by admin | Oct 19, 2011 | GIPS, Global Investment Performance Standards

#2 Using spreadsheets to maintain your GIPS compositesTSG began surveying the industry on the presentation standards (initially the AIMR-PPS(R); later GIPS(R) (Global Investment Performance Standards)) in 1994, and we’ve done it several times since then. We have...

by admin | Oct 18, 2011 | GIPS, Global Investment Performance Standards

Let’s start with a joke: As a salesman approaches a farmhouse door, he notices a three-legged pig hobbling about on the front porch. The salesman knocks on the door and is greeted by the farmer. Before making his pitch he asks “what happened to this...

by admin | Oct 14, 2011 | GIPS, Global Investment Performance Standards, Standard Deviation

A verification client called me with the following question: they have historically calculated dispersion around the composite’s return; however, their new GIPS(R) (Global Investment Performance Standards) system measures it around the average of the accounts...

by admin | Oct 10, 2011 | GIPS, Global Investment Performance Standards, net of fees

We received a question from a client recently, who cited the GIPS(R) (Global Investment Performance Standards) Fees Guidance Statement.On page 5 we find the following:Let’s focus on the sentence that reads “In these situations, it is most appropriate to...

by admin | Oct 7, 2011 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, GIPS, Modified Dietz, significant cash flows

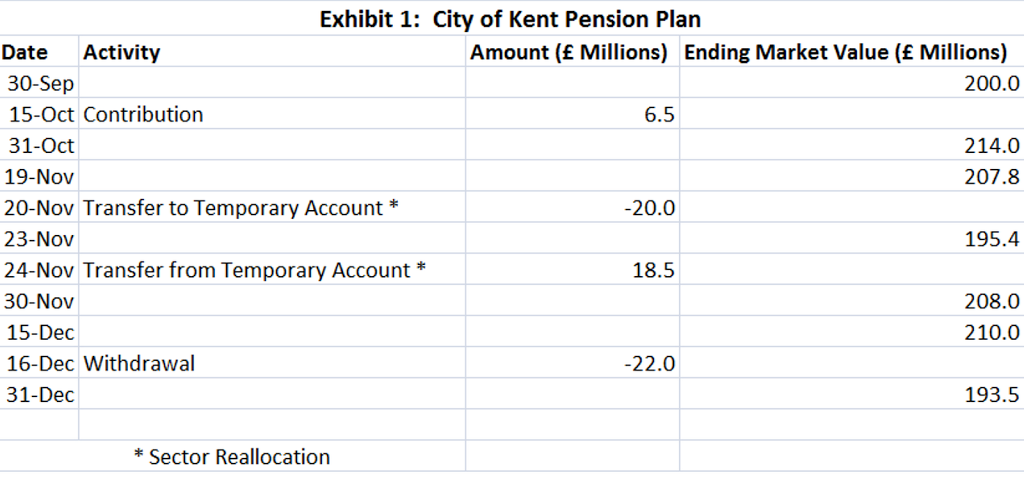

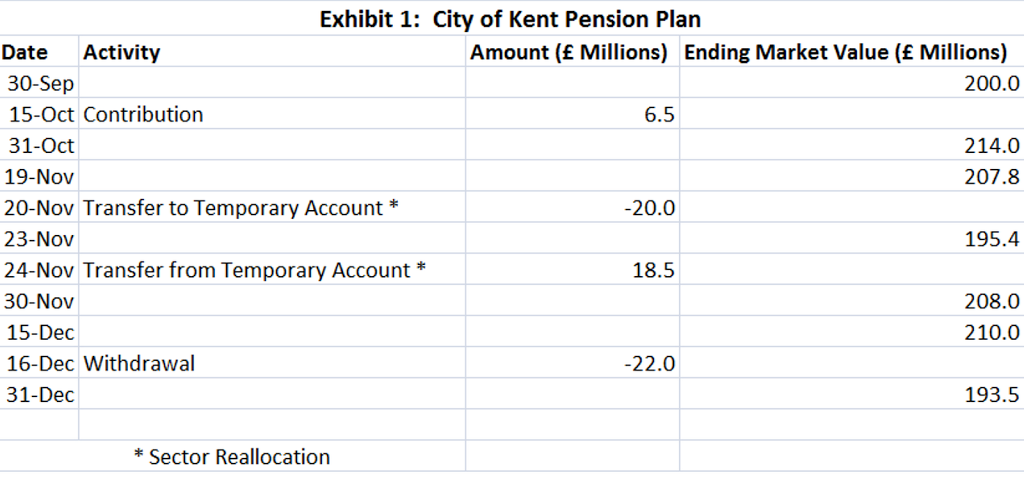

An Expert Level candidate asked some questions related to sample exam Item Set #15; the vignette is described below:White Oaks Investment Management, a firm that claims to comply with the GIPS standards, manages an equity portfolio for the City of Kent’s pension plan....

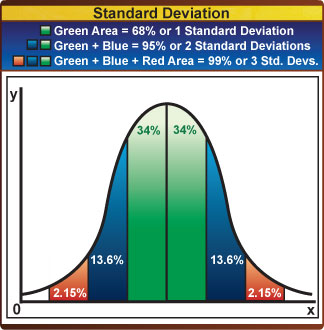

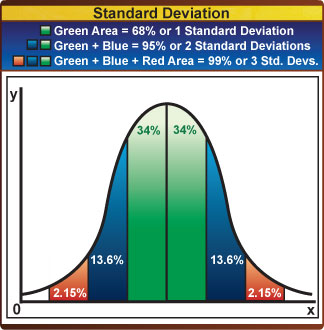

by admin | Oct 4, 2011 | CIPM, CIPM expert, CIPM Principles, composite dispersion, external dispersion, GIPS, internal dispersion, Standard Deviation, TI BA II Plus, tracking error

CIPM candidates are required to be able to calculate standard deviations for several purposes, including:the dispersion of annual portfolio returns within a composite (internal dispersion)the variability of a composite’s past 36 months of returns (external...