by admin | Mar 5, 2012 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, ex-post risk, external dispersion, GIPS, internal dispersion, Standard Deviation

It has actually become apparent to me during the course of conducting GIPS verifications that there is some confusion as to when internal dispersion and external dispersion must be shown. It occurred to me that CIPM candidates may have the same...

by admin | Jan 30, 2012 | GIPS, Global Investment Performance Standards, Standard Deviation

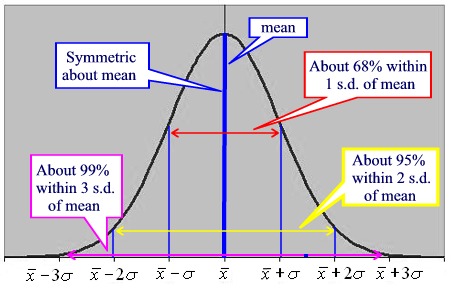

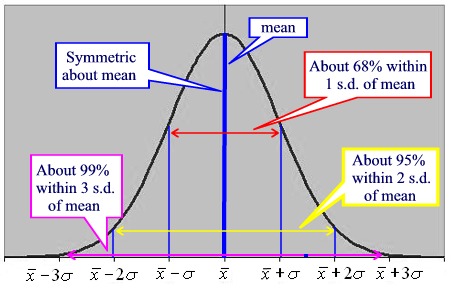

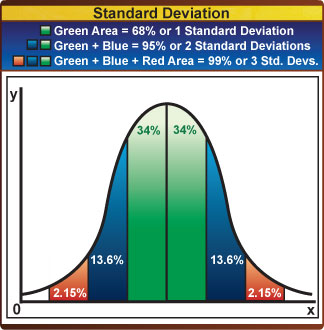

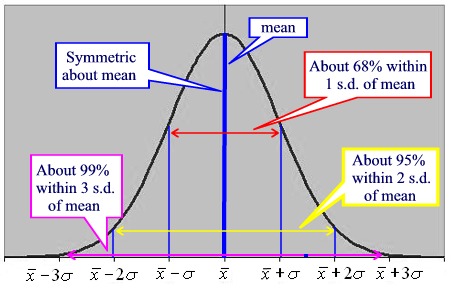

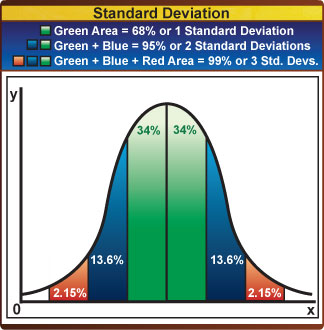

I participated in a panel discussion last week for the New York Society of Security Analysts (NYSSA). Questions arose regarding the use of standard deviation with GIPS(R) (Global Investment Performance Standards). I used my standard graphic, which distinguishes...

by admin | Jan 25, 2012 | GIPS, Global Investment Performance Standards, risk, Sharpe ratio, Standard Deviation

The Global Investment Performance Standards (GIPS(R)) now require compliant firms to include the 3-year, annualized standard deviation for the composite and its benchmark. And while this was a somewhat controversial move, it’s here, so we live with it. But, why...

by admin | Jan 19, 2012 | GIPS, Global Investment Performance Standards, risk, Standard Deviation

Confusion abounds when it comes to standard deviation. Some of the issues include:Equal-weighted or asset-weighted?Divide by “n” or “n-1”?Is it a measure of variability, volatility, or dispersion?Is it a measure of risk?What’s the best...

by admin | Oct 14, 2011 | GIPS, Global Investment Performance Standards, Standard Deviation

A verification client called me with the following question: they have historically calculated dispersion around the composite’s return; however, their new GIPS(R) (Global Investment Performance Standards) system measures it around the average of the accounts...

by admin | Oct 4, 2011 | CIPM, CIPM expert, CIPM Principles, composite dispersion, external dispersion, GIPS, internal dispersion, Standard Deviation, TI BA II Plus, tracking error

CIPM candidates are required to be able to calculate standard deviations for several purposes, including:the dispersion of annual portfolio returns within a composite (internal dispersion)the variability of a composite’s past 36 months of returns (external...