It has actually become apparent to me during the course of conducting GIPS verifications that there is some confusion as to when internal dispersion and external dispersion must be shown. It occurred to me that CIPM candidates may have the same confusion.

Internal dispersion is a required presentation element of GIPS compliant composite presentations, as required by provision 5.A.1.i. Provision 4.A.8 also requires compliant firms to disclose what measure of dispersion is shown.

External dispersion is a required presentation element of GIPS compliant compliant composite presentations for periods ending on or after January 1, 2011, for both the composite and the benchmark. This is required by provision 5.A.2. An additional risk measure (using the same periodicity) is required if firms feel that the three-year annualized ex-post standard deviation is not relevant or appropriate.

So what is the difference between internal dispersion and external dispersion, both in terms of what they measure and when they are required?

Internal dispersion is a measure of the range of returns within the composite within each annual period. Firms are only required to show this when the composite has more than five portfolios (firms can, of course, opt to show internal dispersion when the composite has five or fewer portfolios). The measure should only include portfolios that were in the composite for the full annual period. Firms can choose what measure of internal dispersion they show (with the exception of real estate composites, where the required measure of dispersion is the range of returns; i.e., the difference between the high and low returns). Some commonly used measures of internal dispersion are:

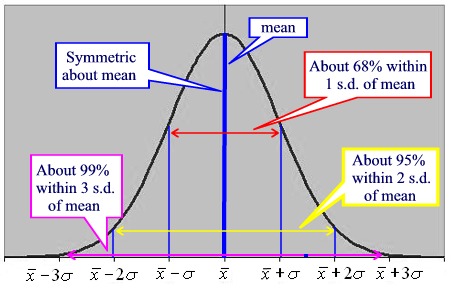

- standard deviation

- range of returns

- quartiles, quintiles, deciles, interquartile ranges

Standard deviation is probably the most commonly used measure of internal dispersion.

External dispersion is also a measure of the range of returns. But in this case we are measuring the range of a given composite’s past returns (over the most recent 36 months). It is meant to be a measure of the composite’s risk. External dispersion is required for any periods ending on/after January 1, 2011, regardless of the number of portfolios in the composite. This is probably the single biggest misconception about the external dispersion that I have seen – many firms think they don’t have to show it if the composite has five or fewer portfolios. But even for a single portfolio composite, the external dispersion must be shown. The only exception to this is for real estate composites (where section I.6 of the GIPS standards apply) and private equity composites (where section I.7 of the GIPS standards apply).

Also, external dispersion must be shown as the three-year ex-post annualized standard deviation (based on monthly returns). So firms don’t have a choice in what measure they show, unless they feel the standard deviation is not relevant or appropriate. If firms feel this is the case, they must still show the three-year ex-post annualized standard deviation – and then they can show the risk measure they feel is more appropriate and/or relevant to their composite.

One more point of comparison is the return that a reader of the presentation should look at in comparison to the dispersion measure.

- internal dispersion is a measure of the range of portfolio returns within the composite, and should be looked at in comparison to the composite’s annual return for that period, which is really a weighted average of the portfolio returns in the composite.

- external dispersion is a measure of the range of composite returns over time, and should be looked at in comparison to the three-year annualized return for that period, which is really a geometric average of the composite returns over time. Note that firms are not required to show the three-year annualized return, but it is recommended by GIPS provision 5.B.4

Long post, but hope this adds some clarity on the subject!