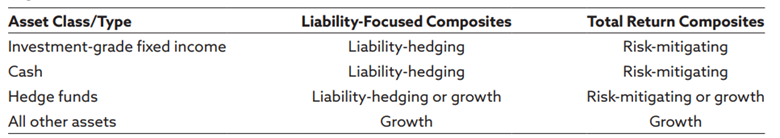

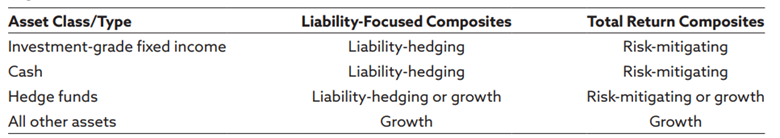

Assets are categorized as growth, liability hedging, or risk mitigating, which is intended to help clarify the portfolio’s purpose or risk profile. For liability-focused composites, assets must be classified as either liability-hedging or growth. For total return composites, they must be classified as either growth or risk-mitigating. While guidance is provided for classifying assets as growth, liability hedging, or risk mitigating, how assets are classified is determined by the firm.

Following is the recommended asset classification scheme:

Source: CFA Institute’s Guidance Statement for OCIO Portfolios

Per the Guidance Statement for OCIO Portfolios Adopting Release, for asset classification, CFA Institute applied a similar methodology to the one used in the GIPS standards for fair value by incorporating a suggested asset classification system. If a firm uses an alternative classification approach, it is required to explain how its classifications differ from the recommended scheme. Hedge funds are the exception to this rule and firms must disclose how they’ve classified them.

Legacy Assets

Options are outlined for the treatment of legacy assets within portfolios – i.e., include or exclude, and how.

Firms must “disclose information about” the legacy assets excluded from composites, but it doesn’t go as far as to say what those details need to be although a sample disclosure provided lets the reader know legacy assets exceeding 5% of a portfolio’s total asset value is excluded.

Reporting – Additional Noteworthy Items

- In their GIPS Reports for Required OCIO Composites, firms are required to present both gross-of-fees and net-of-fees time-weighted returns. Both gross and net returns must reflect the deduction of transaction costs, fees for underlying funds, and externally managed accounts. Net returns must reflect the deduction of the firm’s investment management fees. There is an exception when the firm controls the investment management fees of the underlying pooled funds when it comes to calculating gross returns

- Firms must disclose each composite’s asset class allocation as of year-end for periods ending on or December 31, 2025. For example, for liability-focused composites, firms must present the percentage of composite assets represented by liability-hedging assets and growth assets as of each annual period end.

- Firms must also present the percentage of composite assets represented by private market investments and hedge funds as of each annual period end for periods ending on or after December 31, 2025.

- In the final guidance, the treatment of the fee schedule was clarified to ensure greater transparency. Firms are required to disclose enough so that the prospective client will understand all fees the firm will earn from the client’s portfolio including the type(s) of fees earned. This allows for more consistent understanding of the costs associated with the firm’s management of OCIO portfolios, addressing concerns raised in the exposure draft about fee clarity and comparability.

- Adjustments were also made to ensure that benchmark selection reflects the unique strategies and goals of OCIO composites, emphasizing relevance, transparency, and proper disclosure.

———————————————————-

1 Per the GIPS Standards for Asset Owners, an asset owner is defined as “an entity that manages investments, directly and/or through the use of external managers, on behalf of participants, beneficiaries, or the organization itself. These entities include, but are not limited to, public and private pension funds, endowments, foundations, family offices, provident funds, insurers and reinsurers, sovereign wealth funds, and fiduciaries.”

Source: CFA Institute’s Guidance Statement for OCIO Portfolios

The Voice

The Voice, by David D. Spaulding, DPS, CIPM

My review of John Irving’s A Prayer for Owen Meany (see below) makes it clear I wasn’t enamored with the book. That said, I did get an idea from it. Owen was the writer of a column in his school’s student newsletter: “The Voice.” Here, he would offer candid comments on any range of subjects. Well, we thought this would be a good addition to our newsletter, and this will be the inaugural offering. We can’t guarantee we’ll have this section in every issue, but it will appear from time-to-time. And, it may occasionally be “penned” by someone else going forward.

CFA Institute recently published the final version of the GIPS® Guidance Statement for OCIO Portfolios (https://tinyurl.com/59catxc8). It states that a required composite structure that was proposed in the exposure draft (https://tinyurl.com/bdhzkcrc) will go into effect on December 31, 2025, for all OCIOs claiming compliance with the GIPS standards.

I looked at the public comments that were submitted (https://tinyurl.com/4menb6ey) and found that most supported this idea. And so, if this was a vote, the majority rules, and so it is what it is. That said, that’s not the way it works. The GIPS governing body takes these comments into consideration, and decides based upon them what the best course of action is.

A number of consulting firms commented, and it’s not surprising that they favor the required structure, as it makes their job easier. But others voiced opposition. And while some like the structure, they suggested that it not be mandatory, but instead recommended. TSG was one of the institutions that felt it should be a recommendation (https://tinyurl.com/2bjb4tdk). Others who preferred this be a recommendation included two country sponsors: the SAAJ (https://tinyurl.com/2xxnr87w), the Country Sponsor for Japan and the Canadian Investment Performance Council (CIPC), Canada’s country sponsor*(https://tinyurl.com/yfje5s8v); as well as two OCIOs: Strategic Investment Group (https://tinyurl.com/ytfwh4fu) and Marquette Associates (https://tinyurl.com/ytfwh4fu).

I think it quite unfortunate that the voices of both OCIOs and country sponsors were not allowed to influence the decision: making these changes would have been much better, I believe, if they were a recommendation rather than a requirement.

Mandating composite structures is a “game changer” for the Standards, and should be unwelcome. Might this set a precedence for future required structures? Recommending is one thing, requiring it is a huge shift. Since there are a number of OCIOs who claim compliance with composites that do not conform to this structure, they will now have to get to work, as the guidance goes into effect at year-end.

Quote of the Month

“You’ll never change your life until you change something you do daily. The secret of your success is found in your daily routine.”

– John C. Maxwell

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “Which U.S Stocks Generated the Highest Long-Term Returns?” by Hendrik (Hank) Bessembinder the W.P. Carey School of Business of Arizona State University, which was published in the Fall 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

This report describes compound return outcomes for the 29,078 publicly-listed common stocks contained in the CRSP database from December 1925 to December 2023. The majority (51.6%) of these stocks had negative cumulative returns. However, the investment performance of some stocks was remarkable. Seventeen stocks delivered cumulative returns greater than five million percent (or $50,000 per dollar initially invested), with the highest cumulative return of 265 million percent (or $2.65 million per dollar initially invested) accruing to long-term investors in Altria Group. Annualized compound returns to these top performers were relatively modest, averaging 13.47% across the top seventeen stocks, thereby affirming the importance of “time in the market.” The highest annualized compound return for any stock with at least 20 years of return data was 33.38%, earned by Nvidia shareholders.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

The Performance Measurement Forum Celebrated its 25th Anniversary of the EMEA Chapter with the 107th Meeting in Barcelona, Spain

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

Contact Patrick Fowler if you would like information about how you can be part of this dynamic group.

Upcoming Webinars / Surveys

Webinar: Performance Measurement Professional Survey Insights

Join us for an exclusive webinar where we will discuss the findings of the 2024 Performance Measurement Professional Survey, conducted by TSG and sponsored by Rimes Technologies. Discover key trends in team structures, credentialing, gender dynamics, compensation, and technology adoption within the performance measurement profession. Gain actionable insights into the evolving challenges and opportunities shaping this critical field, and explore strategies to stay ahead in a rapidly changing industry. This session will provide valuable perspectives to enhance your understanding and drive organizational success.

Key Takeaways:

• Comparative analysis of survey results from 2000, 2008, and 2024

• Insights into compensation trends and credentialing advancements

• The role of technology and AI in transforming workflows

• Strategies for fostering diversity and innovation in performance teams

Don’t miss this opportunity to stay informed and inspired.

When: Wednesday, February 5, 2025 at 11:00 AM (EST)

Where: Online (and recorded)

Duration: 60 minutes

Register by clicking on the graphic below or by clicking here.

Institute / Training

Access TSG’s Online Training

Content With One Pass

Potpourri

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: February 10, 2025

Spring Issue: March 10, 2025

Book Review

A Prayer for Owen Meany, by John Irving

Review by David D. Spaulding, DPS, CIPM

Since watching the movie “Simon Birch,” roughly 25 years ago, I have wanted to read the book that inspired the movie, A Prayer for Owen Meany, by John Irving. I have watched other movies based on his books (e.g., “The Cider House Rules” and “The World According to Garp”), but for some reason I really wanted to read the Owen Meany book. But to wait a quarter of a century? Perhaps I should have waited a bit longer.

While reading the book, I rewatched “Simon Birch,” and noted that the movie is not actually “based on” the book. Apparently, Irving felt the book drifted too far away from the story, and didn’t want to mislead readers. It is quite true that the book and movie are quite different: not just the names (e.g., Simon Birch rather than Owen Meany) but how old the protagonist dies, as well as how he dies, are vastly different.

The book is quite long (627 pages), so capturing much of the book would be quite a challenge. That said, there are similarities (e.g., that Simon is lifted by his classmates in their religion class, only to be scolded by the teacher, as if he had asked to be lifted and transported about the room; how Joe’s (John’s) mother dies from a baseball hit by Simon), but the differences, and the absence of so much, makes the movie not a very good representation.

I mentioned the book is long, and I think perhaps too long. There were times when I was tempted to give up, because the story just went on, and on, and on. But, I’ll confess the author would often bring something up I found interesting.

In reviewing the reviews on Amazon, I discovered that I wasn’t alone in thinking the book is too long. Review titles such as “Boring,” “long and wordy and boring,” along with “and it goes on and on and on …………” are in line with my thinking.

Along with some others who read the book, I didn’t care for Irving’s use of the story as a platform for his apparent anti-American views. As the narrator, “John” has moved to Canada during the Vietnam war. At first, we are led to believe this was to avoid the draft, but that isn’t the case [sorry if this is a “spoiler”]: I’ll withhold the reasons. Often, Irving would shift the time to 1987, when he is living and teaching in Toronto, at which point he would drone on and on about what he doesn’t like about what is occurring. Seriously? This had no relevance whatsoever to the story, so was clearly Irving’s way of sharing his politics, which was quite unnecessary and a distraction.

My greatest disappointment was the book’s ending. The author gives “spoiler alerts” throughout the book: we know Owen will die, but not when or how. When we do, it’s definitely not what the reader expected.

The movie might be labeled a “tear jerker.” The book? No. His death was almost anticlimactic.

While I have enjoyed other Irving-based movies, I won’t bother reading the books they’re based upon. Is he a good story teller? Yes. But, he must get paid by the word.

And while I’m glad I read it, because it had been a book I wanted to read, I could have spent my time reading something a lot better, no doubt. To say I was disappointed is an understatement.

Guidance Statement for OCIO Portfolios – TSG’s Key Takeaways and Summary

Author: Jennifer Barnette, CIPM

The CFA Institute has introduced a new Guidance Statement specifically for Outsourced Chief Investment Officer (OCIO) firms, providing a tailored framework designed specifically for OCIOs under the broader Global Investment Performance Standards (GIPS®). The customized nature of the framework is intended to address the unique challenges and responsibilities faced by certain OCIO firms in implementing the GIPS standards. The guidance should help OCIO firms understand how to structure composites, report performance in a GIPS report, and classify assets or asset types. All of which results in a seemingly significant step in comparability across OCIO firms.

This guidance becomes effective on December 31, 2025, and will be mandatory for firms providing OCIO services and claiming compliance with the GIPS standards. Firms claiming compliance with the GIPS standards must adhere to all relevant requirements of the GIPS Standards for Firms, as well as the applicable provisions in the Guidance Statement for OCIO Portfolios, when presenting a GIPS Report to a prospective OCIO Portfolio client. In our public comment in response to the exposure draft, we recommended the CFA Institute provide more time for implementing the guidance, but believed an effective date 12 months after the issue date would be the minimum that firms already claiming compliance with the GIPS standards would need to implement any necessary changes.

One of the key changes from the exposure draft to the final guidance is the clarification of who the guidance applies to, which was an area we thought needed clarity. The final version addresses industry feedback by clarifying the scope and specifying who is covered by the guidance, replacing “institutional investor” in the exposure draft with “asset owner” in the final guidance. Asset owner is a clearly defined term in the GIPS standards.1 The document goes a step further by explicitly stating the guidance does not apply to portfolios managed for retail clients. Overall, our concern regarding the uncertainty around the definition of the prospective client in the Exposure Draft has been adequately addressed. An OCIO Portfolio can be held by only asset owners.

An OCIO Portfolio is defined as a pool of assets of an asset owner for which a firm provides both strategic investment advice (e.g., “crafting or refining the portfolio’s long-term asset allocation strategy to align with the client’s objectives and risk tolerance or advising on the development of the Investment Policy Statement”) and investment management services. Essentially, strategic investment advice is about high-level guidance without direct management of assets. Whereas, with investment management service the emphasis is on execution and oversight of the client’s assets in line with the agreed-upon objectives. The guidance statement specifically calls out certain back-office tasks like “raising cash” and/or rebalancing as not falling under investment management services. But it does make room for a firm to classify assets as discretionary even if the firm isn’t allowed to make decisions without prior client approval for each action.

An OCIO Portfolio is not an OCIO Portfolio if the firm does not manage all asset classes representing an asset owner’s investment mandate.

When presenting to UK Pension plans, the Guidance Statement for OCIO Portfolios does not apply as those providers are following the GIPS Standards for FMP.

Composite Structure — Strategic Asset Allocation Focused on Either Liability Obligations or Capital Growth

All discretionary, fee-paying OCIO Portfolios must be included in a “Required OCIO Composite.”

Firms must construct composites that align with the following framework, assigning OCIO Portfolios to composites based on strategic asset allocation:

A comparison of the final strategic allocations in the table above to the ones in the Exposure Draft show meaningful changes to the ranges for Aggressive and Moderately Aggressive:

Source: CFA Institute’s EXPOSURE DRAFT GUIDANCE STATEMENT FOR OCIO STRATEGIES

In our response to the Exposure Draft, we voiced concern that firms may find this structure too prescriptive and not reflective of their actual strategies. This could lead to a scenario where firms create and maintain two sets of composites, one that the firm is required to create to be compliant, and one that reflects the firm’s actual strategies and marketing efforts.

Asset Classification – Growth, Liability-Hedging, or Risk-Mitigating

Assets are categorized as growth, liability hedging, or risk mitigating, which is intended to help clarify the portfolio’s purpose or risk profile. For liability-focused composites, assets must be classified as either liability-hedging or growth. For total return composites, they must be classified as either growth or risk-mitigating. While guidance is provided for classifying assets as growth, liability hedging, or risk mitigating, how assets are classified is determined by the firm.

Following is the recommended asset classification scheme:

Source: CFA Institute’s Guidance Statement for OCIO Portfolios

Per the Guidance Statement for OCIO Portfolios Adopting Release, for asset classification, CFA Institute applied a similar methodology to the one used in the GIPS standards for fair value by incorporating a suggested asset classification system. If a firm uses an alternative classification approach, it is required to explain how its classifications differ from the recommended scheme. Hedge funds are the exception to this rule and firms must disclose how they’ve classified them.

Legacy Assets

Options are outlined for the treatment of legacy assets within portfolios – i.e., include or exclude, and how.

Firms must “disclose information about” the legacy assets excluded from composites, but it doesn’t go as far as to say what those details need to be although a sample disclosure provided lets the reader know legacy assets exceeding 5% of a portfolio’s total asset value is excluded.

Reporting – Additional Noteworthy Items

- In their GIPS Reports for Required OCIO Composites, firms are required to present both gross-of-fees and net-of-fees time-weighted returns. Both gross and net returns must reflect the deduction of transaction costs, fees for underlying funds, and externally managed accounts. Net returns must reflect the deduction of the firm’s investment management fees. There is an exception when the firm controls the investment management fees of the underlying pooled funds when it comes to calculating gross returns

- Firms must disclose each composite’s asset class allocation as of year-end for periods ending on or December 31, 2025. For example, for liability-focused composites, firms must present the percentage of composite assets represented by liability-hedging assets and growth assets as of each annual period end.

- Firms must also present the percentage of composite assets represented by private market investments and hedge funds as of each annual period end for periods ending on or after December 31, 2025.

- In the final guidance, the treatment of the fee schedule was clarified to ensure greater transparency. Firms are required to disclose enough so that the prospective client will understand all fees the firm will earn from the client’s portfolio including the type(s) of fees earned. This allows for more consistent understanding of the costs associated with the firm’s management of OCIO portfolios, addressing concerns raised in the exposure draft about fee clarity and comparability.

- Adjustments were also made to ensure that benchmark selection reflects the unique strategies and goals of OCIO composites, emphasizing relevance, transparency, and proper disclosure.

———————————————————-

1 Per the GIPS Standards for Asset Owners, an asset owner is defined as “an entity that manages investments, directly and/or through the use of external managers, on behalf of participants, beneficiaries, or the organization itself. These entities include, but are not limited to, public and private pension funds, endowments, foundations, family offices, provident funds, insurers and reinsurers, sovereign wealth funds, and fiduciaries.”

Source: CFA Institute’s Guidance Statement for OCIO Portfolios

Industry Dates and Conferences

Celebrating 35 Years of Excellence: What to Expect from TSG in 2025

As TSG marks its 35th anniversary, we’re thrilled to announce a dynamic lineup of events, learning opportunities, and networking activities designed to elevate your performance measurement expertise and strengthen our vibrant community. Here’s what’s in store for the year ahead:

April: Forums and Roundtables

Engage with Industry Leaders

- 23rd: Asset Owner Roundtable (AORT) – A platform for advanced discussions on performance and risk.

- 24th-25th: North American Forum – Join our membership group for thought leadership, practical insights, and collaborative dialogue.

The Performance Measurement Forum and AORT events foster interactive networking and knowledge sharing, connecting professionals with global leaders to tackle pressing challenges and innovative solutions.

May: PMAR Connections

Join the Premier Conference in Investment Performance Measurement

- 20th: WiPM In-Person Meeting – Build mentorships, collaborate, and connect with the Women in Performance Measurement (WiPM) for a half day event preceding PMAR.

- 21st-22nd: PMAR North America at The Heldrich in New Brunswick – Experience cutting-edge sessions and thought-provoking discussions led by top industry speakers.

For over 26 years, PMAR has been the flagship conference where investment performance professionals gather to shape the industry’s future.

June: EMEA Forum in Belfast

- 19th-20th: Performance Measurement Forum (EMEA) – Convene with global leaders for discussions in Belfast, Northern Ireland.

Explore performance and risk topics, implementation strategies, and innovative solutions tailored to the European market.

July: Toronto Networking Event

- 22nd: Performance Measurement Networking in Toronto, Canada – Partnering with Rimes Technologies and First Rate, this event provides a space to connect and share insights.

Stay tuned for additional details on this interactive gathering in one of Canada’s key financial hubs.

September: PMAR Europe in London

- 17th: PMAR Europe – London’s premier event for innovation and networking.

This is the European counterpart to our North American event, focusing on cutting-edge topics and innovations.

October: Performance Training in San Francisco

Develop key skills with our in-depth, in-person training programs:

- 7th-8th: Fundamentals of Performance Measurement Training – Ideal for newcomers or those seeking a refresher.

- 8th-9th: Performance Measurement Attribution Training – Dive deep into attribution methodologies to enhance your expertise.

November: Fall EMEA Forum in Copenhagen

- 6th-7th: Performance Measurement Forum (EMEA) – Expand your perspective with insights from global leaders at our fall meeting in Denmark.

December: Year-End Wrap-Up in Louisville

Conclude 2025 with these essential events:

- 3rd: Fall Asset Owner Roundtable (AORT) – Advanced discussions to round out the year.

- 4th-5th: Fall North American Forum – Close the year with innovation and collaboration.

Celebrating 35 Years of Excellence

2025 marks an incredible milestone in TSG’s journey. In addition to our events, we’ll reflect on 35 years of empowering performance measurement professionals through:

- Special Retrospectives

- Exclusive Content

- Community Celebrations

We take immense pride in our legacy of success, innovation, and leadership. As we look ahead, TSG remains committed to advancing the field of investment performance measurement and empowering professionals worldwide.

Mark Your Calendars! Let’s make 2025 a year to remember.

For information on the 2025 events and membership opportunities, please contact Patrick Fowler at 732-873-5700.

That’s a Good Question

A few weeks ago, a colleague of mine (note: This is from an Asset Manager) was asking how we could get quarterly marketing materials published and out to market faster. One of the things I mentioned is that the GIPS reports we produce every quarter can take quite a bit of time, because they require some manual formatting and of course, meticulous review. He mentioned that our colleagues at other firms only produce annual GIPS reports at year end, and all performance YTD is reported preliminary.

We have always produced quarterly GIPS reports; the entirety of the reasons for that, I’m not sure. From a GIPS perspective, I don’t see anything wrong with the annual reporting. From your point of view, do you see any risks in making this change from quarterly production to annual and providing interim performance as preliminary? What do you see most of your clients to in this regard? In your opinion, what benefits could we potentially be losing if we were to switch from quarterly to annual GIPS reports and performance finalization?

Response:

First, I don’t think there’s anything wrong with publishing “preliminary, subject to change.” I believe the expectation is that if you do this, your error correction policy would come into effect if the revised numbers differ. I think your P&P should be amended to reference this new practice, and how errors would be handled.

I’m aware that some firms issue “flash reports” for quarterly numbers. I’ve never actually seen them, but believe they’re separate and apart from the actual GIPS reports. I’ve copied my colleague, Ashley Reeves, who may be able to share more on this.

Most firms, I believe, wait until they’ve been verified to update their year-end numbers. While this is definitely not necessary, it’s still pretty common practice.

I understand the interest in getting year-end numbers out quickly; perhaps within the first couple weeks of the new year. A “preliminary/subject to change” note would probably be fine. But, in actuality, you don’t have to label; you could just distribute and be aware that changes may occur. By labeling, you’re at least making the recipient know they’re preliminary.

Hope this helps.

David Spaulding, DPS, CIPM

I agree with Dave that if you want to continue using quarterly GIPS reports and reporting preliminary data, any changes to final data are subject to the firm’s error correction policies. See the relevant guidance in the attached Q&A.

I’m also chiming in to confirm that almost all of my clients report performance quarterly, but the majority of my clients do this in some format that is outside of a GIPS report, e.g., Dave’s referenced flash report. They only update their GIPS report annually as required. And as Dave stated, most of my clients only update their GIPS reports during the verification engagement and then start distributing them once the verification is complete.

And as you would probably guess, quarterly reporting format and data is largely driven by the SEC Marketing Rule, but most of my clients include additional periods beyond the required 1, 5, and 10 years.

When I was in industry, I was faced with the same question. We released quarterly marketing “books” with all of our marketed strategies that went to everyone, prospects, current clients, and consultants. Most of this book was made up of rolling returns, risk measures, and portfolio characteristics, all updated through the most recent quarter end. At the end of the book, we had all of the corresponding GIPS reports, also updated quarterly.

For a variety of reasons, we made the switch to annual for the GIPS reports and I don’t remember ever hearing anything negative about this change from anyone. It took some of the work off of our performance team, reduced our exposure to errors under GIPS, and made the production of the books quicker. I would expect that your firm would see the same benefits.

Ashley Reeves, CIPM

Follow-up

Thank you both very much for your thoughts.

I’m considering doing preliminary quarterly reporting and annual GIPS reports. The experience you shared in your last paragraph, Ashley, I find particularly inspiring. It speeds things up, frees the team up to accomplish other things, and reduces the risk of GIPS errors.

I am curious – while preliminary reporting will naturally result in corrections over time, even though the corrections weren’t GIPS errors, as the errors were not in GIPS reports – did your firm(s) ever issue similar corrections and redistributions of quarterly materials? Or simply make the corrections and ensure the corrected returns were part of next quarter’s reports?

Conclusion

If the quarterly reports don’t mention “GIPS” and aren’t part of a GIPS report, then they do not fall within the GIPS error correction rules. That said, you should consider employing them here, because if you determine a material error occurred, you probably would want to issue a corrected version. No need to correct for immaterial errors, in my view.

Responses from David Spaulding, DPS and Ashley Reeves, CIPM

Please submit your questions to Patrick Fowler.

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.