One area that often results in a lot of confusion (and probably some controversy) is how one should calculate performance attribution of a portfolio that includes derivatives. I have been of the opinion that if the portfolio holds anything that isn't represented in...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Performance attribution with derivatives

Occasions when the cure is worse than the disease

In their classic, A Monetary History of the United States, 1967- 1960, Milton Friedman and Anna Jacobson Schwartz observed that FDR's bank holiday, shortly after he took office in 1933, which was supposed to have been a cure was, in reality, "worse than the disease."A...

First Madoff, now Wasendorf: Knowing who you can trust is getting increasingly difficult

I sometimes jokingly say that since I was once a politician, lying comes naturally to me. And we know how politicians typically rank on the scale of trustworthiness. Lawyers and used car salesmen are also among those who seem to garner little respect in the trust...

TSG now offers Opeational Reviews

TSG announced yesterday that we now offer operational reviews. While we've actually been performing this service for 20 years, we never told anyone about it...seems odd, right? When a client would come to us and ask, "can you review our operation, to identify...

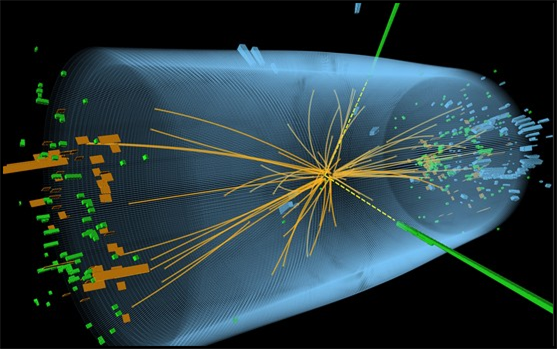

What we might learn from the Higgs boson?

I must confess a fair amount of interest in the recent discovery of the Higgs boson, aka "The God Particle." It is an amazing story, though its true meaning seems beyond the grasp of most of us mortals. I won't bother to attempt to explain what it is, since there are...

A twist on handling the interaction effect

One of the topics which often results in debate is the interaction effect. Recall that in performance attribution, specifically with the "Brinson models," we have two effects: allocation and selection. Depending on how we calculate these effects we may have a third:...

First Principles in Performance & Risk

A first principle is refers to "any axiom, law, or abstraction assumed and regarded as representing the highest possible degree of generalization."Fields such as philosophy, mathematics, and physics have them. Does performance and/or risk measurement? I think there...

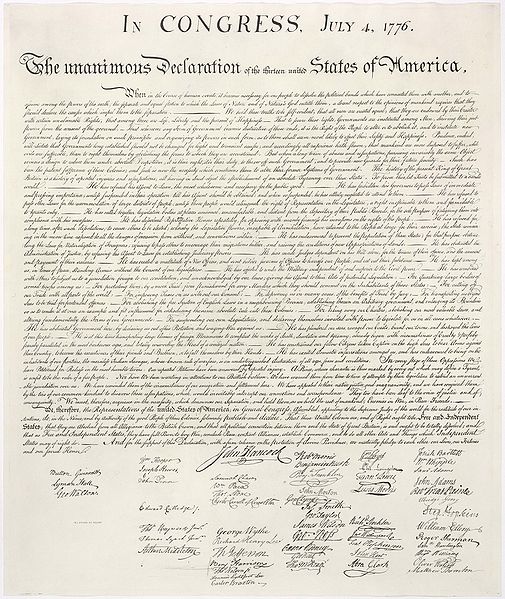

A mid-week holiday

It has become fashionable here in the United States to move holidays to a Monday or Friday, so as to have a three-day weekend. This has happened with Memorial Day and Veterans' Day, for example. I was born on Veterans' Day (what used to be Armistice Day), and I...

Can a GIPS-compliant firm show a “rep” portfolio? Should the UAPS permit them?

I had a recent conversation about the UAPS (Universal Advisor Performance Standards), which provides the ability for a compliant firm to show a representative ("rep") portfolio's performance. I mentioned that the white paper is a draft and subject to change. However,...

Documenting your risk measure

At TSG's PMAR Europe conference earlier this month, one speaker suggested that Bill Sharpe's revised eponymously named risk-adjusted return is more typically employed than the original. While I don't have a lot in the way of empirical evidence, I believe...