The SEC has taken action against ZPR Investment Management, a Florida separate-account money manager. InvestmentNews provides a synopsis of what the case involves. The article reports that "Max E. Zavanelli — a portfolio manager who has compared his success at...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

The SEC Takes Action Against Firm Misprepresenting Their Compliance With the GIPS Standards

And so, how many levels ARE THERE to GIPS verification?

There appears to still be some confusion regarding "levels" of verification, when it comes to the Global Investment Performance Standards (GIPS(R)). None of us who lived through it, I'm sure, want to return to the days of the AIMR Performance Presentation Standards...

Five Keys to Provide the Right Performance Information

We are and have been in the "information age" for some time, but we're arguably still struggling with it. There have been massive reports about the massive amount of information we're subjected to on a daily basis. Many (probably all of us) are in the information...

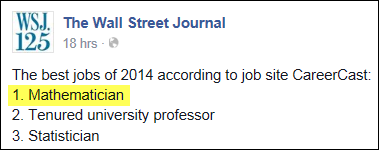

A reason for performance measurement professionals to celebrate!

The Wall Street Journal posted the following yesterday: Well, to me this is a reason for performance measurers to celebrate. Why?, you might ask: because: we're mathematicians. Wikipedia defines a mathematician as "a person with an extensive knowledge of...

Buddy, can you spare … two minutes? Our “mini” survey won’t even take THAT long! And yet, your views are highly desirable

We're wrapping up our "mini" GIPS® survey, but first want to hear from you! It's REALLY fast to do; we only ask four questions: 1. Your Name/ Company/ Title 2. Does your firm currently claim compliance with the GIPS® standards? 3. Do you want to see a guidance...

What performance measurers can learn from golf

I took most of this week off so that a friend of mine and I could go to the Masters golf tournament in August, GA. Our wives came along, though they stayed at our hotel location (in Savannah, GA) while we headed to yesterday's final practice round and par-3...

Understannding the rules, the conventions

This morning, I had to phone in a prescription refill to our pharmacy (CVS). They have an automated system that allows you to enter a number associated with the prescription, which makes the process pretty simple; simple up to one point, at least for me.My wife is...

Dealing with denial

Yesterday's WSJ had a book review on The Unpersuadables, by Will Storr. It isn't clear that I have much interest in the book, though the ideas summarized in the review are intriguing. The reviewer, Michael Shermer, identifies some of the folks highlighted in Storr's...

A demonstration of superior risk management

Risk measurement is a challenge; risk management, even more so. This video is a great demonstration of properly managing risks. What can we learn from it? I think that we have the vision to be able to see when things aren't working out as planned or expected, need to...

GIPS’ Sunset Rules and Q&As … what do YOU think?

We are hosting a "mini" survey, and would like your thoughts, IF your firm claims compliance with the Global Investment Performance Standards. There are really only two questions. It should take you only a minute or so to complete it! The first deals with sunset...