Issue Contents:

Who Knew?

Unexpected Discovery With Daily Returns and Less Frequent Valuations

Author: David D. Spaulding, DPS, CIPM

I was doing a “software certification” for a client; this is one of the services we offer.

It turns out this vendor only offers daily returns. And, I learned that while most of their clients value securities daily, some do it weekly or monthly.

I had this sneaking suspicion that using stale prices might be problematic. As I was wrapping the assignment up, I spent a bit of time looking into this and I found that yes, we could see problems.

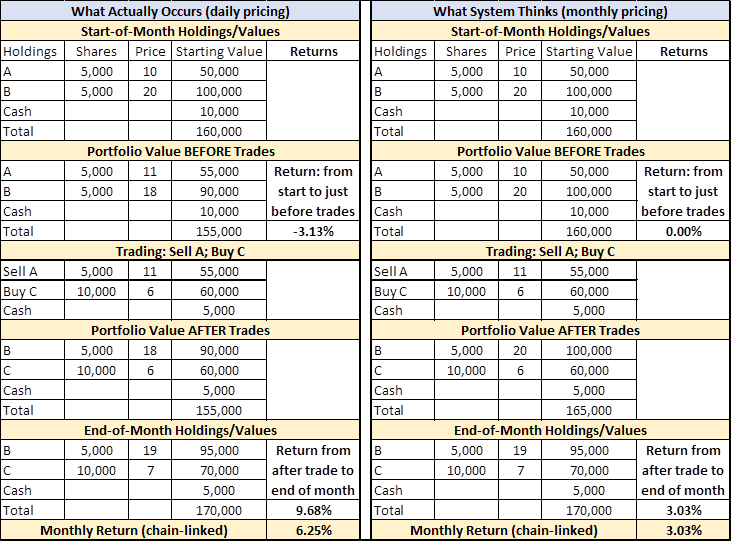

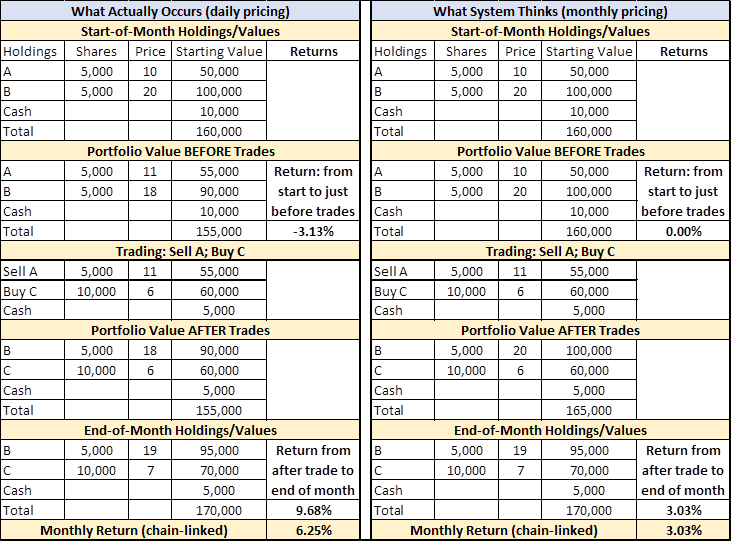

I crafted this as an example:

Perhaps the issue is clear, but I’ll briefly explain.

We begin with just two securities in our portfolio, A and B, along with some cash. On the left-hand side, the portfolio is valued daily. At some point in the month, we sell out the holdings in A and purchase C. This requires us to calculate the return from the start of the month to the point just before the day of the trades; our return is -3.13%. We then continue until the end of the month; and the return for the second part is 9.68 percent. Linking yields a monthly return of 6.25 percent.

On the right-hand side, we only value once a month. Meaning, when just before the trades occur, both A’s and B’s values haven’t changed, so our return for the first part of the month is 0.00 percent. We make the trade, so we see how A’s value increased; B’s remains as it started the month. Going to the end of the month, when we revalue the portfolio, our return is 3.03 percent. Linking the two sub-period returns yields 3.03 percent.

Quite a difference, yes? Daily valuations yields 6.25%; monthly 3.03 percent. Since there are no external flows, a Modified Dietz for the month would yield 6.25%.

I will have more to say on this in an upcoming article.

How many vendors offer only daily returns, even when their clients value less often than daily? Might there be many cases where the returns are in error?

The Voice

FOUNDER/CEO’S NOTE

TSG’s proud legacy of innovation, education, and service to the performance profession

I’ll confess that I find inspiration from many sources, usually from somewhere completely outside of our industry. And for this note, my inspiration was the January 2025 issue of Porsche Panorama, the official magazine of the Porsche Club of America. I’ve been a member of PCA for the past few years, having purchased my very first Porsche (a Boxster) four years ago. My wife, Kerry, and I are active members of the Everglades chapter in Southwest Florida, where we live half the hear.

It turns out the PCA is celebrating its 70th anniversary, double the one TSG is now celebrating.

I began TSG out of a spare bedroom in our home in North Brunswick, NJ. At the time, I wanted to focus on technology and operational projects for investment advisors. We were involved with software development, operations reviews, and other activities.

Two years after we began, CFA Institute (then known as AIMR, or the Association for Investment Management and Research) began to unveil its Performance Presentation Standards (AIMR-PPS®). I attended a few events, and concluded that given my prior experience being responsible for performance measurement and designing a performance system for the investment advisor I worked for prior to starting TSG, that there might be an opportunity for our firm to get involved.

I recall sitting in sessions with Mel Ashland, founder of Ashland Accounting, and his wife, Brooke. We were both seeing opportunities to provide verification services. At the time, the “Big 8” [now the “final 4”] also saw opportunities.

I added TSG’s name to the list of verifiers and conducted our first verification in 1992, for a firm located in Montreal, Quebec.

What the company has become is not very close to what I thought it would be. Around 1995, a colleague told me that when he thought of performance measurement, he thought of our firm. I was flattered, but also a bit surprised, because at the time we were still involved in projects outside of performance measurement. But we did begin to focus more and more on performance, and less and less on anything else.

Over time, we added more services and products, including The Journal of Performance Measurement® (JPM), my first book on performance measurement, training classes, PMAR (Performance Measurement, Attribution & Risk conferences), the Performance Measurement Forum, the Asset Owners’ Roundtable, operations and systems reviews, and more. When the CFAI was looking for proposals to conduct training, Herb Chain [former partner at Deloitte], Matt Forstenhausler [former partner at E&Y], and I agreed to propose as a team, and we were selected! We taught several classes, both in America and abroad, for a number of years. It was a great deal of fun. Over the years, we came up with the idea of certifying performance measurement professionals, honoring individuals who’ve made great contributions to the industry (through the Hall of Fame and Women in Performance awards), and created a group dedicated to promoting women in the industry (Women in Performance Measurement (WiPM)).

Patrick Fowler joined our firm over 25 years ago, fresh out of college. I had known Patrick since he was about seven, and my late wife, Betty, suggested I approach him for a position I was looking to fill. We have always been close to his family, and Betty knew he was about to graduate. Fortunately, he accepted, and his role has expanded considerably over the years, becoming our firm’s Chief Operating Officer many years ago, and our President not long thereafter.

Both my sons joined over 21 years ago, something Betty didn’t see coming: why would they want to work for their father? Chris immediately took on the role of sales, and has become our Chief Growth Officer. And Doug took on the role of editor of JPM. He is involved in much that we publish, including working with Patrick on their monthly podcasts.

We had known John Simpson from when he worked at Integrated Decision Systems (IDS). When we learned he had become available, both Chris and Patrick marched into my office, telling me we had to hire him. We did, and we were so fortunate to do that.

Over the years we have been fortunate to attract industry veterans to our team. One of the things we emphasize, that distinguishes our verification practice from others, is the use of senior performance measurement professionals. Our team of Ashley Reeves, Jennifer Barnette, Kathleen Seagle, Todd Jankowski, and Wendy Wee.

An organization such as ours cannot succeed without a strong support structure. Linda Burk has been our head of admin for more than 12 years. Andrew Tona, who is our unofficial factotum, joined more than 10 years ago, and Jean Bryer has been my EA for more than seven years.

As a relatively small firm, headquartered in Central New Jersey, we have met with what some might consider unbelievable success. Our client list includes many very well known and sizable asset owners and asset managers. We have the pleasure of serving clients around the globe. Through our Performance Measurement Forum and Asset Owners’ Roundtable, we have formed relationships which we value a great deal. Through the JPM, we have had the opportunity to engage with Nobel Prize winners, leading investment managers, and many investment professionals. Chris, Patrick, and I even got to attend the closing bell at NASDAQ, where I had the honor of ringing it, along with two others.

After the death of my first wife, I decided to move to Naples, Florida, where, in a sense, I began a new life. I began dating, met Kerry, a Crown Attorney from Ontario, fell in love, and married her on, of course, Performance Measurement Professional’s Day, 2024. My sons, Chris and Doug, were in our wedding party. Joining us were Patrick, John, and Andrew.

It’s been a lot of fun, though also often filled with challenges. Not many firms make it to 35 years. Granted, we’re just half as old as the PCA, but both organizations are growing and continuing to have an impact on those they serve.

I feel extremely blessed and grateful. Thanks to all who have helped us along the way, and have allowed us to serve them.

Quote of the Month

“The more time you spend complaining about what you deserve, the less time you have to focus on what you can create. Focus on what you can control.”

― James Clear

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “Training Performance Measurement Professionals” by Frances Barney Knutsen, CFA; Ralph Medina of BNY; Norm Hargraves of BNY; and Brian Milton of BNY, which was published in the Fall 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

The objective of this article is to highlight training best practices for new performance analysts in asset management firms. Approaches to performance measurement vary, often depending on the size of the firm, and the new analyst training program should be structured to reflect the firm’s approach. Generally, new analyst training starts with the firm’s policies, procedures, and code of conduct, and then progresses to general software skills, performance analysis calculation methodologies, risk management, and other specialized topics. Training may be delivered through written materials, recorded lectures, live instruction, or online with some interactivity. Readers should note that having a defined plan for assessing new analysts’ knowledge is critical. Finally, instilling a culture of continuous learning and mentoring allows firms to build high-performing teams.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

Upcoming Webinars / Surveys

Webinar: Should Your Firm Pursue GIPS® Compliance and Verification?

Join us for an insightful webinar exploring the benefits of GIPS® compliance and verification for investment firms. We’ll discuss how adopting these standards can enhance your firm’s credibility and trust, ensure standardized performance reporting, and align with industry best practices. Learn how GIPS® can help attract external capital, improve internal processes, and support regulatory alignment. Whether you’re considering compliance or looking to optimize your current practices, this session will provide valuable guidance to help you make an informed decision.

Don’t miss this opportunity to stay informed.

When: Tuesday, April 8, 2025 at 11:00 AM (ET)

Where: Online (and recorded)

Duration: 60 minutes

Register by clicking on the graphic below or by clicking here.

Institute / Training

Access TSG’s Online Training

Content With One Pass

Who Knew?

Unexpected Discovery With Daily Returns and Less Frequent Valuations

Author: David D. Spaulding, DPS, CIPM

I was doing a “software certification” for a client; this is one of the services we offer.

It turns out this vendor only offers daily returns. And, I learned that while most of their clients value securities daily, some do it weekly or monthly.

I had this sneaking suspicion that using stale prices might be problematic. As I was wrapping the assignment up, I spent a bit of time looking into this and I found that yes, we could see problems.

I crafted this as an example:

Perhaps the issue is clear, but I’ll briefly explain.

We begin with just two securities in our portfolio, A and B, along with some cash. On the left-hand side, the portfolio is valued daily. At some point in the month, we sell out the holdings in A and purchase C. This requires us to calculate the return from the start of the month to the point just before the day of the trades; our return is -3.13%. We then continue until the end of the month; and the return for the second part is 9.68 percent. Linking yields a monthly return of 6.25 percent.

On the right-hand side, we only value once a month. Meaning, when just before the trades occur, both A’s and B’s values haven’t changed, so our return for the first part of the month is 0.00 percent. We make the trade, so we see how A’s value increased; B’s remains as it started the month. Going to the end of the month, when we revalue the portfolio, our return is 3.03 percent. Linking the two sub-period returns yields 3.03 percent.

Quite a difference, yes? Daily valuations yields 6.25%; monthly 3.03 percent. Since there are no external flows, a Modified Dietz for the month would yield 6.25%.

I will have more to say on this in an upcoming article.

How many vendors offer only daily returns, even when their clients value less often than daily? Might there be many cases where the returns are in error?

Industry Dates and Conferences

Celebrating 35 Years of Excellence: What to Expect from TSG in 2025

As TSG marks its 35th anniversary, we’re thrilled to announce a dynamic lineup of events, learning opportunities, and networking activities designed to elevate your performance measurement expertise and strengthen our vibrant community. Here’s what’s in store for the year ahead:

April: Forums and Roundtables

Engage with Industry Leaders

- 23rd: Asset Owner Roundtable (AORT) – A platform for advanced discussions on performance and risk.

- 24th-25th: North American Forum – Join our membership group for thought leadership, practical insights, and collaborative dialogue.

The Performance Measurement Forum and AORT events foster interactive networking and knowledge sharing, connecting professionals with global leaders to tackle pressing challenges and innovative solutions.

May: PMAR Connections

Join the Premier Conference in Investment Performance Measurement

- 20th: GIPS Workshop & Q&A with TSG’s Dream Team (Free for TSG’s Verification Clients)

- 21st-22nd: PMAR North America at The Heldrich in New Brunswick – Experience cutting-edge sessions and thought-provoking discussions led by top industry speakers.

For over 26 years, PMAR has been the flagship conference where investment performance professionals gather to shape the industry’s future.

June: EMEA Forum in Belfast

- 19th-20th: Performance Measurement Forum (EMEA) – Convene with global leaders for discussions in Belfast, Northern Ireland.

Explore performance and risk topics, implementation strategies, and innovative solutions tailored to the European market.

July: Toronto Networking Event

- 22nd: Performance Measurement Networking in Toronto, Canada – Partnering with Rimes Technologies and First Rate, this event provides a space to connect and share insights.

Stay tuned for additional details on this interactive gathering in one of Canada’s key financial hubs.

September: PMAR Europe in London

- 17th: PMAR Europe – London’s premier event for innovation and networking.

This is the European counterpart to our North American event, focusing on cutting-edge topics and innovations.

October: Performance Training in San Francisco

Develop key skills with our in-depth, in-person training programs:

- 7th-8th: Fundamentals of Performance Measurement Training – Ideal for newcomers or those seeking a refresher.

- 8th-9th: Performance Measurement Attribution Training – Dive deep into attribution methodologies to enhance your expertise.

November: Fall EMEA Forum in Copenhagen

- 6th-7th: Performance Measurement Forum (EMEA) – Expand your perspective with insights from global leaders at our fall meeting in Denmark.

December: Year-End Wrap-Up in Louisville

Conclude 2025 with these essential events:

- 3rd: Fall Asset Owner Roundtable (AORT) – Advanced discussions to round out the year.

- 4th-5th: Fall North American Forum – Close the year with innovation and collaboration.

Celebrating 35 Years of Excellence

- We take immense pride in our legacy of success, innovation, and leadership. As we look ahead, TSG remains committed to advancing the field of investment performance measurement and empowering professionals worldwide.

Mark Your Calendars! Let’s make 2025 a year to remember.

For information on the 2025 events and membership opportunities, please contact Patrick Fowler at 732-873-5700.

That’s a Good Question

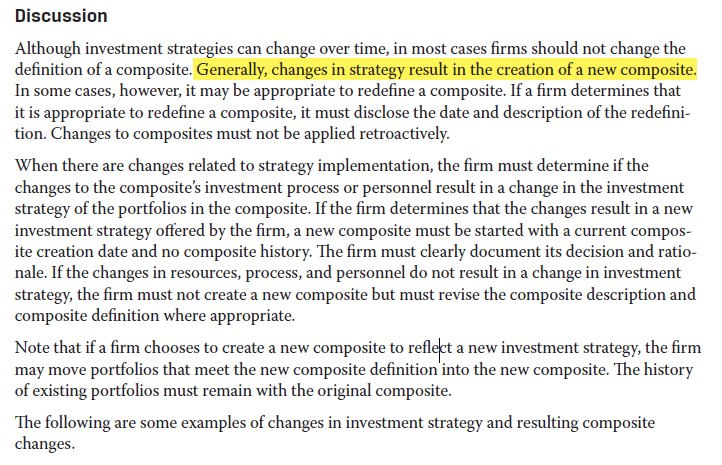

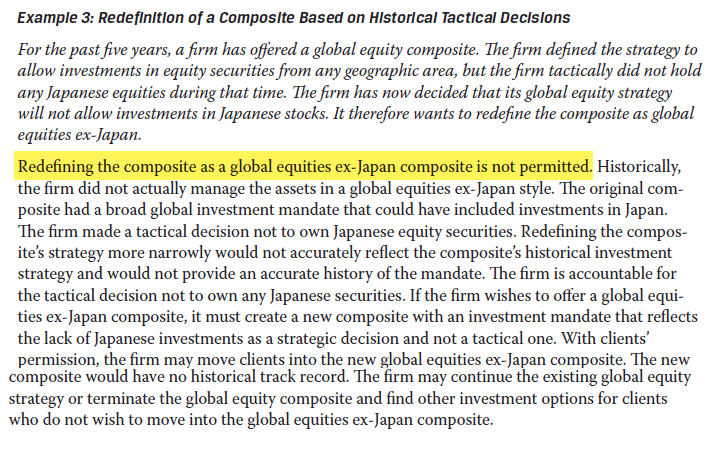

Question: What would be a material change to the strategy investment process that makes the composite track record no longer consistent?

For example, will change the number of holdings count down to 50 from 130-150?

Response:

That is an excellent question, and one that is quite difficult to answer.

To help address this, I looked at the GIPS Handbook for Firms (attached), where, on page 164, we find:

I also found this example on pages 165-166:

I think that comparing the revised strategy with the original, to consider how material would the differences be, is critical. Comparing, for example, the returns between the two for a period of time, to see how different they are/would be.

Going from 130-150 down to 50 would, in my view, constitute a material change, mandating the creation of a new composite.

Hope this helps.

Dave Spaulding, DPS, CIPM

Please submit your questions to Patrick Fowler.

Potpourri

In The News

“First Rate, Inc. partners with TSG because they are a trusted leader in the performance measurement industry and their goals and values deeply align with our own. Their expertise, credibility, and strong industry relationships make them a great partner, helping us connect with our ideal markets and putting us in front of key decision-makers.

TSG consistently delivers opportunities that enhance our visibility and position us in front of the right audience, firms that need and value our solutions. Whether through their industry-leading Forum events, PMAR conferences, thought leadership, or GIPS and performance consulting services, they provide direct access to decision-makers who are actively seeking innovative performance measurement solutions.

As a trusted partner, TSG’s integrity, professionalism, and deep industry commitment help us build meaningful relationships globally and drive impactful conversations that support our business growth.”

Alex Serman, CIPM, First Rate

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: March 10, 2025

Spring Issue: July 14, 2025

Answer to “Did you know?” Question. Answer: Loonie

TSG Milestones

Book Review

You Never Know, by Tom Selleck

Review by David D. Spaulding, DPS, CIPM

When I learned that Tom Selleck had written an autobiography (or, to use his term, a memoir), I knew I wanted to read it. My late wife, Betty, and I, were introduced to him in the series Magnum, and we both enjoyed it immensely. We saw him in some of the movies he did, and she became a huge fan of Blue Bloods, a series I never watched, though perhaps should have.

As for me “reading” the book, well, I’m taking some liberties here, because I actually listened to it via Audible, and that’s how I recommend you “read” it. The book is narrated by the author, who does an exceptional job.

Authors who narrate often emit emotions that might not be as evident in the written word, and Tom Selleck is no different.

The book doesn’t feel like most autobiographies. While listening, it occurred to me that it was if Tom was sitting across from me, simply telling me about his life: i.e., it is written in a conversational style.

While I don’t know the man, Tom Selleck, personally, I feel like he’s someone I would welcome as a friend. We are alike in many ways. In his writing, he is down-to-earth, candid, frank, honest.

Since he only touches on Blue Bloods in the epilogue, I am hopeful he will write a sequel.

I strongly recommend this book. And if you listen or read it, I hope you enjoy it as I have.

A growing consensus for lower expected returns in equity is causing investors to turn to bonds as an increasingly-attractive source of risk-adjusted returns. One survey of investment firms estimates large cap equity returns at only 6.4% with corporate bonds earning 4.8% with lower volatility risk. Investors are realizing that managing total portfolio volatility risk requires a more substantial exposure to bonds; this is especially true for managing sudden and severe short-term equity market downturns.

The trend of higher allocations to illiquid alternatives increases the risk of funding the client’s required payouts from the equity portfolio, and bonds are emerging as an ideal means of helping to provide funding certainty amidst uncertain equity markets. And while equity alpha remains elusive for many managers, substantial research is emerging that supports the greater likelihood of finding more reliable alpha in bonds, given the exploitable factors that drive bond performance.

Despite these advantages, bonds continue to be poorly understood and underutilized, especially among risk managers and performance analysts. Our session on maximizing the value of the bond investments within the asset owner portfolio dispels the misunderstandings regarding how bonds are issued, traded and allocated in multi-asset portfolios. This includes examples of key market events where bonds drove portfolio success, as well as guidance in how to seek bond alpha. Moving from strategic to tactical positioning, we conclude with a true decision-based approach to performance attribution, eliminating the key misperceptions and unnecessary complexities found in some bond models.

Interested in learning more? Sign up for PMAR North America to experience the full presentation by Steve Campisi, CFA.of The Pensar Group.

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.