Tomorrow, I will be hosting an open Q & A (question and answer) session for CIPM candidates. This is a chance for you to ask questions as you are (hopefully) doing your final studying for October's exams! The session is open to both Principles Level...

CIPM Exam Tips & Tricks

Lorem ipsum dolor sit amet.

CIPM Open Question/Answer Session… Tomorrow!

Loyalty Only Goes So Far…

There was good news in the media this morning, as the United States Internal Revenue Service (IRS) awarded a former UBS employee in the amount of $104 million USD for "whistle-blowing" regarding activities at UBS that assisted some of the firm's clients in hiding...

Campisi Fixed Income Attribution – Price Contribution Explained

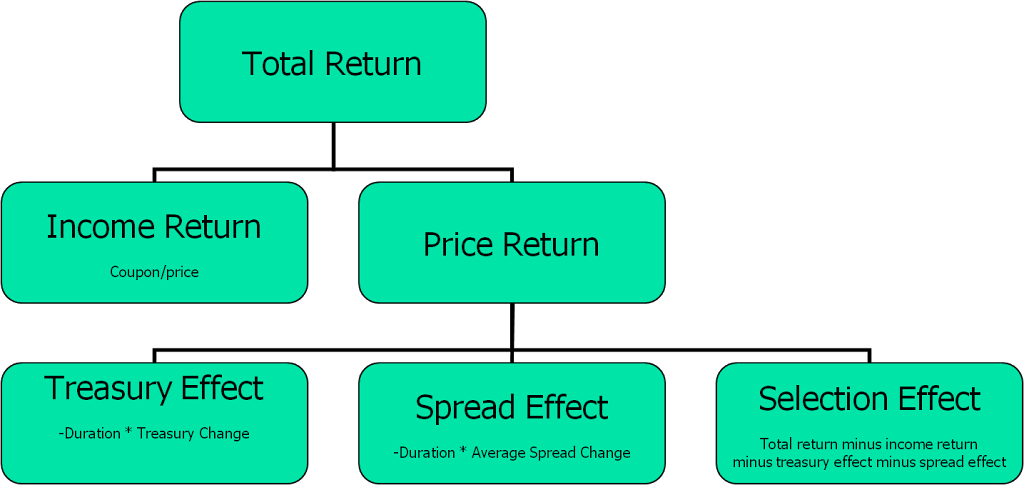

The CIPM curriculum does not give much of an explanation of bond pricing in relation to interest rates, so here is a brief primer.Price change on bonds can be explained by how interest rates change during the period.Bonds are a lending agreement: the purchaser...

Sample Rate of Return Exercise – Cash Flow Timing

A Principles Level candidate emailed me the following problem, and asked me about how to interpret the timing of the cash flows: In this case, given that they tell you that the fair valuations are inclusive of the flows, my interpretation would be that the timing of...

Campisi Fixed Income Attribution – Income Contribution Explained

Recall from my previous posting, the steps to executing the Campisi fixed income attribution model are:Decompose the benchmark return into:- income contribution- Treasury contribution (i.e., price change due to changes in Treasury rates)- spread contribution (i.e.,...

Correction to Exercise on Sample Exam (Principles Level)

Last week, when I was teaching TSG's CIPM Exam prep class for the Principles Level, a student asked me for help with a question on a sample exam from CFA Institute. The question read: Which of the following is most likely not a requirement of the GIPS standards...

Decomposing the Campisi Fixed Income Attribution Model

For many CIPM Expert Level candidates, fixed income attribution is the most difficult topic. This is evident when I teach TSG's CIPM prep classes, as we devote an entire afternoon to the subject. Among the three models that candidates are required to learn...

Futures Contracts: a Brief Primer

At the Expert Level of the CIPM curriculum, candidates are required to deal with return calculations of portfolios with futures contracts, as well as attribution analysis. A good number of candidates, however, have little to no background on futures contracts,...

Distinguishing between GIPS Pre-verification and Verification Procedures

One of the Learning Outcome Statements at the Expert Level requires CIPM candidates to know the pre-verification procedures and verification procedures prescribed in the GIPS standards. A common question that I get is how to tell whether something is a...

Why Don’t We Annualize Returns of Less Than One Year?

Most performance analysts have heard it said that we should never annualize returns of less than one year. Some may also be aware that GIPS provision I.5.A.4 (2010 edition of GIPS) forbids compliant firms from annualizing returns for periods of less than a...