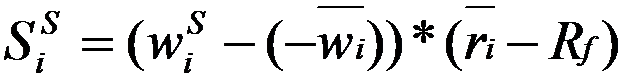

An Expert Level candidate sent me a question asking about the formula (shown above) for the asset allocation decision for market-neutral hedge funds, as discussed in the reading, “Performance Attribution with Short Positions” by Jose Menchero, Ph.D.

In particular, the candidate asked why there is an extra “minus” sign on the benchmark sector weight.

The key things to know to answer this question are as follows:

- In the Menchero framework, the weights of assets (or sectors, and sub-sectors) is positive for long positions and negative for short positions.

- Also, in the Menchero framework, the returns of assets (or sectors, and sub-sectors) is positive when the value of the assets goes up and negative when the value of the assets goes down.

- An appropriate benchmark for a market-neutral hedge fund would be perfectly hedged. This means the benchmark is simultaneously long and short the same assets, with a 100% net exposure to cash. The reading perhaps does not explain this in detail, but the idea is that the typical index has only long positions. Thus, one creates the “perfectly hedged” benchmark by assuming that the short weights for a sector or sub-sector are the same as the long weights.

So, you can think of the minus sign that is inside the parenthesis with “w bar” (i.e., the benchmark sector weight) as changing the sign of the weight from positive to negative.

This ensures that the formula for asset allocation (referred to as sector selection in the Menchero reading) has its traditional results:

- Value will be added when the manager overweights sectors that outperform the risk-free rate, and when the manager underweights sectors that underperform the risk-free rate

- Value will be subtracted when the manager overweights sectors that underperform the risk-free rate, and when the manager underweights sectors that outperform the risk-free rate