Issue Contents:

A Recent Study Reveals How the Performance Profession is Evolving in Two Key Aspects

Summary by FactSet

In a recent research study where we spoke to over 300 asset management decision-makers around the world, it is evident there are changes taking place among performance teams. Their feedback provides insight into where the occupation stands today and the near-term path forward. We’d like to share with you the highlights of two developments the study has revealed: department integration and skillsets.

Combining Into Risk and Reporting Teams

A material change across performance teams is the increased integration with other parts of the business. In our research, 65% and 58% of respondents said their performance teams are integrated with risk and reporting teams, respectively. A majority of respondents (98%) anticipate further integration with either risk or reporting in the near future.

As with any combination, there’s a need for thoughtful balance. More than two-thirds of respondents believe their performance team is valued by the organization and is perceived as offering good value.

To avoid diluting the performance team’s capabilities—and the real benefits they provide to the business—consider how to keep the core skillsets front and center throughout (and especially after) the integration process. Enable teams to maintain a sense of ownership and control. Doing so could help address the worry of some respondents that perceptions of that role will be diluted or even negatively impacted if performance teams are simply merged into other functional groups.

Growing Demand for New Skills

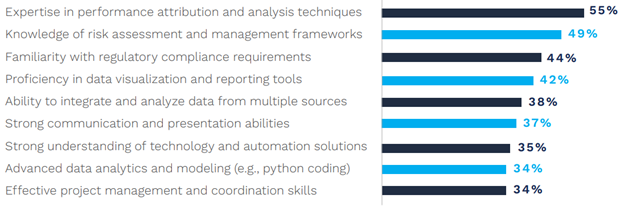

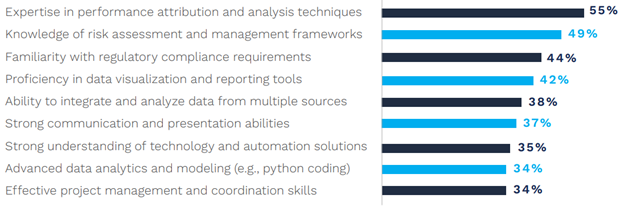

Because the operating environment is evolving, asset management firms are simultaneously seeking to add new competencies and capabilities to their teams. As the chart shows, more than half of respondents said the No. 1 in-demand skills they want to add are performance attribution and analysis techniques. And nearly half of respondents are seeking performance professionals with knowledge of risk assessment and management frameworks.

There are also two notable findings to highlight from the lower half of the above chart. First is that 34% of respondents view Python coding (i.e., advanced data analytics and modeling) as an in-demand skillset. We believe the need for that skillset is building momentum, and we anticipate it will grow rapidly in the near term.

Second, reflecting the shift to more individuals working in remote locations, about one-third of respondents also seek strong communication, presentation, and project management skills. This highlights how organizations are striving to be nimbler and more productive.

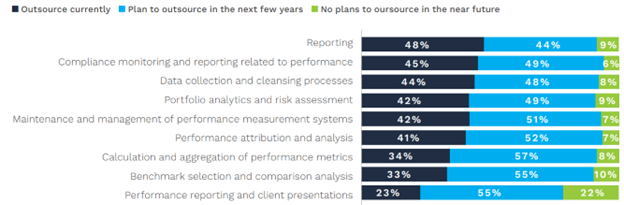

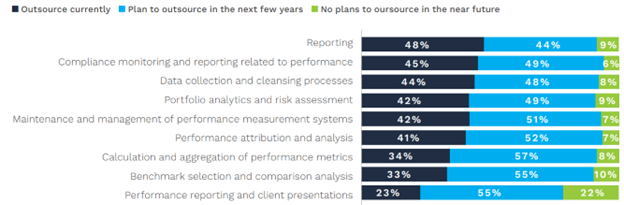

Given the competition for hiring and retaining talented employees, some firms are using (or planning to use) managed services from a third party. As the chart below shows, for example, nearly half (48%) of the respondents have outsourced reporting, and 44% have plans to do so in the next few years. All respondents using such services say they have helped address the challenges their performance teams face.

In Conclusion

All said and done, there are continued positives for performance teams. Professionals are increasingly in a position to work in a way that suits their individual needs and preferences while still serving clients. And they are being asked to undertake more interesting and sophisticated work by organizations that value their contributions.

Organizations that consider an optimal operating model and team structure—including the potential benefit of managed services and co-sourcing to fill gaps—could be assumed to have a competitive advantage.

Interested in reading the full research report? Click here to download your free copy of our In the Thick of It: How Performance Teams are Driving Value Across the Organization eBook.

Have an opinion? Please share it with Patrick Fowler.

Quote of the Month

“We are the masters of unsaid words, but slaves of those we let slip out.”

-Winston Churchill

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step towards a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights, “Using Model Fees to Report Net Returns, Contributions, and Model Fee Effect in Geometric Attribution” by Ian Thompson, Ph.D. of BNY Mellon and Satheesh Jagannathan, CFA, CIPM of BNY Mellon, which was published in the Spring 2024 (vol. 28, issue #3) of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

The Securities and Exchange Commission (SEC) mandated advisers to report extracted performance on a net basis wherever gross performance is presented. Since computing the actual net returns could be difficult for historical time periods, the SEC allows using a model fee to compute and report net returns. We believe it would be useful to have a framework to compute net returns from the model fee and report linked multi-period net returns, net contributions, and a model fee effect in Geometric attribution.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

Reminder: GIPS® Standards Compliance Notification Due Date Is June 30

Organizations that claim compliance with the Global Investment Performance Standards (GIPS) must submit a GIPS compliance notification to CFA Institute every year prior to the June 30 deadline.

If your organization hasn’t registered with CFA Institute in 2024, you’ll need to update your GIPS compliance notification before June 30. Here’s the link to update your firm’s registration: https://compliancetracking.cfainstitute.org/update-gips

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.SpauldingGrp.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

Welcome New Members To The Performance Measurement Forum

The Performance Measurement Forum has met 103 times over the past 25 years, and will meet again in Las Vegas, NV and Athens, Greece this month. We celebrate and recognize our newest member, Diamond Hill.

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

TRIVIA TIME

Here’s This Month’s Trivia Questions; Answers In The Next Issue!

Responses received with all correct answers to the question below will receive a special gift.

1. What New York City bar was the location of a 1969 uprising credited as sparking the modern LGBTQ+ rights movement?

2. What are the first 22 cards in a tarot deck called?

3. What was the name of the possessed hotel in Stephen King’s novel (and movie) The Shining, based on the real-life Stanley Hotel in Colorado?

Submit your responses to: PFowler@TSGpeformance.com

Last Month’s Trivia Solutions.

1. Who, in 1903, was the first woman to win a Nobel Prize?

Answer: Marie Curie

2. What year did the Berlin Wall fall?

Answer: 1989

3. What element does the chemical symbol Au stand for?

Answer: Gold

4. What is the smallest planet in our solar system?

Answer: Mercury

5. What is the highest-grossing Broadway show of all time?

Answer: The Lion King

Correct responses to the trivia questions:

- Anthony Howland

Please submit your puzzle solution or puzzle ideas to Patrick Fowler.

Compliance Corner

Something To Think About

One of our clients includes the returns of a benchmark that represents their strategy as a way to demonstrate the importance of dividends, comparing with or without their reinvestment. Might this be construed as hypothetical performance, with the benchmark masquerading as model performance? The new Marketing Rule has restrictions on their use.

Book Review

Lawrence in Arabia, by Scott Anderson

Review by David D. Spaulding, DPS, CIPM

For some reason, I’ve always been fascinated with Lawrence of Arabia, perhaps driven by seeing the 1962 movie. But, I had never read about him, so when I was in London, visiting my favorite bookstore, Hatchards on Piccadilly, I picked up this fascinating biography.

While the book provides a great deal of information about Lawrence, often quite personal, what the author shares about that time in history (including World War I, the Ottoman Empire, and the desire for an independent Middle East) is perhaps even more inspiring. For me, a history buff, it was so much I was totally unaware of.

The author’s writing style is “right up my alley,” as he interjects humour [I’m in Canada as I write this, so am obliged to use their form of the word] and clever phrasing. For example, “But Lawrence was nothing if not resourceful, and he had next thought to put one of his more pronounced personality traits to good use: the ability to annoy.” “…plans unblemished by any attempt at actual execution.” “British generals often gave away in stupidity what they had gained in ignorance.” “With remarkable disingenuousness.”

Gaining some insights into the Ottoman Empire inspired me to download from Audible “The Ottomans, Khan, Caesar, and Caliphs,” by Marc David Baer, which I am now listening to [and which is also exceptional].

Although Lawrence in Arabia is a biography of Thomas Edward (T.E.) Lawrence, the reality is the author spends more time addressing so much more about the times, the people, the challenges.

I recommend it with great pleasure.

A Recent Study Reveals How the Performance Profession is Evolving in Two Key Aspects

Summary by FactSet

In a recent research study where we spoke to over 300 asset management decision-makers around the world, it is evident there are changes taking place among performance teams. Their feedback provides insight into where the occupation stands today and the near-term path forward. We’d like to share with you the highlights of two developments the study has revealed: department integration and skillsets.

Combining Into Risk and Reporting Teams

A material change across performance teams is the increased integration with other parts of the business. In our research, 65% and 58% of respondents said their performance teams are integrated with risk and reporting teams, respectively. A majority of respondents (98%) anticipate further integration with either risk or reporting in the near future.

As with any combination, there’s a need for thoughtful balance. More than two-thirds of respondents believe their performance team is valued by the organization and is perceived as offering good value.

To avoid diluting the performance team’s capabilities—and the real benefits they provide to the business—consider how to keep the core skillsets front and center throughout (and especially after) the integration process. Enable teams to maintain a sense of ownership and control. Doing so could help address the worry of some respondents that perceptions of that role will be diluted or even negatively impacted if performance teams are simply merged into other functional groups.

Growing Demand for New Skills

Because the operating environment is evolving, asset management firms are simultaneously seeking to add new competencies and capabilities to their teams. As the chart shows, more than half of respondents said the No. 1 in-demand skills they want to add are performance attribution and analysis techniques. And nearly half of respondents are seeking performance professionals with knowledge of risk assessment and management frameworks.

There are also two notable findings to highlight from the lower half of the above chart. First is that 34% of respondents view Python coding (i.e., advanced data analytics and modeling) as an in-demand skillset. We believe the need for that skillset is building momentum, and we anticipate it will grow rapidly in the near term.

Second, reflecting the shift to more individuals working in remote locations, about one-third of respondents also seek strong communication, presentation, and project management skills. This highlights how organizations are striving to be nimbler and more productive.

Given the competition for hiring and retaining talented employees, some firms are using (or planning to use) managed services from a third party. As the chart below shows, for example, nearly half (48%) of the respondents have outsourced reporting, and 44% have plans to do so in the next few years. All respondents using such services say they have helped address the challenges their performance teams face.

In Conclusion

All said and done, there are continued positives for performance teams. Professionals are increasingly in a position to work in a way that suits their individual needs and preferences while still serving clients. And they are being asked to undertake more interesting and sophisticated work by organizations that value their contributions.

Organizations that consider an optimal operating model and team structure—including the potential benefit of managed services and co-sourcing to fill gaps—could be assumed to have a competitive advantage.

Interested in reading the full research report? Click here to download your free copy of our In the Thick of It: How Performance Teams are Driving Value Across the Organization eBook.

Have an opinion? Please share it with Patrick Fowler.

Industry Dates and Conferences

- June 12 – Spring Meeting of the Asset Owner Roundtable (AORT) – Las Vegas, NV

- June 13-14 – Spring North American Meeting of the Performance Measurement Forum – Las Vegas, NV

- June 27-28 – Spring EMEA Meeting of the Performance Measurement Forum – Athens, Greece

- November 7-8 – Autumn EMEA Meeting of the Performance Measurement Forum – Barcelona, Spain

- November 20 – Fall Meeting of the Asset Owner Roundtable (AORT) – Charleston, SC

- November 21-22 – Fall North American Meeting of the Performance Measurement Forum – Charleston, SC

For information on the 2024 events, please contact Patrick Fowler at 732-873-5700.

Institute / Training

Access TSG’s Online Training

Content With One Pass

Question 6: Do you agree with requiring firms to disclose information about their policy for the treatment of legacy assets?

As stated in response to question #5, legacy assets are not just an OCIO consideration. There should be no additional or different disclosure requirements that OCIO strategy composites need to adhere to that others do not. We think the requirements should remain consistent throughout, and this should be evaluated as a requirement under the next edition of the GIPS standards for all firms that deal with legacy assets. We believe this disclosure should be a recommendation rather than a requirement.

That’s a Good Question

“We sub-advise multiple pooled funds, both broad and limited distribution. Must we put them into a composite and have a GIPS composite report prepared for them?”

Good question. While the Standards are actually silent on this, the Firm Handbook isn’t. On page 16 we find the following: “If a firm is the sub-advisor for a pooled fund that is marketed or distributed by another firm as either an LDPF or a BDPF, the firm acting as sub-advisor must treat the sub-advised pooled fund as a segregated account. It must be included in a composite if it is fee-paying and discretionary. Only if the firm offers participation in the pooled fund, either directly or through an agent, would the pooled fund be considered either a BDPF or LDPF.” And so the answer is that when you’re the sub-advisor, you must treat the pooled fund as you would any separately managed account, and put it into a composite.

Good thing to clarify.

There’s actually a couple of interesting, subtle points here that firms may not realize. I’ve had clients with each of these situations.

First, let’s say the firm manages a few BDPFs, and happens to sub-advise a BDPF of a completely different strategy; that they do not manage or offer any of these as a segregated account. The firm may think that for the BDPF they sub-advise, they don’t have to produce a GIPS Report, similar to them not having to produce GIPS Reports for their BDPFs. But, for the BDPF that they sub-advise, they must produce a GIPS Report. Specifically and notably, a GIPS Composite Report (not a GIPS Pooled Fund Report).

Second, let’s say the firm manages a few LDPFs, and happens to sub-advise a LDPF of a completely different strategy; that they do not manage or offer any of these as a segregated account. The firm may think that for the LDPF they sub-advise, they must produce a GIPS Pooled Fund Report, similar to them being required to produce GIPS Pooled Fund Reports for their LDPFs. But, for the LDPF that they sub-advise, they must produce a GIPS Composite Report rather than a GIPS Pooled Fund Report.

Of course, GIPS Pooled Fund Reports and GIPS Composite Reports are pretty similar, but a couple of distinctions (not an exhaustive list)

- GIPS Pooled Fund Reports must include an expense ratio; GIPS Composite Reports are not required to have this unless they are being provided to prospective pooled fund investors

- Net returns in GIPS Pooled Fund Reports must be net of all pooled fund fees and expenses. In a GIPS Composite Report, net returns may be calculated as for any other segregated account (gross is net of transaction costs, net is gross further reduced by management fees; in either case, you must disclose if anything else is deducted)

Thanks to TSG’s CEO Dr. David Spaulding and Chief Verification Officer (CVO), John D. Simpson, CIPM for their responses.

Please submit your questions to Patrick Fowler.

Potpourri

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Summer Issue: July 12, 2024

Fall Issue: October 11, 2024

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.