by TSG | Apr 16, 2013 | GIPS, Performance Perspectives Newsletter

VOLUME 10 – ISSUE 8 April 2013 Download PDF...

by admin | Apr 10, 2013 | additional information, CIPM, CIPM Exam Tips & Tricks, CIPM expert, GIPS, GIPS additional information, GIPS compliance, GIPS supplemental information, GIPS verification, supplemental information

In the world of GIPS compliance and composite presentations, there is “supplemental information” and there is also “additional information”… but what is the difference?When I explain these concepts to students in TSG’s classes or to...

by TSG | Nov 15, 2012 | GIPS, Performance Perspectives Newsletter

VOLUME 10 – ISSUE 3 November 2012 Download PDF...

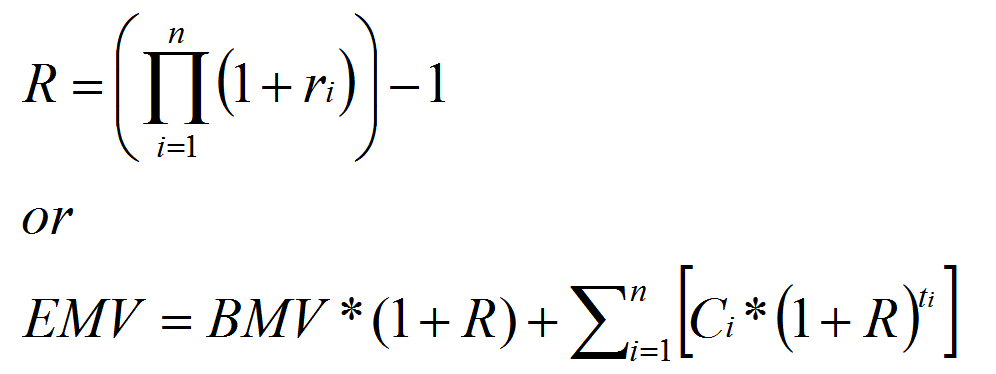

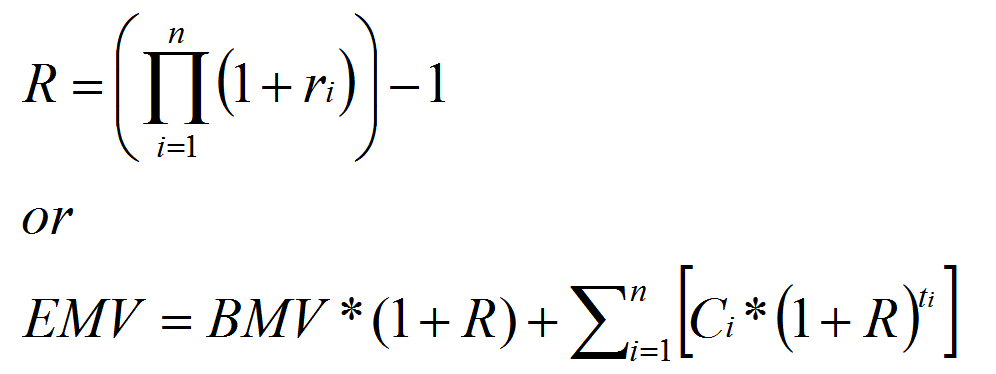

by admin | Sep 10, 2012 | CIPM, CIPM expert, GIPS, internal rate of return, performance measurement, SI-IRR, since inception internal rate of return, time-weighted return

CIPM Expert Level candidates must know what return calculations are required by the Global Investment Performance Standards (GIPS(r)), and in which circumstances. Most of the time, time-weighted return (TWR) is required, but in some cases a since inception...

by admin | Aug 25, 2012 | CIPM, CIPM Exam Tips & Tricks, CIPM Principles, GIPS, performance measurement

Last week, when I was teaching TSG’s CIPM Exam prep class for the Principles Level, a student asked me for help with a question on a sample exam from CFA Institute. The question read: Which of the following is most likely not a requirement of the GIPS...

by admin | Aug 20, 2012 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, GIPS, GIPS pre-verification, GIPS verification

One of the Learning Outcome Statements at the Expert Level requires CIPM candidates to know the pre-verification procedures and verification procedures prescribed in the GIPS standards. A common question that I get is how to tell whether something is a...