Last night, my hometown team, the Los Angeles Dodgers, was defeated by the St. Louis Cardinals in the National League Championship series. The Cardinals will go on to the World Series for a chance at what could be their 20th world championship... while the...

CIPM Exam Tips & Tricks

Lorem ipsum dolor sit amet.

Losing Is Painful…

A Little Piece on GIPS… (repost)

(Note: I wrote this post as a guest blogger for the STP Investment Services blog, but it appears that blog is offline and we received a request for the information, so I decided to post the information directly here.) The What, Why and Who of the...

Battle of the Nobel Prize Winners: Fama vs. Sharpe!

OK, I'm just kidding... there is no grand battle here between economists (and Nobel prize winners) Eugene Fama and William Sharpe. That being said, CIPM candidates at the Principles level *are* expected to deal with the following Learning Outcome Statement...

Congratulations to Eugene Fama (Nobel Prize)!

Congratulations to Professor Eugene Fama of the University of Chicago! The Royal Swedish Academy of Sciences just announced that Mr. Fama (along with Robert Schiller and Lars Peter Hansen) has won this year's Nobel prize in Economics, for their work on developing...

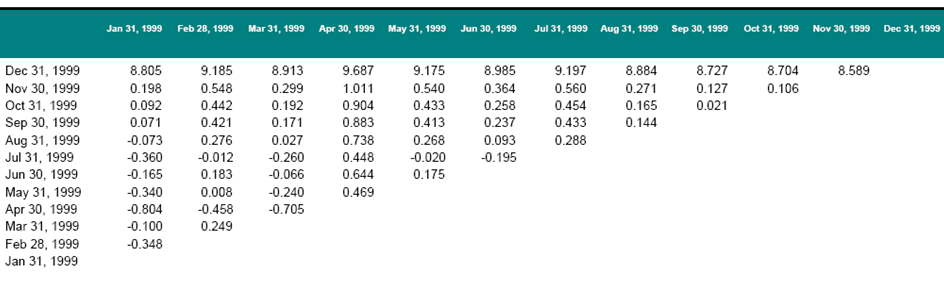

What Is a Performance Triangle?

At the CIPM Expert Level, the topic of "performance triangles" is covered, and there is one specific Learning Outcome Statement on the subject:Demonstrate the use of performance triangles vs. benchmarks in assessing a manager's track record Having said that, the...

Fast Calculation of Internal Rate of Return (in Multiple Choice Situations…), Part II

In my last post, I covered a "fast" way to solve multiple choice internal rate of return exercises. In today's post, I look at a second quick method. Recall the details from the last post: Account market value on 3/31 is $56.3 million Account market value on 4/11 is...

Fast Calculation of Internal Rate of Return (in Multiple Choice Situations…), Part I

I have covered the steps to calculating internal rate of return in a few different posts on the blog, including here, here and here. I have also covered the steps to use the cash flow worksheets of the TI BA II Plus and the HP 12 C. You may have read the curriculum...

Performance with Leverage: Part II

Yesterday, I covered return calculation for a portfolio with leverage. To review, the background information is:The investor wants to acquire a 500 million euro property but only has 400 million in cashThe investor borrows 100 million euro in order to acquire...

Performance with Leverage, Part I

Leverage can be a confusing topic, so I figured it is worth covering in a few blog posts. In this first post, we'll deal with return calculations for portfolios that employ leverage.Leverage is the use of borrowing, typically with an intent to amplify investment...

Common Themes: “Dietz-Style Equations”

For today's post, I'd like to review some of the "Dietz-style" formulae we use to calculate true time-weighted return and estimated time-weighted return. I've never actually seen the formulae presented this way, but hopefully doing it in this fashion will help...