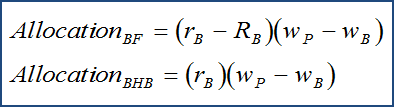

The late Damien Laker once opined that there was no difference between the two “Brinson models,” Brinson-Fachler and Brinson-Hood-Beebower. I went out of my way to enlighten him on this subject, pointing out that the allocation effect for the latter uses only the benchmark sector return while the former uses the benchmark sector return minus the benchmark return:

As a result, there can be sizable differences in the results and, at times, even sign-switching!

The BHB model rewards investors who overweight positively performing sectors, while the BF only does so if the sector outperforms the benchmark. When discussing this in our training classes, I explain that if all the sectors are positive, BHB would want the investor to overweight them all!

The WSJ today reported that all 10 stock sectors of the S&P 500 will, in fact, have positive gains for this year (“All 10 Stock Sectors Post Gains in Big Year.” Dan Strumpf Page C4).

Thus, we have such an occurrence when the investor is supposed to overweight everything; but how can they do this without borrowing money? They can’t. BF, more correctly, I believe, wants the investor to only overweight those sectors that fall above the benchmark itself.

Thus, we have a perfect example to draw upon to demonstrate the superiority of the older (by only one year) model, which Gary Brinson crafted with Nimrod Fachler.