There was good news in the media this morning, as the United States Internal Revenue Service (IRS) awarded a former UBS employee in the amount of $104 million USD for “whistle-blowing” regarding activities at UBS that assisted some of the firm’s clients in hiding assets from the IRS. The $104 million USD reward is reputed to be the largest ever given for whistle-blowing.

This announcement comes on the heels of the SEC issuing its first ever whistle-blowing award (a much smaller sum of $50,000 USD) to someone who helped stop “multi-million dollar fraud” from occurring.

I am reminded when I read these stories of Provision IV.A of the Standards of Professional Conduct, which CIPM candidates are required to know and interpret as part of the ethics component of the CIPM Curriculum. This provision reads:

In matters related to their employment, Members and Candidates must act for the benefit of their employer and not deprive their employer of the advantage of their skills and abilities, divulge confidential information, or otherwise cause harm to their employer.

It is important to understand that loyalty only goes so far – as covered persons (those bound by the CIPM Code of Ethics and Standards of Professional Conduct), we are not required to put our employer’s interest beyond our own in all situations. Two key situations are mentioned in the readings place limitations on loyalty. One deals specifically with whistleblowing, and the other deals with personal interests.

With respect to whistleblowing, from page 143 in the CIPM Principles VitalBookshelf readings:

- Whistleblowing. A member’s or candidate’s personal interests, as well as the interests of his or her employer, are secondary to protecting the integrity of capital markets and the interests of clients. Therefore, circumstances may arise (e.g., when an employer is engaged in illegal or unethical activity) in which members and candidates must act contrary to their employer’s interests in order to comply with their duties to the market and clients. In such instances, activities that would normally violate a member’s or candidate’s duty to his or her employer (such as contradicting employer instructions, violating certain policies and procedures, or preserving a record by copying employer records) may be justified. Such action would be permitted only if the intent is clearly aimed at protecting clients or the integrity of the market, not for personal gain.

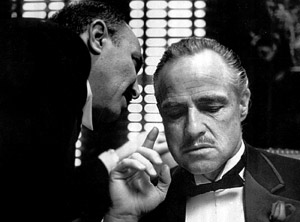

The picture above shows Marlon Brando in “The Godfather” film – certainly, he commanded a high level of loyalty by persons under his watch. It may seem with companies of the stature of UBS and similar firms that the loyalty they “encourage” is similarly intimidating. But the Code and Standards call upon us as performance professionals to do what is ethically correct – and whistleblowing may be necessary in some scenarios, in order to do what is ethically correct.

On the other point, personal interests, from page 141 in the CIPM Principles VitalBookshelf readings:

- This standard is not meant to be a blanket requirement to place employer interests ahead of personal interests in all matters. The standard does not require members and candidates to subordinate important personal and family obligations to their work. Members and candidates should enter into a dialogue with their employer about balancing personal and employment obligations when personal matters may interfere with their work on a regular or significant basis.

Happy studying!