Can’t decide? Why not “split the difference,” and go with a midday cash flow?

Occasionally, we hear from firms who just can’t decide whether to employ a start- or end-of-day cash flow policy. As you’re probably aware, for quite some time I’ve advocated a “dual” policy. That is,

- Treat inflows as start-of-day events

- Treat outflows as end-of-day events.

I initially backed into this approach. I stumbled upon examples that brought out the flaws in both the SOD and EOD methods, and concluded that a dual approach was superior. Since then, I’ve found many employing this method. But, there are some who still advocate a midday cash flow approach. Is this a good and acceptable solution?

Theory: The midday cash flow approach removes the problems of start and end-of-day. But does it?

While I don’t often see the midday cash flow alternative employed, I recognize that some firms seem to think it solves the problems that are inherent the start and end-of-day approaches. Many software vendors offer it. And some performance measurement professionals who haven’t yet adopted it think that it may, in fact, be a reasonable alternative.

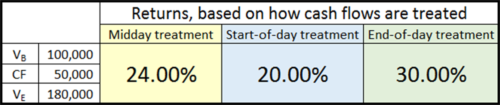

Consider the following example. A portfolio starts with $100,000 that’s invested in a single stock valued at $10 a share. An inflow of $50,000 occurs, and is immediately invested in this same stock, also at $10 a share. At the end of the day the stock price has risen to $12. What’s the return? The following table provides the results, using three cash flow timing methods.

It should be evident that the correct return is 20.00 percent, since the stock price rose from $10 to $12.

- The end-of-day approach resulted in a return that is overstated. The cash flow is ignored (by carrying a weight of zero in the denominator), meaning that the entire gain for the day ($30,000) was attributed solely to the start-of-day value. ∙

- The midday cash flow method gave us a return that is also overstated. Since the gain attributed to the cash flow was only applied to half of its amount (because a weight of 0.5 was used in the denominator), we get an overstatement.

- The start-of-day approach gave us the correct result. It attributed the gain from the flow to the full amount of the flow (by using a full weight of 1.0 in the denominator).

Is this sufficient to deter you from wanting to “split the difference” and go with a midday cash flow method? I’ll have more to say about this in this month’s newsletter. Care to chime in? Please do!