by admin | Jul 29, 2025 | money-weighting, time-weighting

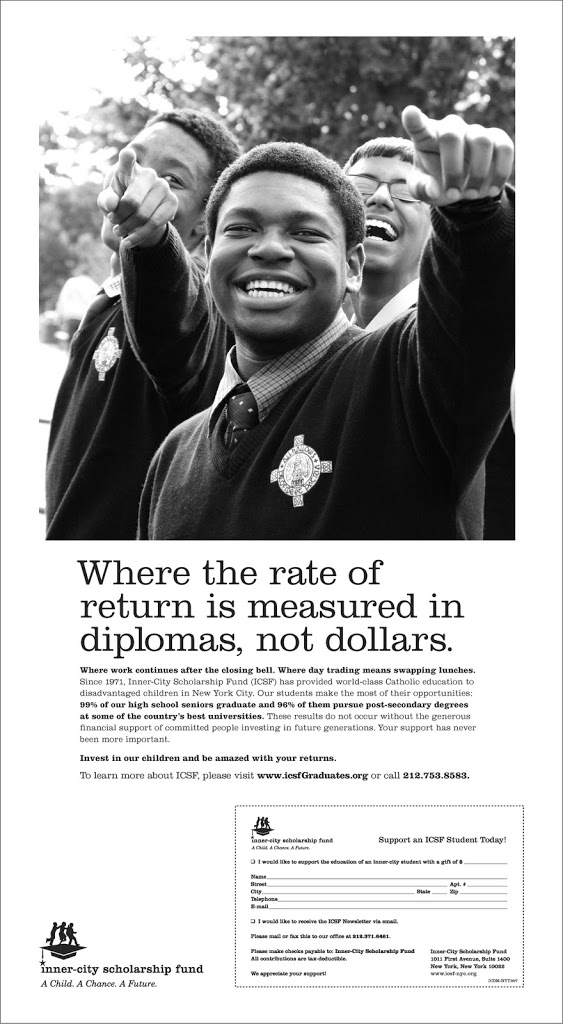

While “risk” seems to be a more commonly found topic in the Wall Street Journal, I was pleased to see this advertisement appear in this past weekend’s edition. First, it’s wonderful to see a focus on diplomas, especially for inter-city...

by admin | Jun 19, 2025 | GIPS, money-weighting, Standard Deviation, time-weighting

As often happens when I read, I stumble upon quotes which I will want to employ in my speaking and writing. Here are just a few from Michael Lewis’ Moneyball, along with commentary: – The meetings, from their point of view, are all about minimizing risk...

by admin | Jun 18, 2025 | attribution, money-weighting, Reporting, time-weighting

One area that often comes up in discussions is client reporting. There are no standards on this topic, although some guidance has been offered. Reporting is made complex for a few reasons. First, at times the client dictates what they want, in which case the...

by admin | Jun 11, 2025 | money-weighting, Returns, risk, Standard Deviation, time-weighting

Continuing our discussion of Michael Lewis’ Moneyball, I think there’s a HUGE parallel between baseball statistics and what we do in investment performance measurement. Both deal with measuring performance: the performance of baseball players / the...

by admin | May 9, 2025 | money-weighting, rates of return, time-weighting

Today’s animation discusses the fairly common situation, where a portfolio loses money but has a positive return. This video discusses how to explain positive returns when losses occur.

by admin | Jan 4, 2025 | money-weighting, time-weighting

When teaching our Fundamentals of Investment Performance course, when writing my books, and often when simply having conversations with clients, I am often faced with the task of explaining, in as clear a manner as possible, the differences between time and money...