TSG was proud to sponsor the 29th Annual Global Investment Performance Standards (GIPS®) Conference last week in Arizona. Thank you to everyone who stopped by the booth and grabbed one of our custom T-shirts. As ususal, they were the hottest swag at the conference.

We had six team members in attendance, including five of our GIPS specialists, who spent the week engaged in sessions, conversations, and discussions with clients and peers from across the industry.

As the premier boutique firm dedicated exclusively to performance measurement and the GIPS® standards, we think it’s important to share the most meaningful takeaways from the event.

Topics covered include:

GIPS Standards Update

Trade Error Policy: Principles and Practice

OCIO Portfolios Under the GIPS Standards Lens

SEC Marketing Rule

Remember, if you’re looking for guidance, whether you’re already compliant and considering a change in verifiers, or just beginning your GIPS journey, TSG is here to help. You can reach us anytime at CSpaulding@TSGperformance.com.

GIPS Standards Update

- Global Acceptance: Organizations currently claiming compliance with the GIPS standards:

- 1,668 organizations in 54 markets*

- 41 global Sponsors*

- Top five markets are:*

- US

- UK

- Canada

- Switzerland

- South Africa

- 25 of the top 25 global firms for all or a part of their assets**

- 86 of the top 100 global firms for all or a part of their assets**

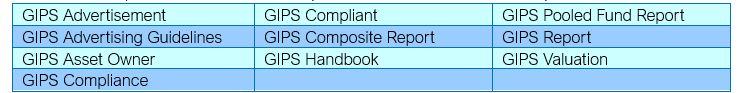

- Trademark Guidelines: GIPS trademark Q&A defined correct usage of the term for all industry participants:

- “GIPS” may only be used as an adjective.

- First reference to “GIPS” in any written or digital material must include the full name — Global Investment Performance Standards (GIPS®) — with the ® symbol.

- Approved “friend words” may follow “GIPS” (like GIPS Report, GIPS Compliance, GIPS Advertisement) while all other uses require “GIPS standards” to be spelled out.

- General references to “GIPS” must include the disclaimer “GIPS® is a registered trademark owned by CFA Institute” while products, services, marketing materials, reports, RFP, website references, etc. must also disclose “CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.”

- Disclaimer must appear on each page (or at the bottom of each webpage) where “GIPS” appears.

- Modification to the GIPS trademark, incorporating it in a hashtag, business, or product name, or use in the plural or possessive is prohibited.

- Forthcoming and New Guidance:

- Guidance Statement for Outsourced Chief Investment Officer (OCIO) Portfolios is effective 31 December 2025. GIPS reports that include performance for periods ending on or after this date must be prepared in according with the Guidance Statement.

- Guidance on attribution reporting and trade error treatment are on the horizon while the following resources were recently made available:

- 2024 Asset Owner Performance Survey

- Introduction to the GIPS Standards for Boards and Decision Makers

- Introduction to the GIPS Standards for Asset Owner Requirements

- New Tools including updated policy templates, disclosure checklists, and a benchmark calculation toolkit

* As of 30 September 2025

** As of 31 October 2024

Trade Error Policy: Principles and Practice

CFA Institute will publish a white paper addressing considerations for trade error policies and a GIPS standards guidance statement addressing performance-related trade error considerations in response to a lack of industry guidance. This is expected to address the following topics:

Identifying, Defining, and Disclosing Trade Errors: Trade errors occur when an executed or unexecuted transaction results in an economic impact. Firms are encouraged to foster a culture in which employees are comfortable reporting trade errors, e.g., by offering training. Material trade errors represent significant events, and their inclusion should be disclosed. Firms should notify clients of all trade errors regardless of who benefits, reinforcing trust and transparency.

Impact: Firms must determine whether an error resulted in a gain or loss, how to calculate any reimbursement, and whether reimbursements have cash-flow implications that impact performance. Removing the erroneous transaction and restoring the portfolio to its intended state (“stripping out the error”) is considered an acceptable approach.

Restoring the Client: Effective policies address opportunity costs, the netting of related gains and losses, whether to add interest to reimbursements, and how to treat transaction costs. Consistent with regulatory guidance, clients should be made “whole,” and gains resulting from errors generally remain with the client.

Performance, Fees, and Forthcoming GIPS Guidance: Trade errors can affect fees and may impact reported performance unless corrected through adjusting transactions. Forthcoming GIPS guidance will clarify how firms must handle errors that would inflate or misrepresent performance including whether firms may exclude impacted portfolios from composites.

OCIO Portfolios Under the GIPS Standards Lens

OCIO Portfolios Under the GIPS Standards Lens

One session at this year’s GIPS Conference reviewed the new Guidance Statement for OCIO Portfolios and explains how firms managing Outsourced Chief Investment Officer (OCIO) portfolios must apply the GIPS standards.

The session began by defining an OCIO as a provider of both strategic investment advice and investment management services to asset owners such as pension plans, endowments, and foundations. It outlined situations where the Guidance Statement does not apply, such as portfolios lacking both advisory and management services, retail client accounts, portfolios that do not include all asset classes of an OCIO portfolio’s mandate, or when fiduciary management providers in the UK are providing information to potential pension scheme trustee clients.

The core of the presentation covered the key concepts of the Guidance Statement:

- Applicability: Firms claiming GIPS compliance must follow all applicable requirements of the GIPS Standards for Firms, as well as all applicable requirements in the Guidance Statement for OCIO Portfolios when providing a GIPS Report to OCIO portfolio prospective clients.

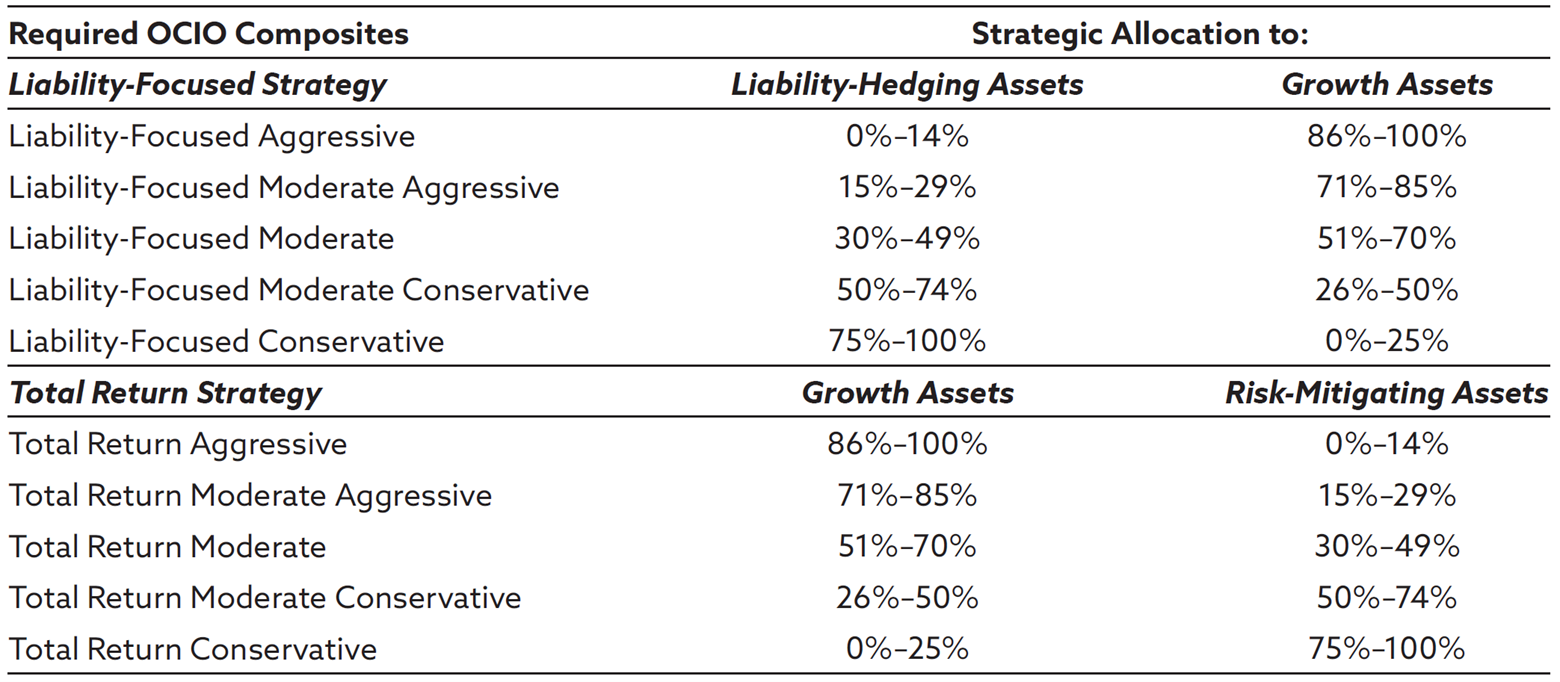

- Required Composite Structure: Firms must classify OCIO portfolios into one of ten required composites based on whether the strategy is liability-focused or total-return-oriented, and on the strategic allocation to specific asset types. For liability-focused composites, assets will be classified as either liability-hedging or growth assets. For total return composites, assets will be classified as either growth or risk-mitigating assets.

Required OCIO Composites for OCIO Portfolios

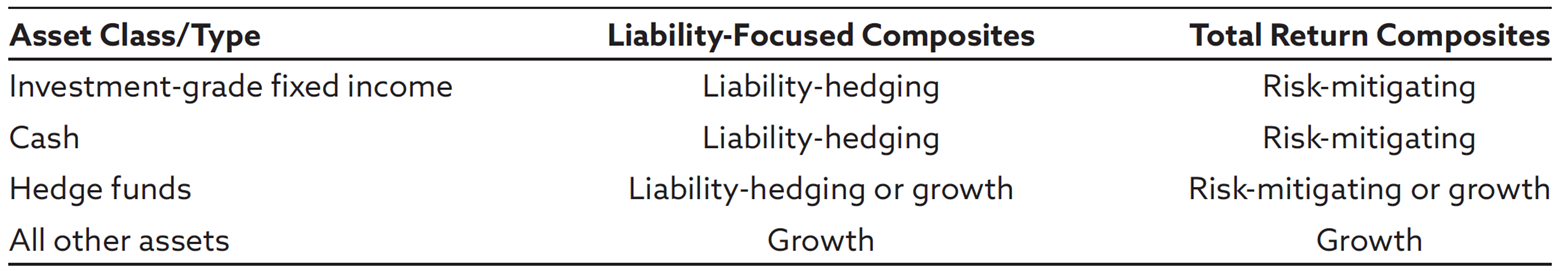

- Asset Classification: Portfolios must be assigned to composites based on strategic allocation. The standards provide recommended classifications for common asset classes but allow firms to deviate with proper disclosure.

Recommended Classifications

- Optional Composites: Firms may create additional composites beyond the required structure.

- Legacy Assets: Firms will need to decide whether these portfolios with legacy assets should be considered discretionary and included in composites. Whatever method a firm chooses, it must clearly disclose how legacy assets were treated so prospective clients can properly evaluate and compare performance.

- Returns: Firms will need to present both gross-of-fees and net-of-fees returns for these composites, given the multiple layers of fees OCIO clients may pay. Both gross-of-fees and net-of-fees returns are assumed to reflect the fees and expenses for underlying pooled funds and externally managed segregated accounts.

The Guidance Statement becomes effective December 31, 2025, and firms must begin applying it to performance for periods ending on or after that date. The presenters emphasized that OCIO consultants and asset owners will increasingly expect GIPS compliance and that noncompliance may become a competitive disadvantage during due diligence.

SEC Marketing Rule

Pamela Grossetti, Partner, K&L Gates LLP

Robert S. H. Shapiro, Partner, Dechert LLP

The following highlights of SEC Marketing Rule presentation from the 29th Annual Global Investment Performance Standards Conference, presented by Pamela Grossetti, Partner, K&L Gates LLP and Robert S. H. Shapiro, Partner, Dechert LLP. Link to full SEC Marketing Rule

Marketing Rule Basics:

SEC Definition of Advertisement: Any direct or indirect communication to more than one person, or to one or more persons if the communication includes hypothetical performance, that:

- offers the adviser’s investment advisory services with regard to securities to prospective clients or private fund investors, or

- offers new investment advisory services with regard to securities to current clients or private fund investors

SEC General Prohibitions: “principles-based”

In any advertisement, an adviser may not:

- Include any untrue statement of a material fact, or omit a material fact necessary to make the statement made, in the light of the circumstances under which it was made, not misleading;

- Include a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the Commission;

- Include information that would reasonably be likely to cause an untrue or misleading implication or inference to be drawn concerning a material fact relating to the investment adviser;

- Discuss any potential benefits to clients or investors connected with or resulting from the investment adviser’s services or methods of operation without providing fair and balanced treatment of any material risks or material limitations associated with the potential benefits;

- Include a reference to specific investment advice provided by the investment adviser where such investment advice is not presented in a manner that is fair and balanced;

- Include or exclude performance results, or present performance time periods, in a manner that is not fair and balanced; or

- Otherwise be materially misleading.

What is SEC Performance

Determining What Is Considered Performance

- “Gross performance” and “net performance” are both defined to mean the performance results of a “portfolio” or portions of a portfolio that are included in extracted performance

- “Portfolio” is defined as a group of investments managed by the investment adviser

- Any performance must be presented on a net basis

- Gross performance may also be presented, when certain conditions are met

- Any presentation of performance is also subject to the general prohibitions

Gross performance

- Gross performance: the performance results of a portfolio before the deduction of all fees and expenses that a client or investor has paid or would have paid in connection with the investment adviser’s investment advisory services to the relevant portfolio.

Net performance

- Net performance is defined as the performance results of a portfolio after the deduction of all fees and expenses that a client or investor has paid, or would have paid, in connection with the investment adviser’s investment advisory services to the relevant portfolio.

Model Fees

Model Fees

- When calculating net returns, advisory fees can be actual fees or model fees

- If using a model fee, net returns must reflect one of the following two options:

- Net returns must be equal to or lower than returns that would have been calculated if actual fees had been deducted; or

- Net returns reflect the deduction of a model fee that is equal to the highest fee charged to the intended audience to whom the advertisement is disseminated

Adopting Release Guidance for Using Model Fees

- To satisfy the final rule’s general prohibition, an adviser generally should apply a model fee that reflects either the highest fee that was charged historically or the highest potential fee that it will charge the investors or clients receiving the particular advertisement.

- Footnote 590 – If the fee to be charged to the intended audience is anticipated to be higher than the actual fees charged, the adviser must use a model fee that reflects the anticipated fee to be charged in order not to violate the rule’s general prohibitions.

- Footnote 593 – … net performance that reflects a model fee that is not available to the intended audience is not permitted under the final rule’s second model fee provision.

Hypothetical Performance

Hypothetical performance includes:

- Targeted or projected performance returns with respect to any portfolio or to the investment advisory services with regard to securities offered in the advertisement

- Model performance not derived from the aggregation of actual investments across multiple funds

- Performance that is back tested by the application of a strategy to data from time periods prior to the periods the strategy was in use.

- Composites that include extracted performance, and extracts taken from composites

SEC staff March 19th, 2025, FAQ on Extracts and Investment Characteristics

Extracted or Investment Characteristics performance may be shown on a gross only basis if:

- The extract or characteristic is clearly identified as gross of fees;

- The performance of the portfolio or composite from which the extract or characteristic was derived is also presented:

- Consistent with the requirements of the Marketing Rule;

- On a gross and net basis, to demonstrate the effect of fees;

- With at least equal prominence to and in a manner designed to facilitate comparison with the extract or characteristic; and

- Over a period of time that includes the entire period over which the extract or characteristic is calculated.

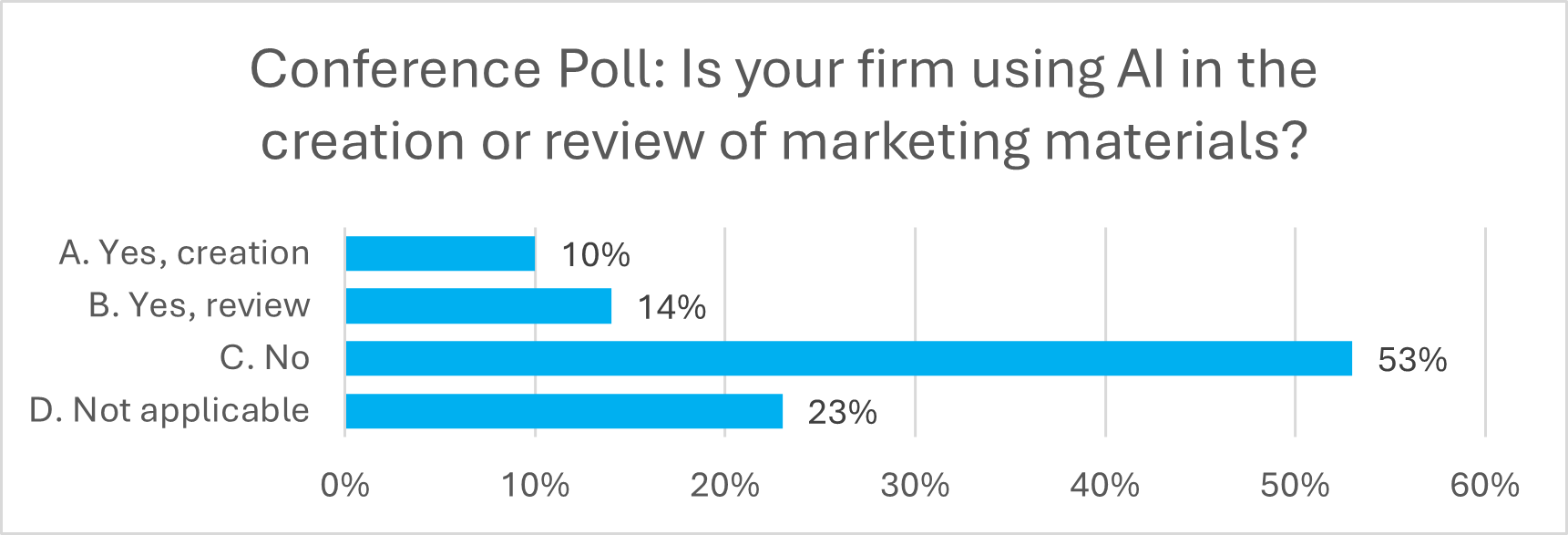

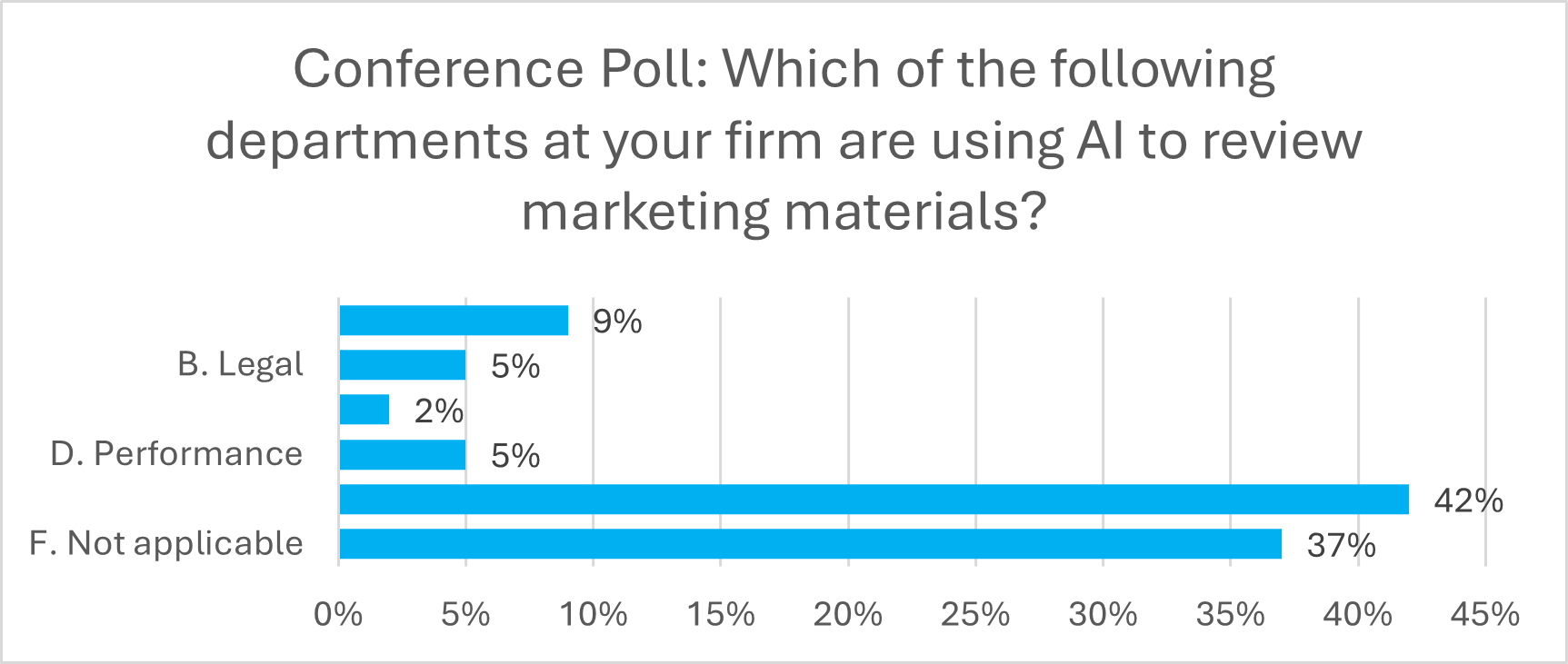

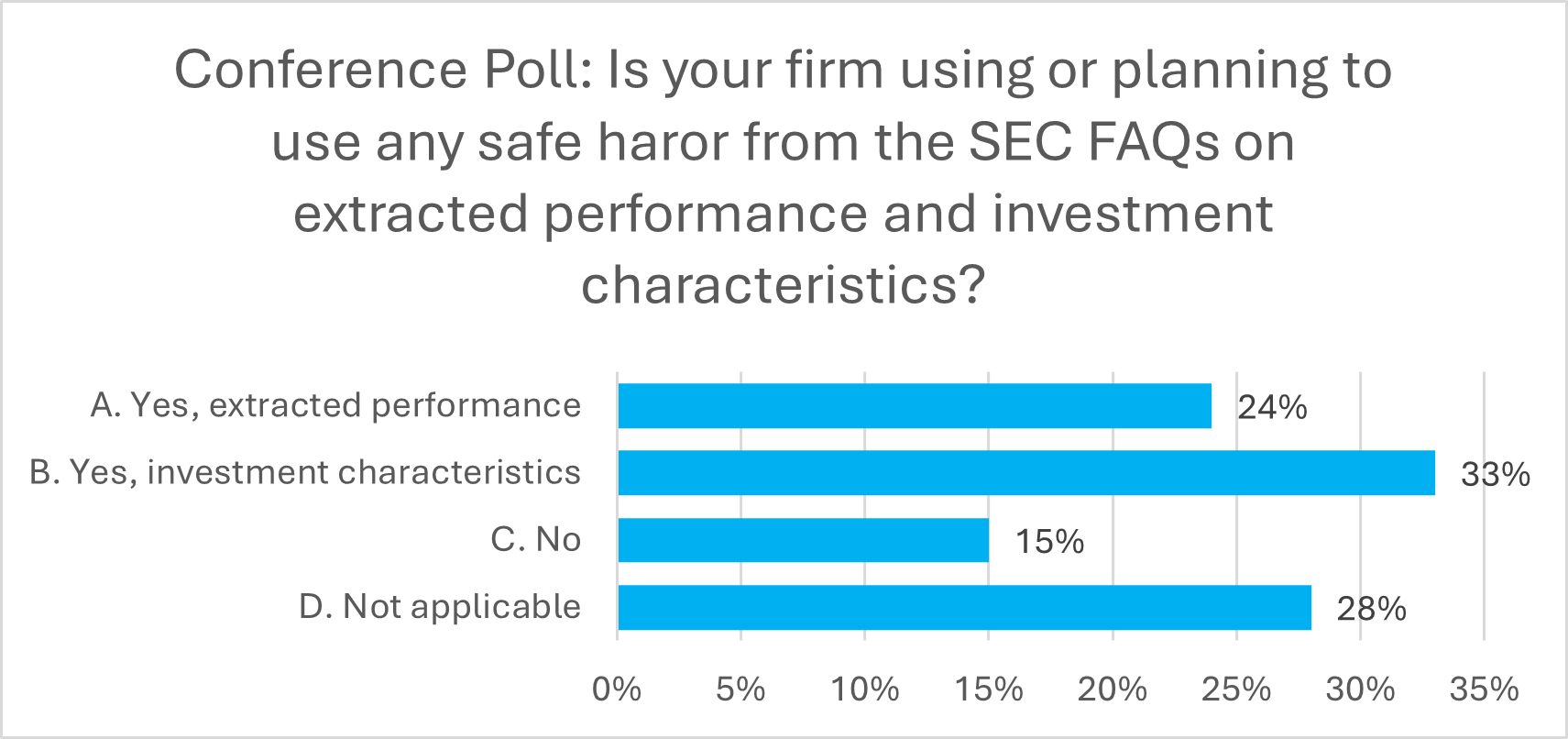

Poll

Representative Accounts and Benchmarks

Representative Accounts

- The performance of a representative account is often used when preparing attribution reports or other analytical information

- Key question is whether the information taken from a representative account is “performance”

- Generally, subject to narrow exceptions, if performance is shown, the performance of all related accounts must be shown

- The recent FAQs provide some relief in this regard

- Attempting to “link” representative accounts may create hypothetical performance issues

Benchmarks

- The Marketing Rule does not require an advertisement to include returns for a benchmark

- The decision to include/not include benchmark returns is left to the discretion of the adviser

- Subject to the general prohibitions and the general anti-fraud provisions of the Federal securities laws

- The GIPS standards require returns of an appropriate benchmark to be included in all GIPS Reports. However, if a firm determines that no appropriate benchmark for the composite or pooled fund exists, the firm is not required to present benchmark returns but must disclose why no benchmark is presented.

Predecessor Performance

SEC Marketing Rule: Performance Portability

Predecessor performance may be shown provided that:

- Person(s) primarily responsible for achieving prior performance results continues to manage accounts at the advertising adviser

- Accounts managed at predecessor adviser are sufficiently similar to accounts managed at advertising adviser

- All accounts managed in a substantially similar manner are advertised unless exclusion of any account would not result in materially higher performance or alter the presentation of any prescribed time periods

- Advertisement clearly and prominently includes all relevant disclosures and indicates performance results were from accounts managed at another entity

- If the portability tests are no longer met because the person(s) primarily responsible for achieving the prior performance no longer manage accounts, the ported performance should not be used

GIPS Standards: Performance Portability

Prior firm performance may be used and linked to the acquiring firm’s performance if:

- Substantially all of the investment decision makers are employed by the new or acquiring firm

- The decision-making process is substantially intact and independent within the new or acquiring firm

- The new or acquiring firm has records to support the performance

- There is no break in the track record between the past firm or affiliation and the new or acquiring firm

- Once the portability tests are met, the prior performance becomes the performance of the new or acquiring firm and can always be used

If you have any questions about these updates or would like more information regarding TSG’s resources for navigating the new OCIO guidance, please contact us at CSpaulding@TSGperformance.com.