GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

TSG Milestones

The Journal of Performance Measurement®

This month’s article brief spotlights “The Importance of Data Quality Checks in Total Return Calculations” by Gerard C. M. van Breukelen. It was published in the Fall 2025 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

It is expected that portfolio total returns are calculated independently and correctly. How many people realize that the quality of input will impact the numbers, especially in the case of large cash flows? In this article we will see distorted performance calculations, for instance due to cash flow timing and incorrect or incomplete portfolio valuations at the moment of the cash flow. This article proposes ways to assess the data quality, and proposes data and setting changes as solutions to present correct total returns.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

Industry Dates and Conferences

35 Years of Excellence: What to Expect From TSG in 2026

Looking Ahead to 2026: New Offerings, Expanded Events, and Deeper Industry Collaboration

As we head into 2026, TSG is expanding its platform of events, research, and industry resources designed to support performance, attribution, risk, and GIPS® professionals across the globe. The newly released 2026 Partnership Opportunities outline a robust lineup of conferences, forums, research initiatives, and media channels that continue to connect practitioners, asset owners, consultants, and technology providers in meaningful ways.

A major new initiative is TSG’s Performance Technology Vendor Matrix, an independent, transparent, vendor-populated comparison tool covering composites, rates of return, attribution, risk, and related functionality. The Matrix is being built to help firms evaluate systems side-by-side based on real-world capabilities and use cases. We are grateful for the early support and collaboration from First Rate, John Norwood, and Confluence, whose input and engagement have been instrumental in shaping the structure and content of this resource as it comes to market.

TSG’s flagship events remain central to our mission. PMAR North America will take place June 10–11, 2026, in New Brunswick, New Jersey, followed by PMAR Europe on September 16, 2026, in London. Both conferences continue TSG’s long-standing commitment to high-quality, practitioner-led programming rather than pay-to-play panels, with opportunities for deep discussion around performance measurement, attribution, and risk.

Research also remains a core focus. In 2026, TSG will relaunch the Asset Owner Performance Measurement Survey, building on prior editions that have become a benchmark for understanding how asset owners structure teams, select technology, integrate risk, and manage data. The survey will again offer sponsors visibility, thought leadership opportunities, and access to detailed results.

Beyond conferences and research, TSG continues to invest in year-round engagement through the Performance Measurement Forum, Asset Owner Roundtable, and regional networking events focused on data analytics and performance measurement. These small-group, interactive settings are designed to encourage open dialogue, shared learning, and lasting professional connections.

Together, these initiatives reflect TSG’s ongoing commitment to advancing best practices and supporting the evolving needs of the global performance community, with 2026 shaping up to be one of our most ambitious and collaborative years yet.

TSG 2026 Events Calendar

| Date | Event | Location |

|---|---|---|

| April 22 | Asset Owner Roundtable (AORT) – Spring | Montreal, QB, Canada |

| April 23–24 | North American Performance Measurement Forum – Spring | Montreal, QB, Canada |

| May 20 | Data Analytics & Performance Measurement Networking Event | Boston, MA, USA |

| June 10–11 | PMAR North America | New Brunswick, NJ, USA |

| June 18–19 | EMEA Performance Measurement Forum – Spring | Milan, Italy |

| September 16 | PMAR Europe | London, England |

| October 22–23 | EMEA Performance Measurement Forum – Fall | Prague, Czech Republic |

| November 18 | Asset Owner Roundtable (AORT) – Fall | San Diego, CA, USA |

| November 19 | North American Performance Measurement Forum – Fall | San Diego, CA, USA |

| TBD | Data Analytics & Performance Measurement Event | Amsterdam, Netherlands |

| TBD | Data Analytics & Performance Measurement Event | Dubai, UAE |

Mark Your Calendars! Let’s make 2026 a year to remember.

For information on the 2026 events and partnership opportunities, please contact Patrick Fowler at 732-873-5700.

ATTN: TSG Verification Clients

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

Compliance Corner

Essential Year-End Compliance Considerations for RIAs and RICs

As 2025 wraps up, firms operating as Registered Investment Advisers (RIAs) or Registered Investment Companies (RICs) face important year-end compliance tasks, especially because year-end AUM levels can trigger new SEC registration requirements.

Key takeaways:

- Firms should begin their annual compliance review under Rule 206(4)-7 — documenting policy effectiveness, past incidents, testing results and operational changes.

- It’s time to review and update Form ADV (Parts 1 & 2) for accuracy. Any business changes, including fee structures, services, conflicts of interest, must be transparently disclosed, and marketing materials and client communications must align with the updated disclosures.

- Prepare for possible regulatory scrutiny: the article recommends firms ready themselves for an exam by the U.S. Securities and Exchange Commission (SEC), including via mock exams or internal reviews, especially focusing on fees/expenses, conflicts of interest, valuation practices, and compliance with the marketing rule.

- Review all marketing and advertising content (performance data, hypothetical returns, third-party ratings) to make sure they are substantiated, accurate, and not misleading.

- Confirm that cybersecurity, data-protection, record-keeping and retention practices are up to date, including archiving communications (email, chats, etc.), maintaining incident-response plans and vendor oversight controls.

Why this matters now:

Because certain thresholds related to assets under management (AUM) are recalculated at year-end, firms may suddenly find themselves subject to SEC registration. Starting these reviews promptly — rather than waiting until the last minute — reduces risk, supports clean filings, and reinforces an overall strong compliance posture going into 2026.

Webinar replay: SEC Marketing Rule FAQs with Lance Dial, Partner, K&L Gates and David Spaulding, DPS, CIPM, TSG Listen as Lance and Dave dive into issues that have challenged advisors since the rule went into effect.

PUZZLE TIME

Congratulations and thank you to Gerard van Breukelen, Gregg Weintraub, and Anthony Howland for submitting the correct solution.

Solution by David Spaulding, DPS, CIPM

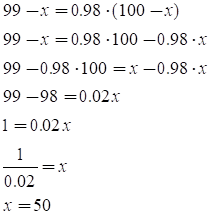

In a room of 100 people, 99% are left-handed. How many left-handed people have to leave the room so their percentage drops to 98 percent?

When I saw this puzzle, I suspected it wouldn’t be too difficult to solve. I also thought that many folks might simply think that if 99% are left-handed, meaning 99 out of the 100 people in the room, to get to 98% would be easy: just have one southpaw leave the room. But that would only hold if the total remained at 100 (i.e., if the left-handed person was immediately replaced by a right-handed one), but this isn’t the situation.

I did some quick trials, to see what would happen when one, two, three people left, and saw that the impact on the percentage wasn’t very much. And so, I employed the bi-section1 technique and found that 50 had to leave. Definitely not what I was suspecting.

I also knew that this is not how we solve mathematical puzzles. Rather, I would have to solve it using algebra.2I spent about 30-45 minutes thinking about it, trying different approaches, but couldn’t arrive at a solution. Later that night, while resting in bed, I spent a few minutes thinking about this puzzle, and the solution, not surprisingly, 3 quickly appeared. Knowing that pale ink is better than the most retentive memory, instead of going to sleep, thinking I’d recall the formula when I arose, I got up and wrote it down. The next morning, I confirmed that the formula was correct:![]() x represents the number of left handed people that must depart. There are 99 left-handed people in the room at the start, so we need to find the number that will remain once the necessary number leave the room (99−x).

x represents the number of left handed people that must depart. There are 99 left-handed people in the room at the start, so we need to find the number that will remain once the necessary number leave the room (99−x).

The right side represents our goal: that is, to find the number that must that will end up in the room after the necessary number of left-handed people have let (100-x), to arrive at the target percentage of left-handed people (98 percent). Extending the formula, we find our solution:

As with many puzzles, one must determine the correct formula; the solution should then come quickly. Simple arithmetic confirms that 49/50 = 98 percent. That is, 50 of the 99 left-handed people leave, resulting in 49 left-handed remaining, plus the single right-handed person, for an ending total of 50 people in the room.

1 The three most common approaches to solving for the IRR are Newton-Raphson, Secant, and Bi-section. Bi-section involves splitting the range of possibilities in half, and continuing this process until the solution is found.

2 I imagine that some of my friends, like Anthony Howland, might see a simple logical approach to solving this puzzle, but I knew algebra would work, and it did, once I found the right starting formula.

3 I suspect you’ve found times when solutions or ideas magically appear when you are at rest. Happens to me all the time.

Upcoming Webinars / Surveys

In Case You Missed It…

Webinar Replay: Performance Measurement Technology Survey Recap

Webinar Replay: Performance Measurement in Private Equity

Webinar Replay: Performance Surprises with David Spaulding, DPS, CIPM

Webinar Replay: Should Your Firm Pursue GIPS® Compliance and Verification?

Webinar Replay: Recently Published SEC Marketing Rule FAQ

Institute / Training

Inside the Institute: A Fresh Perspective

Institute.TSGperformance.com

Link to the Class: Performance Measurement Attribution

By Jesse Teller

Module 1 – Attribution Fundamentals & Equity Attribution

Performance Attribution Module 1 focused on providing the essential material needed for a thorough understanding of what attribution is. The lesson started with the basics of attribution, which was broken down into allocation, stock selection, and currency contribution. These core components were introduced in a way that made their roles in performance measurement intuitive and logical. From there, the module walked through both absolute attribution and contribution techniques, helping to clarify how portfolio elements contribute to overall returns. Next came relative attribution, which added another layer of depth, comparing performance against benchmarks. The rationale behind why we do attribution really clicked. The framework made sense from the start, and each section built logically on the last. Dave’s use of real-world examples and logical comparisons also helped improve my understanding of the topic. Attribution is not something I have learned much about previously, so the clarity created by the examples was very beneficial. I also found that some of the formulas were hard to memorize and apply, despite a conceptual understanding. However, I know I could improve with more practice and experience.

That’s a Good Question

“My firm is an OCIO. Must our 2025 reports reflect the necessary changes to comply with the new OCIO guidance?”

TSG Response: The guidance provides this wording for the “effective date”: “The Guidance Statement for OCIO Portfolios has an effective date of 31 December 2025. GIPS Reports for Required OCIO Composites that include performance for periods ending on or after 31 December 2025 must be prepared in accordance with the Guidance Statement for OCIO Portfolios.” <emphasis in original>

The new rules apply when firms prepare their GIPS Reports that includes performance as of 31 December 2025. That is, when OCIO firms update their GIPS Reports to include 2025 performance, they must have converted over to the new rules.

Potpourri

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: January 12, 2026

Spring Issue: March 30, 2026

For any questions, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

Book Review

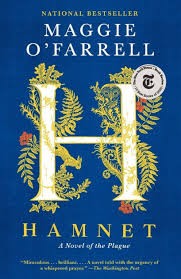

Hamnet

by Maggie O’Farrell,

Review by Douglas Spaulding

“Grief, like a bitter wind, blows through a family, and yet in its passing, leaves a strange, quiet beauty behind.”

Hamnet by Maggie O’Farrell is a work of historical fiction that imagines the life and death of William Shakespeare’s son, and it explores grief, romance, motherhood, love, and how tragedy can be transformed into art. In the novel, Shakespeare’s wife is known as Agnes instead of Anne (her name appeared as Agnes Hatheway in her father’s will). Agnes is a healer, often providing neighbors with herbal remedies, and she is viewed by many with suspicion due to her supernatural sensitivities and intuitions.

Most of the action of the novel takes place from Agnes’s perspective. It follows her from her early life and romantic relationship with Shakespeare through motherhood, family life, and loss. The novel concludes by drawing a connection between her son Hamnet and the play Hamlet, exploring how this affects and changes her.

I couldn’t put this book down, and I felt transported to a different time and place. It was a magical reading experience, both devastating and deeply cathartic, as well as uplifting and inspiring. A story I’ll never forget.

The movie adaptation of Hamnet, starring Jessie Buckley and Paul Mescal, is out now.

Issue Contents:

The Voice

Being Aware of Tels

By David Spaulding, DPS, CIPM

Before I begin, let me make it clear that yes, this piece actually does relate to performance measurement. However, it begins with a metaphor.

I recently purchased a “smart scale” from Hume Health. I didn’t even know there was such a thing as a “smart scale,” though I do encounter one when I go to my doctor’s for my annual physical. The scale was highly ranked when I did a Google search. There’s a video I found that pointed out how accurate it is (https://tinyurl.com/486t8cjn). I’ve been using it for several weeks, and noticed a few “tels,”* which raise questions about its accuracy.

First, it often reports a weight on my phone app that is 0.1 lbs. higher than what the scale shows (e.g., this morning the scale showed 200.3 but the app had 200.4).

Second, it says that my chronological age is 74. Since I had turned 75, this result is a bit curious. If it can’t get my chronological age right, how much confidence should I put in the metabolic or biological age it reports, or, for that matter, other statistics it provides? Add to that the apparent mis-reporting (overstating) of my weight. I’ve sent emails in to their customer service, and await their responses.

That said, there does appear sufficient evidence that much of what they report is accurate, though I look forward to comparing its results with my doctor’s when I visit next year.1

When we do GIPS® and non-GIPS verifications, we also look for tels. That is, statistics that suggest the client might have some issues.

An example: I recently did a GIPS verification and found a portfolio with an annual return over 1500 percent. There is no question the return is wrong, but what about the other, not so obvious, returns? One wonders, is this an anomaly or something more? Other tels might be finding accounts that don’t belong in a composite because of their holdings or being below the composite’s minimum.

It’s typical to sample client data, and when the sample we select is 100% clean, we tend to think the rest of the data is as well. However, when we find issues, we will dig a bit further, to try to ascertain if there are problems we need to address.

Tels2 are valuable tools. Being alert for them is important, not just for verifiers, but the firms and institutions responsible for their calculations and reporting.

1 In case you were wondering, I do recommend the scale. I talked our company president, Patrick Fowler, into buying one, and plan to give my sons each one for Christmas [but please don’t tell them].

2 A “tel” (short for “telegraph”) is a signal. Poker players look for tels given off by the others at the table. They’re any behavior, action, or cue that gives us information about their hand (particularly good or bad) or intentions (e.g., to bluff). If you’re alert, it can give you an advantage. In the movie Maverick, there’s a scene when the eponymous character, played by Mel Gibson, points out a tel that Jody Foster has. Because they’re involuntary, she was unaware of it, and denied it, only to learn from the other players at the table that she actually did.

Quote of the Month

“Success isn’t overnight. It’s when every day you get a little better than the day before. It all adds up.”

– Dwayne Johnson

Compliance Corner

Essential Year-End Compliance Considerations for RIAs and RICs

As 2025 wraps up, firms operating as Registered Investment Advisers (RIAs) or Registered Investment Companies (RICs) face important year-end compliance tasks, especially because year-end AUM levels can trigger new SEC registration requirements.

Key takeaways:

- Firms should begin their annual compliance review under Rule 206(4)-7 — documenting policy effectiveness, past incidents, testing results and operational changes.

- It’s time to review and update Form ADV (Parts 1 & 2) for accuracy. Any business changes, including fee structures, services, conflicts of interest, must be transparently disclosed, and marketing materials and client communications must align with the updated disclosures.

- Prepare for possible regulatory scrutiny: the article recommends firms ready themselves for an exam by the U.S. Securities and Exchange Commission (SEC), including via mock exams or internal reviews, especially focusing on fees/expenses, conflicts of interest, valuation practices, and compliance with the marketing rule.

- Review all marketing and advertising content (performance data, hypothetical returns, third-party ratings) to make sure they are substantiated, accurate, and not misleading.

- Confirm that cybersecurity, data-protection, record-keeping and retention practices are up to date, including archiving communications (email, chats, etc.), maintaining incident-response plans and vendor oversight controls.

Why this matters now:

Because certain thresholds related to assets under management (AUM) are recalculated at year-end, firms may suddenly find themselves subject to SEC registration. Starting these reviews promptly — rather than waiting until the last minute — reduces risk, supports clean filings, and reinforces an overall strong compliance posture going into 2026.

Webinar replay: SEC Marketing Rule FAQs with Lance Dial, Partner, K&L Gates and David Spaulding, DPS, CIPM, TSG Listen as Lance and Dave dive into issues that have challenged advisors since the rule went into effect.

In The News

29th Annual Global Investment Performance Standards (GIPS®) Conference Key Takeaways (GIPS; Trade Error Policy; OCIO; SEC Marketing Rule)

By Todd Jankowski, CFA, CIPM, CFP®; Ashley Reeves, CIPM; Kathleen Seagle, CIPM

Reprinted from Performance Perspectives Blog

TSG was proud to sponsor the 29th Annual Global Investment Performance Standards (GIPS) Conference last week in Arizona. Thank you to everyone who stopped by the booth and grabbed one of our custom T-shirts. As usual, they were the hottest swag at the conference.

We had six team members in attendance, including five of our GIPS specialists, who spent the week engaged in sessions, conversations, and discussions with clients and peers from across the industry.

As the premier boutique firm dedicated exclusively to performance measurement and the GIPS standards, we think it’s important to share the most meaningful takeaways from the event.

Topics covered include:

- GIPS Standards Update

- Trade Error Policy: Principles and Practice

- OCIO Portfolios Under the GIPS Standards Lens

- SEC Marketing Rule

Remember, if you’re looking for guidance, whether you’re already compliant and considering a change in verifiers, or just beginning your GIPS journey, TSG is here to help. You can reach us anytime at CSpaulding@TSGperformance.com.

GIPS Standards Update

- Global Acceptance: Organizations currently claiming compliance with the GIPS standards:

- 1,668 organizations in 54 markets1

- 41 global Sponsors*

- Top five markets are:*

- US

- UK

- Canada

- Switzerland

- South Africa

- 25 of the top 25 global firms for all or a part of their assets2

- 86 of the top 100 global firms for all or a part of their assets2

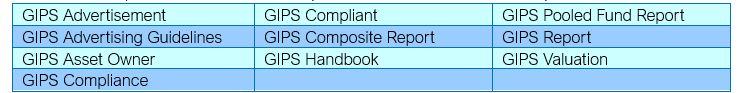

- Trademark Guidelines: GIPS trademark Q&A defined correct usage of the term for all industry participants:

- “GIPS” may only be used as an adjective.

- First reference to “GIPS” in any written or digital material must include the full name — Global Investment Performance Standards (GIPS®) — with the ® symbol.

- Approved “friend words” may follow “GIPS” (like GIPS Report, GIPS Compliance, GIPS Advertisement) while all other uses require “GIPS standards” to be spelled out.

- General references to “GIPS” must include the disclaimer “GIPS® is a registered trademark owned by CFA Institute” while products, services, marketing materials, reports, RFP, website references, etc. must also disclose “CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.”

- Disclaimer must appear on each page (or at the bottom of each webpage) where “GIPS” appears.

- Modification to the GIPS trademark, incorporating it in a hashtag, business, or product name, or use in the plural or possessive is prohibited.

- Forthcoming and New Guidance:

- Guidance Statement for Outsourced Chief Investment Officer (OCIO) Portfolios is effective 31 December 2025. GIPS reports that include performance for periods ending on or after this date must be prepared in according with the Guidance Statement.

- Guidance on attribution reporting and trade error treatment are on the horizon while the following resources were recently made available:

- 2024 Asset Owner Performance Survey

- Introduction to the GIPS Standards for Boards and Decision Makers

- Introduction to the GIPS Standards for Asset Owner Requirements

- New Tools including updated policy templates, disclosure checklists, and a benchmark calculation toolkit

1 As of 30 September 2025

2 As of 31 October 2024

Trade Error Policy: Principles and Practice

CFA Institute will publish a white paper addressing considerations for trade error policies and a GIPS standards guidance statement addressing performance-related trade error considerations in response to a lack of industry guidance. This is expected to address the following topics:

Identifying, Defining, and Disclosing Trade Errors: Trade errors occur when an executed or unexecuted transaction results in an economic impact. Firms are encouraged to foster a culture in which employees are comfortable reporting trade errors, e.g., by offering training. Material trade errors represent significant events, and their inclusion should be disclosed. Firms should notify clients of all trade errors regardless of who benefits, reinforcing trust and transparency.

Impact: Firms must determine whether an error resulted in a gain or loss, how to calculate any reimbursement, and whether reimbursements have cash-flow implications that impact performance. Removing the erroneous transaction and restoring the portfolio to its intended state (“stripping out the error”) is considered an acceptable approach.

Restoring the Client: Effective policies address opportunity costs, the netting of related gains and losses, whether to add interest to reimbursements, and how to treat transaction costs. Consistent with regulatory guidance, clients should be made “whole,” and gains resulting from errors generally remain with the client.

Performance, Fees, and Forthcoming GIPS Guidance: Trade errors can affect fees and may impact reported performance unless corrected through adjusting transactions. Forthcoming GIPS guidance will clarify how firms must handle errors that would inflate or misrepresent performance including whether firms may exclude impacted portfolios from composites.

OCIO Portfolios Under the GIPS Standards Lens

OCIO Portfolios Under the GIPS Standards Lens

One session at this year’s GIPS Conference reviewed the new Guidance Statement for OCIO Portfolios and explains how firms managing Outsourced Chief Investment Officer (OCIO) portfolios must apply the GIPS standards.

The session began by defining an OCIO as a provider of both strategic investment advice and investment management services to asset owners such as pension plans, endowments, and foundations. It outlined situations where the Guidance Statement does not apply, such as portfolios lacking both advisory and management services, retail client accounts, portfolios that do not include all asset classes of an OCIO portfolio’s mandate, or when fiduciary management providers in the UK are providing information to potential pension scheme trustee clients.

The core of the presentation covered the key concepts of the Guidance Statement:

- Applicability: Firms claiming GIPS compliance must follow all applicable requirements of the GIPS Standards for Firms, as well as all applicable requirements in the Guidance Statement for OCIO Portfolios when providing a GIPS Report to OCIO portfolio prospective clients.

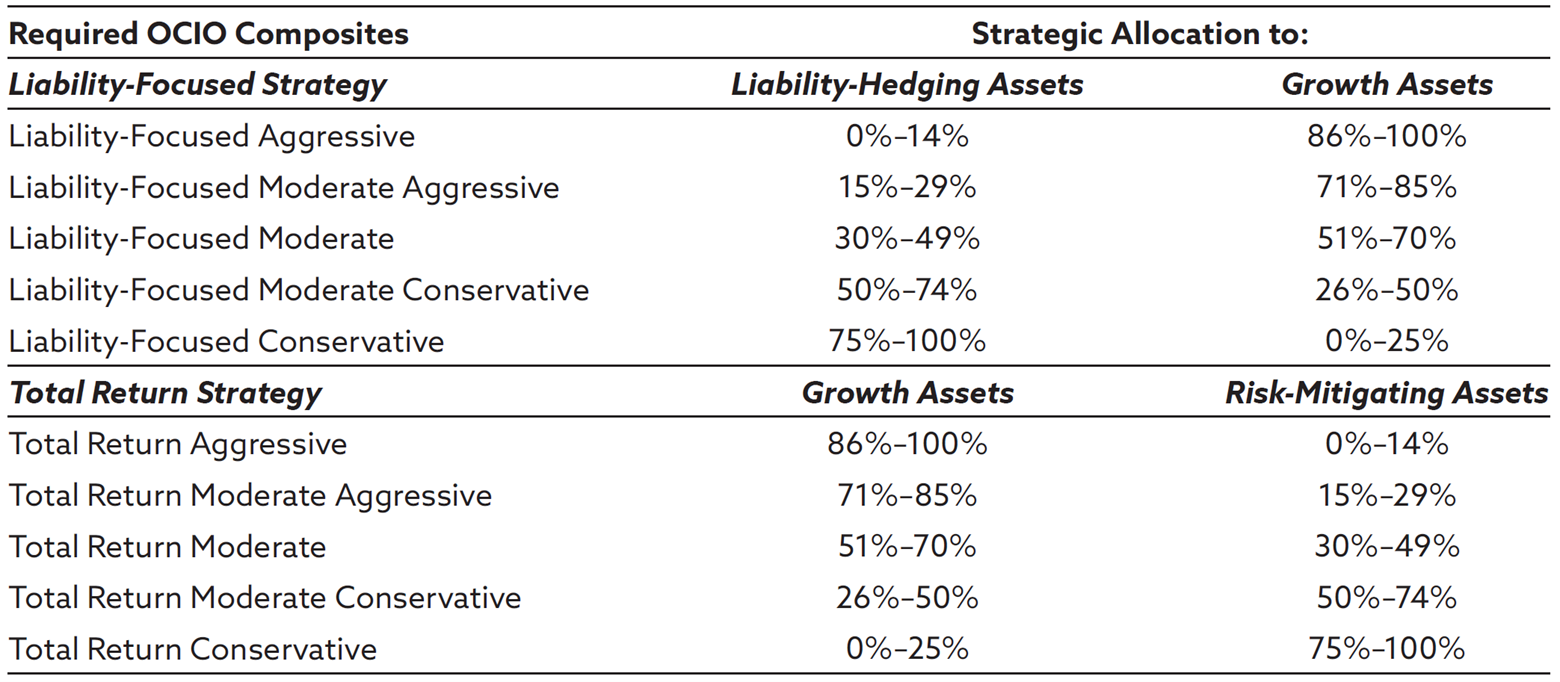

- Required Composite Structure: Firms must classify OCIO portfolios into one of ten required composites based on whether the strategy is liability-focused or total-return-oriented, and on the strategic allocation to specific asset types. For liability-focused composites, assets will be classified as either liability-hedging or growth assets. For total return composites, assets will be classified as either growth or risk-mitigating assets.

Required OCIO Composites for OCIO Portfolios

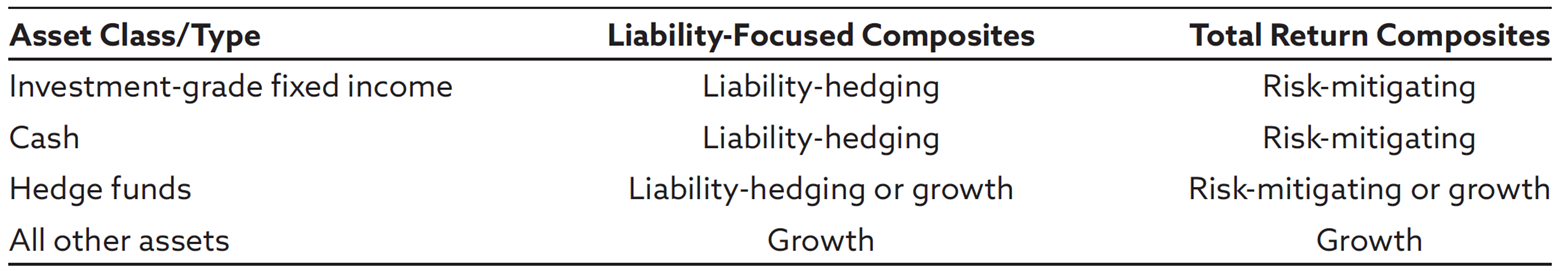

- Asset Classification: Portfolios must be assigned to composites based on strategic allocation. The standards provide recommended classifications for common asset classes but allow firms to deviate with proper disclosure.

Recommended Classifications

- Optional Composites: Firms may create additional composites beyond the required structure.

- Legacy Assets: Firms will need to decide whether these portfolios with legacy assets should be considered discretionary and included in composites. Whatever method a firm chooses, it must clearly disclose how legacy assets were treated so prospective clients can properly evaluate and compare performance.

- Returns: Firms will need to present both gross-of-fees and net-of-fees returns for these composites, given the multiple layers of fees OCIO clients may pay. Both gross-of-fees and net-of-fees returns are assumed to reflect the fees and expenses for underlying pooled funds and externally managed segregated accounts.

The Guidance Statement becomes effective December 31, 2025, and firms must begin applying it to performance for periods ending on or after that date. The presenters emphasized that OCIO consultants and asset owners will increasingly expect GIPS compliance and that noncompliance may become a competitive disadvantage during due diligence.

SEC Marketing Rule

Pamela Grossetti, Partner, K&L Gates LLP

Robert S. H. Shapiro, Partner, Dechert LLP

The following highlights of SEC Marketing Rule presentation from the 29th Annual Global Investment Performance Standards Conference, presented by Pamela Grossetti, Partner, K&L Gates LLP and Robert S. H. Shapiro, Partner, Dechert LLP. Link to full SEC Marketing Rule

Marketing Rule Basics:

SEC Definition of Advertisement: Any direct or indirect communication to more than one person, or to one or more persons if the communication includes hypothetical performance, that:

- offers the adviser’s investment advisory services with regard to securities to prospective clients or private fund investors, or

- offers new investment advisory services with regard to securities to current clients or private fund investors

SEC General Prohibitions: “principles-based”

In any advertisement, an adviser may not:

- Include any untrue statement of a material fact, or omit a material fact necessary to make the statement made, in the light of the circumstances under which it was made, not misleading;

- Include a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the Commission;

- Include information that would reasonably be likely to cause an untrue or misleading implication or inference to be drawn concerning a material fact relating to the investment adviser;

- Discuss any potential benefits to clients or investors connected with or resulting from the investment adviser’s services or methods of operation without providing fair and balanced treatment of any material risks or material limitations associated with the potential benefits;

- Include a reference to specific investment advice provided by the investment adviser where such investment advice is not presented in a manner that is fair and balanced;

- Include or exclude performance results, or present performance time periods, in a manner that is not fair and balanced; or

- Otherwise be materially misleading.

What is SEC Performance

Determining What Is Considered Performance

- “Gross performance” and “net performance” are both defined to mean the performance results of a “portfolio” or portions of a portfolio that are included in extracted performance

- “Portfolio” is defined as a group of investments managed by the investment adviser

- Any performance must be presented on a net basis

- Gross performance may also be presented, when certain conditions are met

- Any presentation of performance is also subject to the general prohibitions

Gross performance

- Gross performance: the performance results of a portfolio before the deduction of all fees and expenses that a client or investor has paid or would have paid in connection with the investment adviser’s investment advisory services to the relevant portfolio.

Net performance

- Net performance is defined as the performance results of a portfolio after the deduction of all fees and expenses that a client or investor has paid, or would have paid, in connection with the investment adviser’s investment advisory services to the relevant portfolio.

Model Fees

Model Fees

- When calculating net returns, advisory fees can be actual fees or model fees

- If using a model fee, net returns must reflect one of the following two options:

- Net returns must be equal to or lower than returns that would have been calculated if actual fees had been deducted; or

- Net returns reflect the deduction of a model fee that is equal to the highest fee charged to the intended audience to whom the advertisement is disseminated

Adopting Release Guidance for Using Model Fees

- To satisfy the final rule’s general prohibition, an adviser generally should apply a model fee that reflects either the highest fee that was charged historically or the highest potential fee that it will charge the investors or clients receiving the particular advertisement.

- Footnote 590 – If the fee to be charged to the intended audience is anticipated to be higher than the actual fees charged, the adviser must use a model fee that reflects the anticipated fee to be charged in order not to violate the rule’s general prohibitions.

- Footnote 593 – … net performance that reflects a model fee that is not available to the intended audience is not permitted under the final rule’s second model fee provision.

Hypothetical Performance

Hypothetical performance includes:

- Targeted or projected performance returns with respect to any portfolio or to the investment advisory services with regard to securities offered in the advertisement

- Model performance not derived from the aggregation of actual investments across multiple funds

- Performance that is back tested by the application of a strategy to data from time periods prior to the periods the strategy was in use.

- Composites that include extracted performance, and extracts taken from composites

SEC staff March 19th, 2025, FAQ on Extracts and Investment Characteristics

Extracted or Investment Characteristics performance may be shown on a gross only basis if:

- The extract or characteristic is clearly identified as gross of fees;

- The performance of the portfolio or composite from which the extract or characteristic was derived is also presented:

- Consistent with the requirements of the Marketing Rule;

- On a gross and net basis, to demonstrate the effect of fees;

- With at least equal prominence to and in a manner designed to facilitate comparison with the extract or characteristic; and

- Over a period of time that includes the entire period over which the extract or characteristic is calculated.

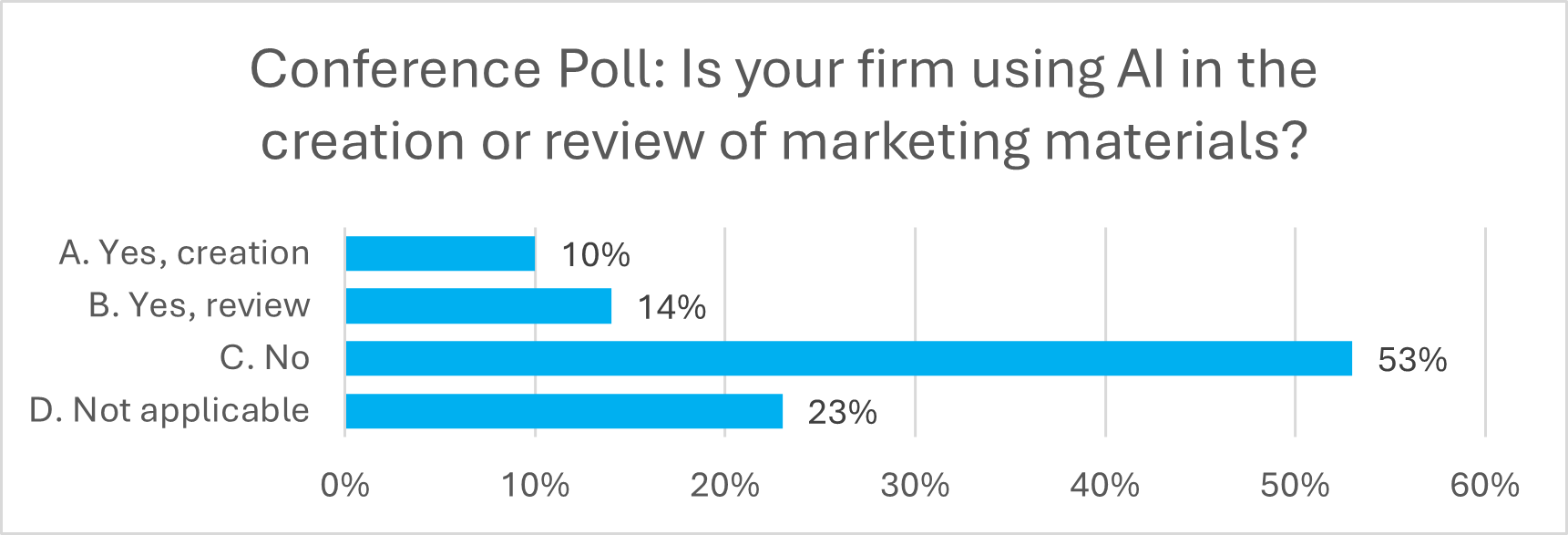

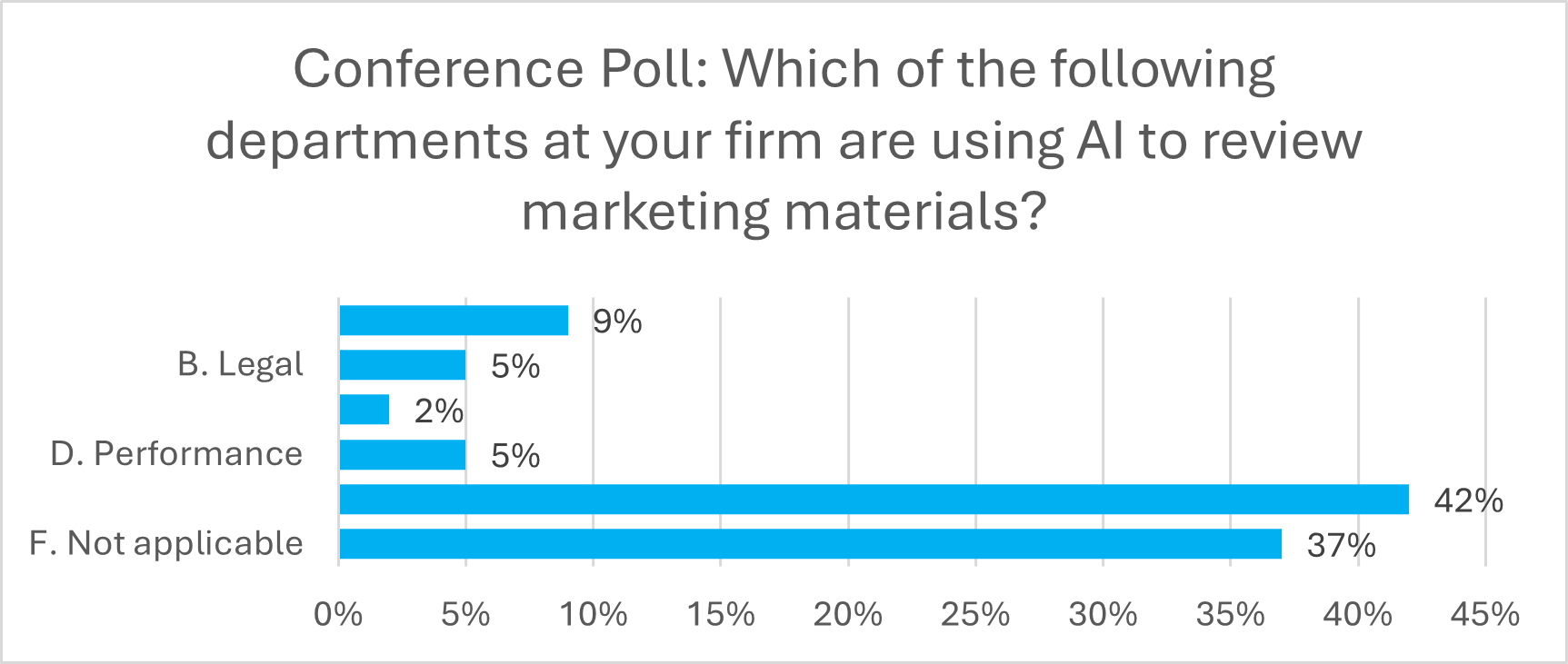

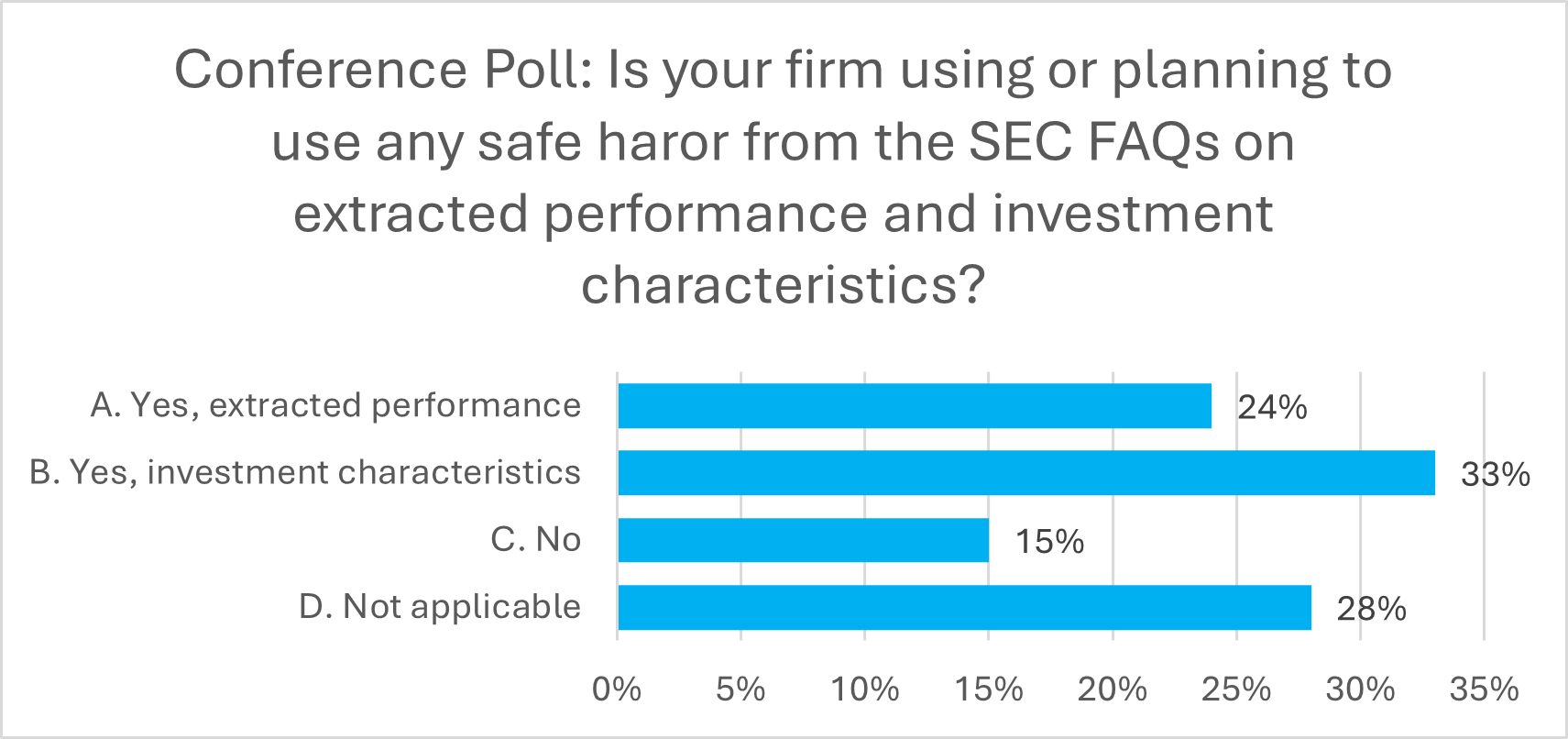

Poll

Representative Accounts and Benchmarks

Representative Accounts

- The performance of a representative account is often used when preparing attribution reports or other analytical information

- Key question is whether the information taken from a representative account is “performance”

- Generally, subject to narrow exceptions, if performance is shown, the performance of all related accounts must be shown

- The recent FAQs provide some relief in this regard

- Attempting to “link” representative accounts may create hypothetical performance issues

Benchmarks

- The Marketing Rule does not require an advertisement to include returns for a benchmark

- The decision to include/not include benchmark returns is left to the discretion of the adviser

- Subject to the general prohibitions and the general anti-fraud provisions of the Federal securities laws

- The GIPS standards require returns of an appropriate benchmark to be included in all GIPS Reports. However, if a firm determines that no appropriate benchmark for the composite or pooled fund exists, the firm is not required to present benchmark returns but must disclose why no benchmark is presented.

Predecessor Performance

SEC Marketing Rule: Performance Portability

Predecessor performance may be shown provided that:

- Person(s) primarily responsible for achieving prior performance results continues to manage accounts at the advertising adviser

- Accounts managed at predecessor adviser are sufficiently similar to accounts managed at advertising adviser

- All accounts managed in a substantially similar manner are advertised unless exclusion of any account would not result in materially higher performance or alter the presentation of any prescribed time periods

- Advertisement clearly and prominently includes all relevant disclosures and indicates performance results were from accounts managed at another entity

- If the portability tests are no longer met because the person(s) primarily responsible for achieving the prior performance no longer manage accounts, the ported performance should not be used

GIPS Standards: Performance Portability

Prior firm performance may be used and linked to the acquiring firm’s performance if:

- Substantially all of the investment decision makers are employed by the new or acquiring firm

- The decision-making process is substantially intact and independent within the new or acquiring firm

- The new or acquiring firm has records to support the performance

- There is no break in the track record between the past firm or affiliation and the new or acquiring firm

- Once the portability tests are met, the prior performance becomes the performance of the new or acquiring firm and can always be used

If you have any questions about these updates or would like more information regarding TSG’s resources for navigating the new OCIO guidance, please contact us at CSpaulding@TSGperformance.com.

What a Word

In this section, we will introduce a word we think is a bit unusual or interesting. We hope you enjoy it. And please feel free to send us your suggestions.

éclat

- brilliance of success, reputation, etc.

- showy or elaborate display.

- acclamation; acclaim.

“Meanwhile, on the strength of Frank’s éclat, the Dorsey band’s initial booking of three weeks at the Astor was extended to fourteen.”

Frank – The Voice

James Kaplan

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.