by admin | Jan 12, 2012 | risk, Sharpe ratio

I’m teaching an in-house Fundamentals of Performance class this week in Canada, and, as usual, we touch upon the Sharpe ratio, and how negative Sharpe ratios can produce results which appear inconsistent with our expectations.To help try to communicate...

by admin | Sep 25, 2009 | GIPS, risk, Sharpe ratio, Standard Deviation

Okay, so the decision has been made: effective January 2011, GIPS compliant firms must report a 36-month annualized standard deviation, on an annual basis (that is, for all years starting with 2011). Further clarity is in order. First, is standard deviation risk?...

by admin | Jul 15, 2009 | risk, Sharpe ratio

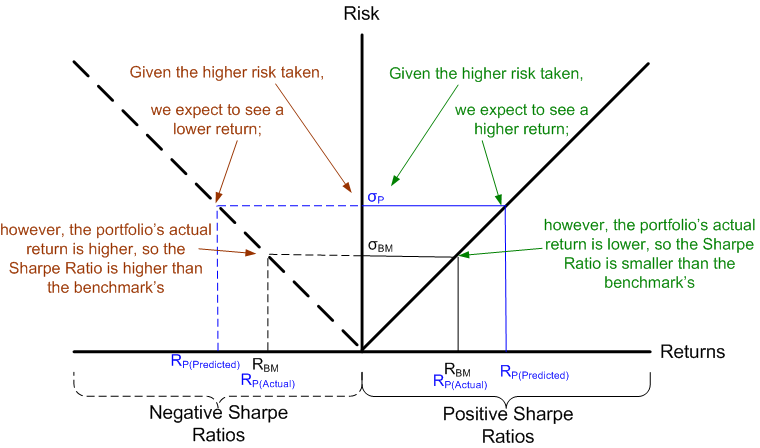

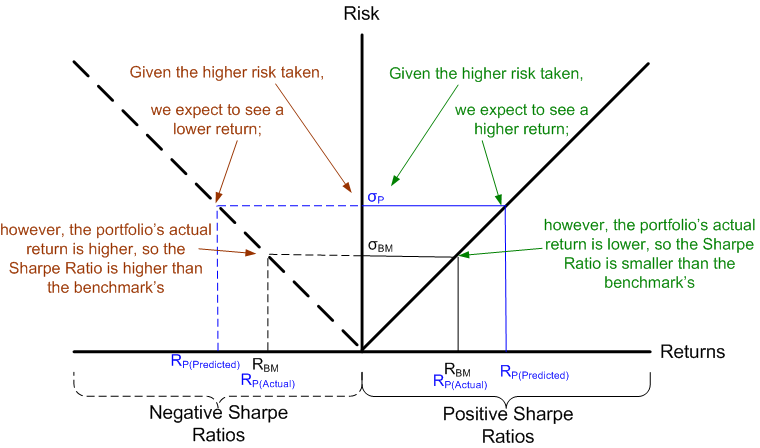

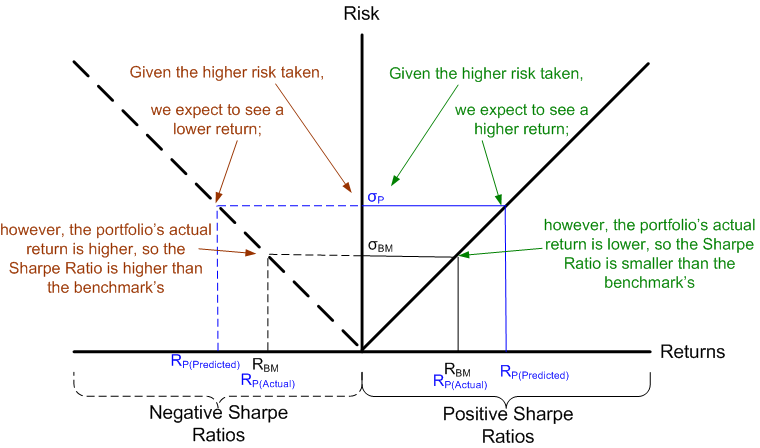

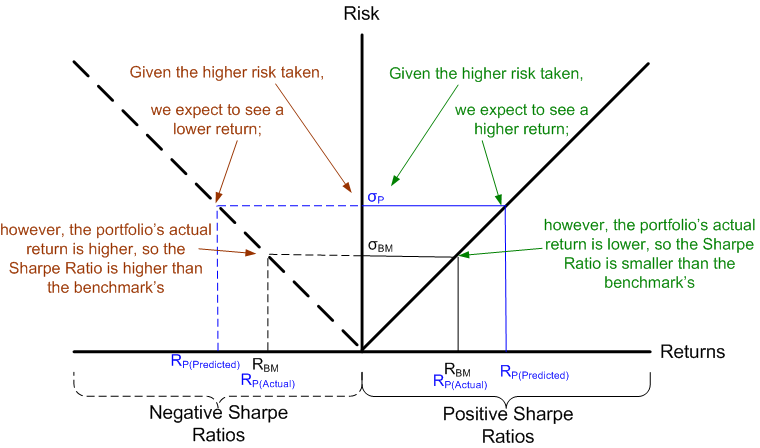

In our newsletter I’ve commented on the perceived problem with negative Sharpe ratios: that the results appear to be counter intuitive. When excess returns are positive, if the portfolio did a better job of managing risk, it will show a higher Sharpe ratio;...