Issue Contents:

Does a bottom-up approach make sense for time-weighted returns?

By David Spaulding, DPS, CIPM

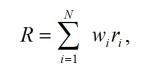

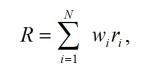

I suspect you may have encountered this formula on occasion:

It basically represents the return, R, as the sum product (to use the Excel function) of the underlying securities or sectors. Our friend, Jose Menchero PhD, CFA, often references it in his articles.1

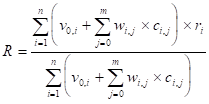

This is a rather simple way to convey what really needs to happen, as the weight, wi, fails to account for cash flows. And so, perhaps a better way to describe what is needed is:

where:

R = the return of the portfolio

v0,i = the ith security’s beginning value

ci,j = the jth flow of the ith security

wi,j = the weighting factor for the jth flow of the ith security

ri = the ith security’s return.

To confess, I’ve never seen the appeal of this approach, save for conveying a “truth” that the whole should be comprised of the sum of its parts.

My counter to it is to simply calculate the portfolio’s return directly, from its starting and ending values, cash flows, and appropriate cash flow weighting; this can be done whether we’re using a daily, exact method, or a monthly approximation formula.

The challenge I have discovered, with building from the bottom up, is that you need to properly account for all the flows, both internal and external. That can be a lot of work.

I’m on the lookout for someone who can convey for us the benefits of actually employing this method.

NOTE: this method is an acceptable way to composite [note the verb form of the noun, composite] portfolios for an asset-weighted composite for GIPS® compliance. But in this piece, I’m asking about it for calculating a portfolio’s return. Please let us know your thoughts. If you do use it, explain why and what you’ve discovered. Thanks!

Note, also that I’ve penned an article on this topic, which will [hopefully] appear in a future issue of The Journal of Performance Measurement®.

1See, for example, Menchero, Jose G. 2000/2001. “A Fully Geometric Approach to Performance Attribution.” The Journal of Performance Measurement. Winter.

Menchero, Jose. 2002/2003. “Performance Attribution With Short Positions.” The Journal of Performance Measurement. Winter.

Interested in reading the full article when it becomes available? Click here

Have an opinion? Please share it with Patrick Fowler.

Quote of the Month

“If you seek peace, be still.

If you seek wisdom, be silent.

If you seek love, be yourself.”

– Becca Lee

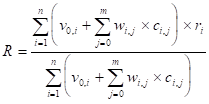

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “A Practical Guide to the Performance Measurement Process: Reflections and Considerations” by Luke Petrus of Ortec Finance and Doug Chau University of Toronto Asset Management Corporation (UTAM), which was published in the Spring 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

The performance measurement process is essential in an investment organization. The analytics derived from this process inform various decisions across the organization and shape future strategic directions. Understanding the complexities of constructing an effective performance process is crucial for creating a robust feedback loop. Here, we offer our perspectives on building an efficient workflow, key considerations when leveraging technology to achieve your goals, and the multi-departmental teams typically involved in implementing the process. Our aim is to encourage you to reflect on your internal processes and emphasize the careful consideration necessary for establishing an effective performance measurement process.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

Attention: TSG Verification Clients Attending the 28th Annual GIPS Conference

TSG will host a dinner on September 17th for clients and invited guests. Please email Chris Spaulding if you are interested in joining us. CSpaulding@TSGperformance.com

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

Welcome To The Performance Measurement Forum

Capital Group!

The Performance Measurement Forum has met 103 times over the past 25 years and our next meetings are scheduled for November in Barcelona, Spain and Charleston, SC. This month we celebrate and recognize our newest member, Capital Group.

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

Contact Patrick Fowler if you would like information about how you can be part of this dynamic group.

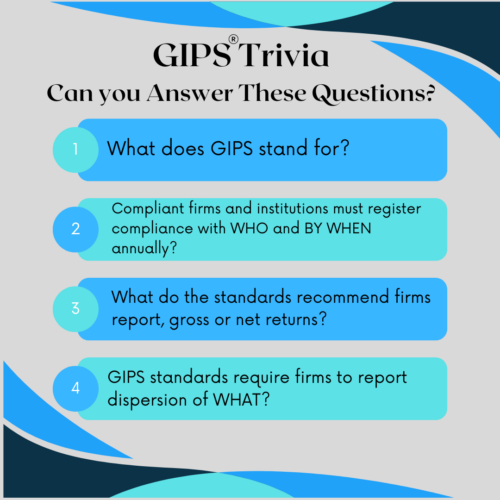

TRIVIA TIME

Here’s This Month’s Trivia Questions; Answers In The Next Issue!

Submit your responses to: PFowler@TSGpeformance.com

Last Month’s Trivia Solutions.

1. What was the first book published by Jane Austen?

Answer: Sense and Sensibility

2. Which two countries have the longest shared international border?

Answer: The United States of America and Canada

3. What year was the first iPhone released?

Answer: 2007

Correct responses to the trivia questions:

- Mike Beck

- Burk Thompson

Please submit your trivia solution or puzzle ideas to Patrick Fowler.

Does a bottom-up approach make sense for time-weighted returns?

By David Spaulding, DPS, CIPM

I suspect you may have encountered this formula on occasion:

It basically represents the return, R, as the sum product (to use the Excel function) of the underlying securities or sectors. Our friend, Jose Menchero PhD, CFA, often references it in his articles.1

This is a rather simple way to convey what really needs to happen, as the weight, wi, fails to account for cash flows. And so, perhaps a better way to describe what is needed is:

where:

R = the return of the portfolio

v0,i = the ith security’s beginning value

ci,j = the jth flow of the ith security

wi,j = the weighting factor for the jth flow of the ith security

ri = the ith security’s return.

To confess, I’ve never seen the appeal of this approach, save for conveying a “truth” that the whole should be comprised of the sum of its parts.

My counter to it is to simply calculate the portfolio’s return directly, from its starting and ending values, cash flows, and appropriate cash flow weighting; this can be done whether we’re using a daily, exact method, or a monthly approximation formula.

The challenge I have discovered, with building from the bottom up, is that you need to properly account for all the flows, both internal and external. That can be a lot of work.

I’m on the lookout for someone who can convey for us the benefits of actually employing this method.

NOTE: this method is an acceptable way to composite [note the verb form of the noun, composite] portfolios for an asset-weighted composite for GIPS® compliance. But in this piece, I’m asking about it for calculating a portfolio’s return. Please let us know your thoughts. If you do use it, explain why and what you’ve discovered. Thanks!

Note, also that I’ve penned an article on this topic, which will [hopefully] appear in a future issue of The Journal of Performance Measurement®.

1See, for example, Menchero, Jose G. 2000/2001. “A Fully Geometric Approach to Performance Attribution.” The Journal of Performance Measurement. Winter.

Menchero, Jose. 2002/2003. “Performance Attribution With Short Positions.” The Journal of Performance Measurement. Winter.

Interested in reading the full article when it becomes available? Click here

Have an opinion? Please share it with Patrick Fowler.

Industry Dates and Conferences

- September 25 – London Performance and Risk Summit

- November 7-8 – Autumn EMEA Meeting of the Performance Measurement Forum – Barcelona, Spain

- November 20 – Fall Meeting of the Asset Owner Roundtable (AORT) – Charleston, SC

- November 21-22 – Fall North American Meeting of the Performance Measurement Forum – Charleston, SC

For information on the 2024 events,

please contact Patrick Fowler at 732-873-5700.

Institute / Training

Access TSG’s Online Training

Content With One Pass

Question 8: Do you agree with requiring firms to initially present at least five years of performance that meets the requirements of the GIPS standards and this Guidance Statement?

Yes, but with some updates to the wording. We believe the intent here is to have this requirement be aligned with the existing guidance and requirements for firms that compete for business and market to prospective clients. If that is the case, please update the language to match the language in Provision 1.A.3 and to state, “…compliance for a minimum of five years or for the period since the firm inception if the firm has been in existence for less than five years.”

That’s a Good Question

Question: Since we use the aggregate method to calculate our composite returns, and therefore don’t asset weight the returns of the portfolios in the composite, must we revalue the portfolios for large external cash flows? The portfolios’ returns don’t play a part whatsoever in our aggregate-based composite return, so revaluing them seems like a waste for us.

We fully understand the logic of your question, since the requirement to revalue for large flows for monthly returns was done to improve their accuracy. The original plan was to require revaluation for all cash flows, so the decision to just require it for large flows was intended to make the requirement less onerous. And so, the requirement was introduced to improve account returns. If the aggregate method doesn’t use account returns, why revalue?

Well, the bottom line answer is: you have to revalue, even when you use the aggregate method. We think this is because the folks who oversee the Standards recognized that account returns that aren’t revalued for large flows are less accurate, period. If you’re going to use them to report to your clients, you should strive to have as accurate results as possible.

Doing so also avails you of the opportunity to convert from the aggregate approach to what we consider a better one: asset-weighting the individual accounts.2

2See Spaulding, David. 2010/2011. “An Analysis of the Aggregate Method to Calculate Composite Returns.” The Journal of Performance Measurement. Winter.

Please submit your questions to Patrick Fowler.

Potpourri

In The News

Answers to last month’s survey

1. Which of the following best describes your firm’s approach to documenting your policies for performance reporting to clients:

A. We maintain a performance policies document specifically for client reporting – 20.0%

B. Our client reporting policies for performance are maintained within our GIPS policies (or in one document for all performance reporting that includes GIPS policies) – 80.0%

C. We do not have documented policies for performance reporting to clients – 0.0%

2. Which of the following best describes your firm’s approach to documenting your policies for attribution reporting (return and/or risk) to clients:

A. We maintain an attribution reporting policies document specifically for client reporting – 20.0%

B. Our client reporting policies for performance are maintained within our GIPS policies (or in one document for all performance reporting that includes GIPS policies) – 40.0%

C. We do not have documented policies for performance reporting to clients – 40.0%

3. Within your firm’s IPS (investment policy statements), do you have a section that addresses performance?

A. Yes – 60.0%

B. No – 40.0%

C. We do not have formal IPS documents – 0.0%

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Fall Issue: October 11, 2024

Winter Issue: January 13, 2025

Book Review

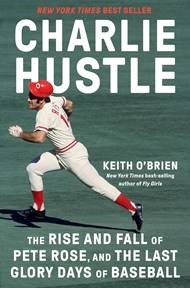

Charlie Hustle, by Keith O’Brien

Review by David D. Spaulding, DPS, CIPM

I grew up a Philadelphia Phillies fan, and still enjoy seeing them play, even though I haven’t lived in Philadelphia for more than 50 years. My wife and I typically see them in Toronto, against the Blue Jays, with each of us adorned with shirts for the team we favor. We’ll be there in September when they come to town, with my sister-in-law, Lorraine, a HUGE Phillies fan, and her husband, Dave.

While I was never a Pete Rose fan, I respected the spirit in which he played the game. And when he joined the Phillies when it seemed impossible for them to win the NL pennant, and then go onto to the World Series, I knew immediately why they signed him: they hoped his spirit and energy would be contagious and picked up by his teammates. Well, it was, and two years after they signed him, they went to only their third World Series (the previous one was against the Yankees in 1950) and won, for the first time! Such excitement for a diehard fan of the team that holds the record for the highest number of losses by any professional team, in any sport: not a record anyone cherishes.

When I learned that Rose was being banished from baseball for gambling on baseball games, including his own team, I was shocked, just as pretty much everyone else. How could this have occurred? Well, this exceptionally detailed book provides some insights, as well as lots of details about Pete, his family, and his strengths and shortcomings.

Rose was introduced to gambling by his father, when he was just a youngster; he’d accompany his father to the race track, and enjoyed cheering for the horses his dad bet on. No doubt this became addictive for himself, too, when he got older. He regularly visited horse racing, dog racing, and jai alai to wager pretty sizable bets. He also regularly bet with bookies on basketball and football (and later baseball) games. The author suggests that he wasn’t particularly good at it, but that didn’t stop him.

I met him one time. This was several years ago. I was teaching one of our firm’s performance measurement courses. My students and I had lunch in the hotel restaurant, and one of them mentioned that Pete Rose was sitting nearby. Well, I had to get up and go to his table: he was sitting there with another gentleman. I thanked him for the inspiration he gave to his fellow Phillies, which brought them their first World Series victory. He was quite pleasant and charming, and seemed to appreciate my visit.

Question: Should he be in the Baseball Hall of Fame? (Share your thoughts by participating in our survey at the end of the newsletter)

My son, Chris, and his family recently visited Cooperstown where the HoF resides: my grandson, Caden, was in a baseball tournament there. They visited the Hall, and took photos with photos of our cousin, Albert Goodwill (A.G.) Spalding, who entered the HoF in 1939.*

From a pure production standpoint, it’s hard to argue that Pete deserves to join our cousin in Cooperstown. The problem: he bet on baseball. As the book points out, posters adorned with Baseball’s Rule 21(d), which specifically prohibits gambling on baseball, are hung in every professional locker room. Rose knew the rules. Not only did he ignore them, he lied about it for 15 years following his banishment.

As his former teammate Johnny Bench explained in an interview,** if Baseball were to admit him, then parents should tell their children that rules don’t matter.

This subject remains controversial.

My answer: I agree with Bench. His violation of this important rule is justification for keeping him out.

As for the book, I recommend it; it’s one of the better baseball books I’ve read. You’ll learn a lot.

* Yes, A.G. Spalding is a distant cousin; something like seventh cousin, seven times removed. And yes, we have a “u” in our name but he doesn’t. We’re still related.

** https://www.youtube.com/watch?v=v_4euOWih_U&ab_channel=DanPatrickShow

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.