During a recent Performance Measurement Think Tank call, I responded to the following question:

When calculating the beta of the holdings in a portfolio (not the trailing returns), do you use the 1) trailing returns of the current holdings or 2) the returns of the actual historical holdings?

I labeled this a “very good question” (not that the other questions weren’t also good). I’d never been asked this question before, and frankly hadn’t even considered it, but believe it has great value and is worthy of reflection and perhaps discussion, too.

The simple answer is “yes.” That is, when calculating beta, you CAN use either approach or both approaches. But depending on which one you use, you will get (a) different answers and (b) a different meaning.

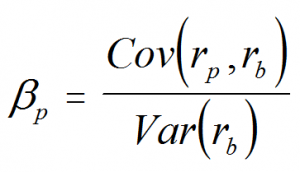

First, the formula for calculating beta

Before we discuss what returns you use, we should consider the formula itself, which is simply:

We take the covariance of the portfolio and benchmark returns, and divide it by the benchmark returns’ variance. We typically do this over a 36 month period, using monthly returns.

Calculating beta: using trailing returns of the actual historical holdings

This is probably the more common approach. What does the result tell us? Well, it gives us the answer to the question: What was the beta that was realized historically for this portfolio, vis-à-vis its benchmark?

This is an ex post or backward looking view of beta, for it tells us the risk that was taken over the prior period.

Calculating beta: using the trailing returns of the current holdings

I would characterize this approach as an ex ante or foreward looking beta. It tells us what the beta is of the portfolio at this moment in time, and therefore can be used to project ahead what the risk will be.

Do both, to provide greater insights into the portfolio’s risk!

Why not calculate beta both ways? This way, you provide even more insights about risk: what was taken plus what’s being taken!

Want to learn more about calculating beta and risk, in general?

TSG’s Fundamentals of Performance Measurement class has a section devoted to risk, and we also have Portfolio Risk, a course that focuses only on risk.

PLUS, this November you can join us for Risk Week, our webinar-based conference.

To learn more, visit the specific pages or call Chris Spaulding.