A few years ago, when our younger son, Douglas, began to participate in the "Tough Mudder" events, he called to tell us how he did. He told my wife that he finished in, as I recall, something like two hours. My wife responded with great pride. When she communicated...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Going beyond statistics as useless information

Public Comment Period Open for Universal Advisor Performance Standards (UAPS)

TSG and Brightscope announced today that UAPS is now open for public comment.We are very pleased that the announcement has already garnered some attention: both MarketWatch and InvestmentNews have run stories, with more expected. The public comment period will last...

Even science doesn’t need equations … to communicate idea, that is

I'm probably beating a dead horse, but will persevere, regardless.This past weekend's WSJ had an interesting article by Stephen Hawking ("A Brief History of a Best Seller"), in which he discusses his famed book's origin. His editor pestered him to make it more...

A cool word: battology

I love dictionary.com; it has a "word of the day" which is often one I'm unfamiliar with. While many are words that fail to inspire me, some do.A few weeks ago, battology was the word they introduced.What a great word! I knew at first it was one I'd like.When I...

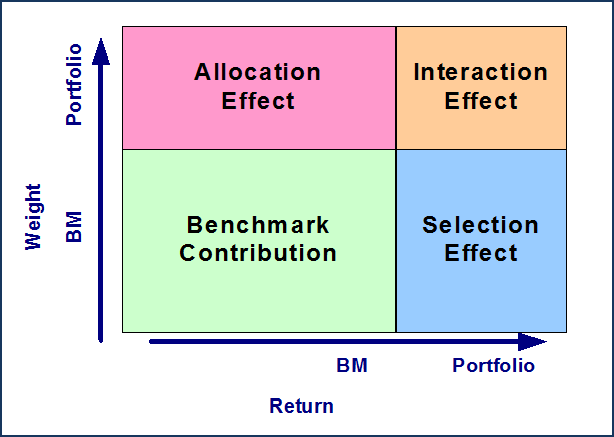

Sector returns: with or without cash

I recently conducted a "non-GIPS(R)" verification for a client's sector returns. They have sliced up their portfolio in a dozen ways (e.g., U.S. growth and value; small, mid, and large cap; emerging markets) and presented returns for a multi-year period. They chose to...

Press Release: TSG Appoints Mark Goodey – Associate for European Business Development

We have known Mark a long time, and respect and like him a great deal. We know that he will be a great addition to our team, and are anxious for him to join us. This new position demonstrates our commitment to the European market, and our desire to expand our services...

It’s not JUST about the numbers, but pretty darn close …

Last week I offered a theory as to why retail investors may not be interested in rates of return, and it resulted in numerous comments from readers. As I was preparing this post, I read the following in an "Op Ed" piece in today's WSJ, by David R. Henderson, titled...

Happy LDW (Labor Day Weekend)

Memorial Day is the "official" start of summer,and Labor Day the official end, despite the fact that both are technically off. But starting next week, we will pretty much return to "business as usual." Hoping you and your family had an enjoyable summer, and that this...

Why retail investors could care less about rates of return

I often hear from those who serve the retail market that they are rarely asked for their rates of return; this seems a bit odd, as it would make sense for investors to want to inquire into a prospective manager's track record.An article in this past weekend's WSJ...

“Cool Words”

As grandparents of two boys (ages four and soon-to-be two), my wife and I have become acquainted with the television show "Yo Gabba Gabba." A regular feature is called "cool tricks," where a guest displays something they think is, well, cool! For example:I...