GIPS(R) (Global Investment Performance Standards) compliant firms routinely establish minimums for accounts to be included in composites. The minimum is the threshold, below which, the account is not representative of the strategy.

But when should an account that falls below the minimum be removed? Or, if it rises above, be added?

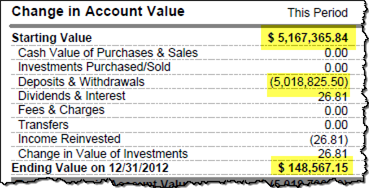

Many firms test only at the beginning of the period: if the account is above at the start of the month, it will be in the composite for the full month. But this can be problematic. For example, one of our verification clients had the following situation:

This particular composite has a $1 million minimum; clearly, the account is above at the start. BUT, at some point during the month, most of the assets left. Granted, if the firm has a significant cash flow policy, the account would be removed for that reason. But, if it doesn’t, should it come out because it fell below the minimum? I would say, “yes!”

The test should be at the start and end of the period. If the account is above at the start and end, it should be in the composite, but if it is below at either the start or end, it should be excluded.