Issue Contents:

Best Practices In Talent Management: Highlights From PMAR

Summary by Patrick W. Fowler

In the ever-evolving landscape of talent recruitment and retention, the operational mode of an organization plays a crucial role. This was a key topic of discussion at last year’s PMAR conference, where industry leaders shared their insights and strategies for navigating this dynamic terrain.

Frances Barney, CFA, a seasoned professional with global experience, shed light on the impact of operating modes on talent management. She emphasized the diverse preferences across different regions, citing India as a case where there’s a keen interest in returning to the office. In contrast, some US locations witness a stronger inclination toward remote work. Understanding these preferences is pivotal in crafting effective talent management strategies tailored to each location’s needs.

Diane Robertson echoed Frances’s sentiments, highlighting the importance of flexibility and role-based analysis. She emphasized the need to align operating modes with organizational goals while recognizing individual preferences. This approach ensures a harmonious blend of remote and office work, catering to diverse roles and employee needs.

Reflecting on the lessons learned from the pandemic, Alex Shafran emphasized the value of fostering connections and investing in non-work related interactions. He stressed the significance of mentorship and networking opportunities, especially for early-career professionals navigating remote work environments.

Addressing the challenges of talent recruitment in the era of remote work, Diane emphasized the need for strategic growth locations and tailored recruiting approaches. By concentrating efforts in key areas and offering diverse career paths, organizations can attract and retain top talent.

The discussion also delved into the evolving nature of job roles, particularly in performance measurement and technology integration. Alex and Frances highlighted the convergence of roles and the increasing demand for technical skills in traditionally non-technical domains. This shift necessitates a proactive approach to upskilling and role redefinition to meet evolving organizational needs.

As the conversation shifted to retention strategies, Frances and Diane underscored the importance of fostering a supportive culture and providing opportunities for career advancement. From targeted training programs to mentorship initiatives, organizations must invest in their employees’ growth and development to enhance retention.

In conclusion, the insights shared at PMAR highlight the multifaceted nature of talent management in today’s dynamic landscape. By embracing flexibility, fostering connections, and investing in employee growth, organizations can navigate challenges and cultivate a thriving workforce poised for success.

Have an opinion? Please share it with Patrick Fowler.

Quote of the Month

“The desire of gold is not for gold. It is for the means of freedom and benefit.”

~Ralph Waldo Emerson~

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step towards a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights, “’Relativity’ in Finance: How a Simple Assumption Led to Many Crises” by Arun Muralidhar, Ph.D. of Mcube Investment Technologies, was published in volume 28, issue #2 of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

Investment theory has implications for asset allocation, asset pricing, and risk-adjusted performance. The statement in finance that “investors maximize the utility of wealth, is largely incorrect” assumes that investors are principals with a deterministic goal. Recommendations from theory are often (blindly) adopted resulting in meaningful systemic risks. Instead, investors delegate to maximize (multiple) goal(s) relative risk-adjusted returns. Investors care about whether their managers are lucky/skilled and their IPSs tell their exact risk specification. This Op-Ed examines the implications for asset allocation, rebalancing, factor investing, fees and regulations, highlights attempts to resolve challenges, suggests innovations, and argues for a relative investment theory paradigm to capture the realities of investing.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

The GIPS® Standards Compliance Notification Due Date Is Approaching

Organizations that claim compliance with the Global Investment Performance Standards (GIPS) must submit a GIPS compliance notification to CFA Institute every year prior to the June 30 deadline.

If your organization hasn’t registered with CFA Institute in 2024, you’ll need to update your GIPS compliance notification before June 30. Here’s the link to update your firm’s registration: https://compliancetracking.cfainstitute.org/update-gips

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.SpauldingGrp.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

Welcome New Members To The Performance Measurement Forum

The Performance Measurement Forum has met 103 times over the past 25 years, and will meet again in Las Vegas, NV and Athens, Greece this June. We celebrate and recognize the two newest members of the group.

- HOOP

- Capital Group

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

TRIVIA TIME

Here’s This Month’s Trivia Questions; Answers In The Next Issue!

Responses received with all correct answers to the question below will receive a special gift.

1. Who, in 1903, was the first woman to win a Nobel Prize?

2. What year did the Berlin Wall fall?

3. What element does the chemical symbol Au stand for?

4. What is the smallest planet in our solar system?

5. What is the highest-grossing Broadway show of all time?

Submit your responses to: PFowler@TSGpeformance.com

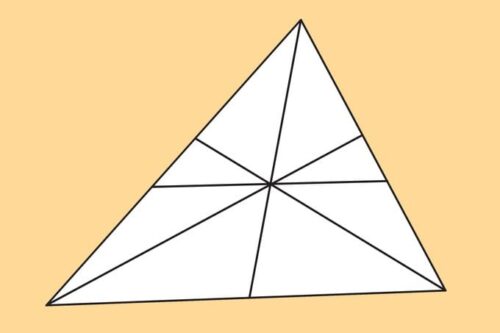

Last Month’s Puzzle And Solution.

How many triangles can you see?

Answer:

23

Correct responses to the puzzle:

- Anthony Howland

Please submit your puzzle solution or puzzle ideas to Patrick Fowler.

Compliance Corner

Marketing Rule Enforcement Remains Priority: SEC Charges Five Advisers For Marketing rule Violations

Authors: Lance C. Dial, Pablo J. Man, Pamela A. Grossetti, and Bradley D. Bostwick of K&L Gates

The SEC recently settled charges against five investment advisers for violating Rule 206(4)-1, known as the Marketing Rule, under the Advisers Act. The violations involved advertising hypothetical performance on their websites to the general public, which the SEC considers inappropriate due to the inability to tailor it to individual investors’ needs. One firm faced additional allegations, including failure to substantiate performance claims and lacking written agreements with endorsing accounting firms. These settlements emphasize the SEC’s focus on enforcing the Marketing Rule’s performance presentation requirements, even after firms removed offending materials from their websites. For a thorough understanding of the Marketing Rule, readers are directed to prior alerts and a Marketing and Advertising Checklist provided by the authors.

Thank you to our friends at K&L Gates for contributing this content.

Book Review

Stay Interesting, by Jonathan Goldsmith

Review by David D. Spaulding, DPS, CIPM

No doubt, everyone is familiar with the Dos Equis commercials involving The Most Interesting Man in the World (e.g., https://tinyurl.com/5n6zv255)

But how many know who the actor was who portrayed this most interesting man?

Jonathan Goldsmith, a many decades struggling actor until he won this role.

You may know that I adopted the moniker of “Most Interesting Man in Performance Measurement” (MIMiPM) a few years ago (e.g.,https://tinyurl.com/yhpzumdy). Just like the Dos Equis character, it was meant to invoke a laugh or two.

I can’t explain how I learned that Jonathan had penned his autobiography, but once I did, I immediately ordered it; and when it arrived, I put aside all the other books I was reading to focus on it. Four days later, I was done.

What a wonderful book. And what a truly interesting man. He was born for this part.

He very cleverly explains how he won the role, not at once, but in small pieces, to keep us in suspense.

I can relate, at least to some degree, to Mr. Goldsmith. One example is with the commercials vs. my posts: “I think they made people laugh.” That was my goal: just to have a bit of fun.

Sometimes, the attempts at humour [sorry, I’m channeling my Canadian side, as I’m heading north] may cause one to think that’s all I’m about, but those who know me know how very serious I can be. But I also appreciate the value of humour; of a good laugh; of having a bit of fun.

His [many] struggles as an actor are, in a sense, our struggles as a company I started 34 years ago. Many foolishly think that starting a company can be easy: perhaps for some, but not most. “As I look back and reminisce over my journey and contemplate surviving the turbulence and difficulties inherent in all our lives to become a successful actor and, hopefully and more important, a successful man, I have many people to thank.”

Substitute “business man” or “business owner” or even “entrepreneur” for “actor,” and you’ve got me.

Do I recommend this book? Absolutely. You’ll laugh. He reveals a great deal about Hollywood, as well as his interesting life.

Yes, Dos Equis chose well, when they picked Jonathan.

Best Practices In Talent Management: Highlights From PMAR

Summary by Patrick W. Fowler

In the ever-evolving landscape of talent recruitment and retention, the operational mode of an organization plays a crucial role. This was a key topic of discussion at last year’s PMAR conference, where industry leaders shared their insights and strategies for navigating this dynamic terrain.

Frances Barney, CFA, a seasoned professional with global experience, shed light on the impact of operating modes on talent management. She emphasized the diverse preferences across different regions, citing India as a case where there’s a keen interest in returning to the office. In contrast, some US locations witness a stronger inclination toward remote work. Understanding these preferences is pivotal in crafting effective talent management strategies tailored to each location’s needs.

Diane Robertson echoed Frances’s sentiments, highlighting the importance of flexibility and role-based analysis. She emphasized the need to align operating modes with organizational goals while recognizing individual preferences. This approach ensures a harmonious blend of remote and office work, catering to diverse roles and employee needs.

Reflecting on the lessons learned from the pandemic, Alex Shafran emphasized the value of fostering connections and investing in non-work related interactions. He stressed the significance of mentorship and networking opportunities, especially for early-career professionals navigating remote work environments.

Addressing the challenges of talent recruitment in the era of remote work, Diane emphasized the need for strategic growth locations and tailored recruiting approaches. By concentrating efforts in key areas and offering diverse career paths, organizations can attract and retain top talent.

The discussion also delved into the evolving nature of job roles, particularly in performance measurement and technology integration. Alex and Frances highlighted the convergence of roles and the increasing demand for technical skills in traditionally non-technical domains. This shift necessitates a proactive approach to upskilling and role redefinition to meet evolving organizational needs.

As the conversation shifted to retention strategies, Frances and Diane underscored the importance of fostering a supportive culture and providing opportunities for career advancement. From targeted training programs to mentorship initiatives, organizations must invest in their employees’ growth and development to enhance retention.

In conclusion, the insights shared at PMAR highlight the multifaceted nature of talent management in today’s dynamic landscape. By embracing flexibility, fostering connections, and investing in employee growth, organizations can navigate challenges and cultivate a thriving workforce poised for success.

Have an opinion? Please share it with Patrick Fowler.

Industry Dates and Conferences

- May 21 – Women in Performance Measurement Meeting – New Brunswick, NJ

- May 22-23 – Performance Measurement, Attribution, and Risk Conference (PMAR) – New Brunswick, NJ

- June 12 – Spring Meeting of the Asset Owner Roundtable (AORT) – Las Vegas, NV

- June 13-14 – Spring North American Meeting of the Performance Measurement Forum – Las Vegas, NV

- June 27-28 – Spring EMEA Meeting of the Performance Measurement Forum – Athens, Greece

- November 7-8 – Autumn EMEA Meeting of the Performance Measurement Forum – Barcelona, Spain

- November 20 – Fall Meeting of the Asset Owner Roundtable (AORT) – Charleston, SC

- November 21-22 – Fall North American Meeting of the Performance Measurement Forum – Charleston, SC

For information on the 2024 events, please contact

Patrick Fowler at 732-873-5700.

- Artificial Intelligence and Risk: Should We Be Concerned?

- What’s Missing from Your Equity Attribution Report?

- ESG: Risk, Compliance, and Regulatory Reporting – Why Having the Right Data and Tools is Essential

- How are the New SEC Guidelines Being Practically Implemented and Applied?

- What to Know About the New GIPS® Guidance for OCIOs

- Essential Skillsets of the Performance Professional

- Methods and Styles of Reporting

- Benchmark Misfit

- Paths to a “Rich” Life

- How to Calculate Returns on Options, Futures, and Swaps

- GIPS Q&A

Institute / Training

Access TSG’s Online Training Content With One Pass

Question 5: Do you agree with the proposed three options for the treatment of legacy assets?

While we generally agree with these options, legacy assets are not just an OCIO consideration as there are other firms that claim compliance with the GIPS standards that also must deal with legacy assets, e.g., private wealth managers. We believe the guidance for legacy assets, in general, should be expanded as a consideration under discretion, it should apply to all firms where legacy assets are a consideration and not specifically to OCIO strategies.

Our firm has provided guidance for these situations for years under the existing guidance for whether these assets would be considered discretionary or non-discretionary. If these legacy assets are determined to be discretionary, then they would be treated as all other discretionary assets within the portfolio and the firm’s managers would now “own” these assets. If these legacy assets are determined to be non-discretionary, then they would be treated as any other client-restricted assets would be with respect to the firm’s existing policies for discretion and exclusion.

If the firm is able to segregate these non-discretionary legacy assets from the main, discretionary portfolio, then the main, discretionary portfolio needs to meet the composite definition for inclusion. This is already required within Section 3 of the GIPS standards and this would be consistent with what other firms are doing that are able use technology to segregate portfolio assets for a variety of composite construction considerations.

That’s a Good Question

We calculate composite performance for model traded client accounts. Typically, the number of the accounts in each composite is significantly large (hundreds or thousands), but they can be made up of relatively small number of accounts, too.

Generally, we include accounts that were “active” (active to follow the model) for the entire measurement period. Beyond this we’re evaluating more inclusion rules to efficiently and effectively manage the composites considering the typical large number of accounts in each composite:

- Outlier returns – Is the practice of excluding active accounts if the specific account return is outside of a certain threshold compared to the asset weighted composite return, or possibly to the equally weighted composite return, commonplace and in-line with GIPS (to essentially remove any accounts that may not have been in-style for the period for any reason)? For example, calculate preliminary composite performance. Identify outliers based on a threshold. Exclude them, and after run final composite performance excluding the outliers. In our situation, accounts typically follow a model and there isn’t a lot of dispersion. Outlier returns are typically indicative of an account not being fully in-style for the full period.

- Significant Cash Flow policy – Is the practice of removing accounts from composites due to a significant cash flow (e.g., 10% or greater) typically implemented for situations where accounts are typically back in style relatively quickly (e.g., 1-3 days)? Is it acceptable and commonplace to implement a SCF policy to mitigate any potential effect, even if accounts are typically traded back to style relatively quickly? If not, when would a SCF policy typically be justified?

- Trade restrictions – Do clients typically exclude accounts for any or all trade restrictions that may occur within a measurement period? I assume that most only exclude if they deem the restrictions significant enough where they don’t feel like they had full discretion to implement the strategy. Is the practice of excluding an account for the measurement period typically implemented if a very temporary trade restriction occurs within the measurement period?

TSG’s response:

- Outlier returns – No. Assuming these are meant to be portfolios managed to a strategy where a manager has discretion, for a GIPS compliant firm, the portfolio would only leave the composite because discretion has been lost due to client-imposed reasons. This could be a “semi-permanent” loss of discretion (e.g., the client has placed a new restriction of some sort on the portfolio) or a temporary loss of discretion (e.g., significant cash flows have occurred). Just being an outlier return is not a reason to remove the portfolio from the composite. It may be a sign of some other issue (perhaps data related, perhaps the account has restrictions that the manager thought wouldn’t have an impact but do, perhaps the portfolio was assigned to the wrong composite to begin with, or perhaps the manager is not consistent in implementing the strategy… these are just examples). But if the client didn’t do anything to prohibit/inhibit the manager’s discretion for a reason that is covered in the firm’s policy on discretion, there would be no reason for the portfolio to be removed from the composite

- Significant Cash Flow policy – Firms should really only use significant cash flow policies if they need to. Again, the idea is that the cash flow is so large that the manager’s discretion is interrupted. If the manager can deal with the cash flows quickly and easily, that suggests returns will not be impacted, so a significant cash flow policy should be avoided. That said, such a policy needs to be ex-ante in nature. Once implemented, it must be followed until the manager decides to stop it. It can’t be a case-by-case basis where the manager says, sometimes we applied it and sometimes we didn’t. Significant cash flow policies are a lot of work for the firm to monitor/apply, so really they should be avoided unless there is a need.

- Trade restrictions – Again, answering this from a GIPS standpoint. I believe, like the first question, you are asking what do GIPS compliant firms do, so you can use it as a guideline for your situation. Keep in mind that a GIPS compliant firm would be required to document the restrictions that cause portfolios to be excluded from composites. Similar to what I said above for SCF policies, if the restriction does not really impact discretion, then using it as a reason to exclude portfolios from composites should be avoided. it just becomes work to track and check, for no real benefit. Transparency of rules used and consistency in application is key. If loss of discretion is only for a brief period and doesn’t really affect anything, then having a rule should be avoided. Sometimes it makes sense to think about what was the reason discretion was lost for such a short time. For example, if there is a custodian account number change – that is not a client-imposed reason. Ideally, the portfolios remain in the composite over that time. That said, maybe in such a case there are systems/operations reasons that make it difficult to achieve this, or maybe the custodian account number change means a trading halt for two to three weeks rather than a more typical two to three days. Then maybe you have to handle it differently.

Thanks to TSG’s Chief Verification Officer (CVO), John D. Simpson, CIPM for his responses.

Please submit your questions to Patrick Fowler.

Potpourri

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Summer Issue: July 12, 2024

Fall Issue: October 11, 2024

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.