by admin | Oct 16, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, GIPS, GIPS standards, GIPS verification, performance measurement, TSG

(Note: I wrote this post as a guest blogger for the STP Investment Services blog, but it appears that blog is offline and we received a request for the information, so I decided to post the information directly here.) The What, Why and Who of the...

by admin | Oct 15, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM Principles, Eugene Fama, Fama-French, Kenneth French, performance measurement, returns-based style analysis, style analysis, William Sharpe

OK, I’m just kidding… there is no grand battle here between economists (and Nobel prize winners) Eugene Fama and William Sharpe. That being said, CIPM candidates at the Principles level *are* expected to deal with the following Learning Outcome...

by admin | Oct 14, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, economics, Eugene Fama, Fama-French, performance measurement, style analysis, TSG

Congratulations to Professor Eugene Fama of the University of Chicago! The Royal Swedish Academy of Sciences just announced that Mr. Fama (along with Robert Schiller and Lars Peter Hansen) has won this year’s Nobel prize in Economics, for their work on...

by admin | Oct 14, 2013 | Investment Performance Guy, News

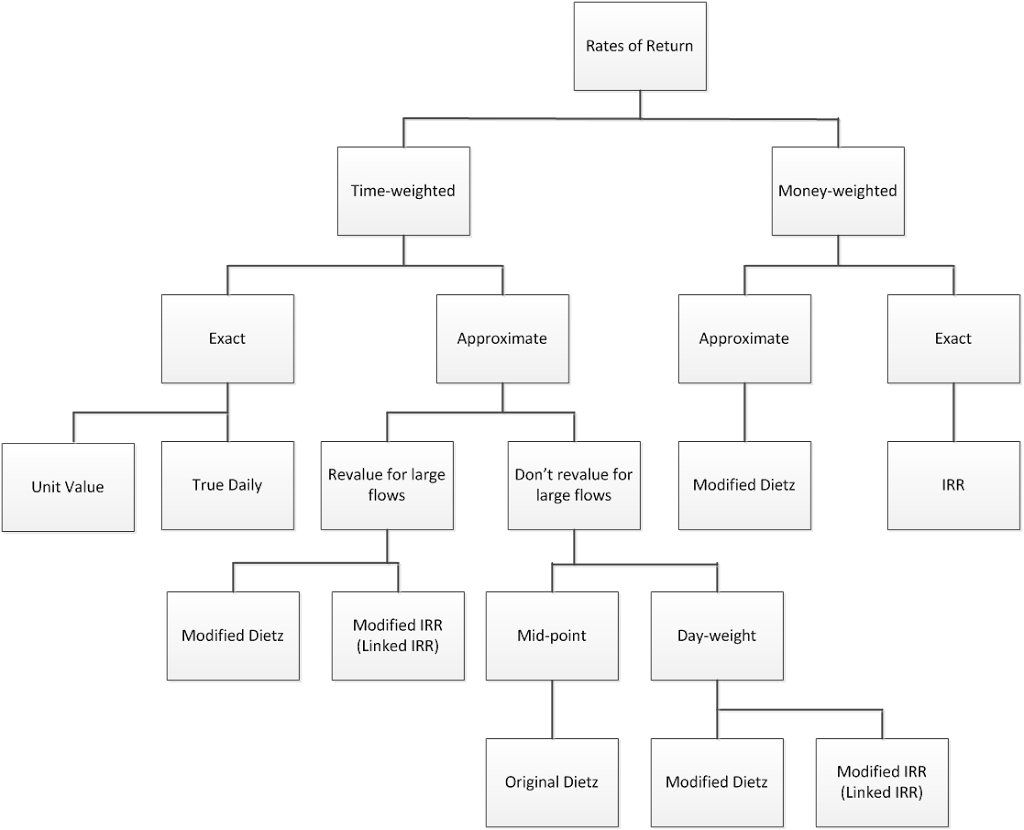

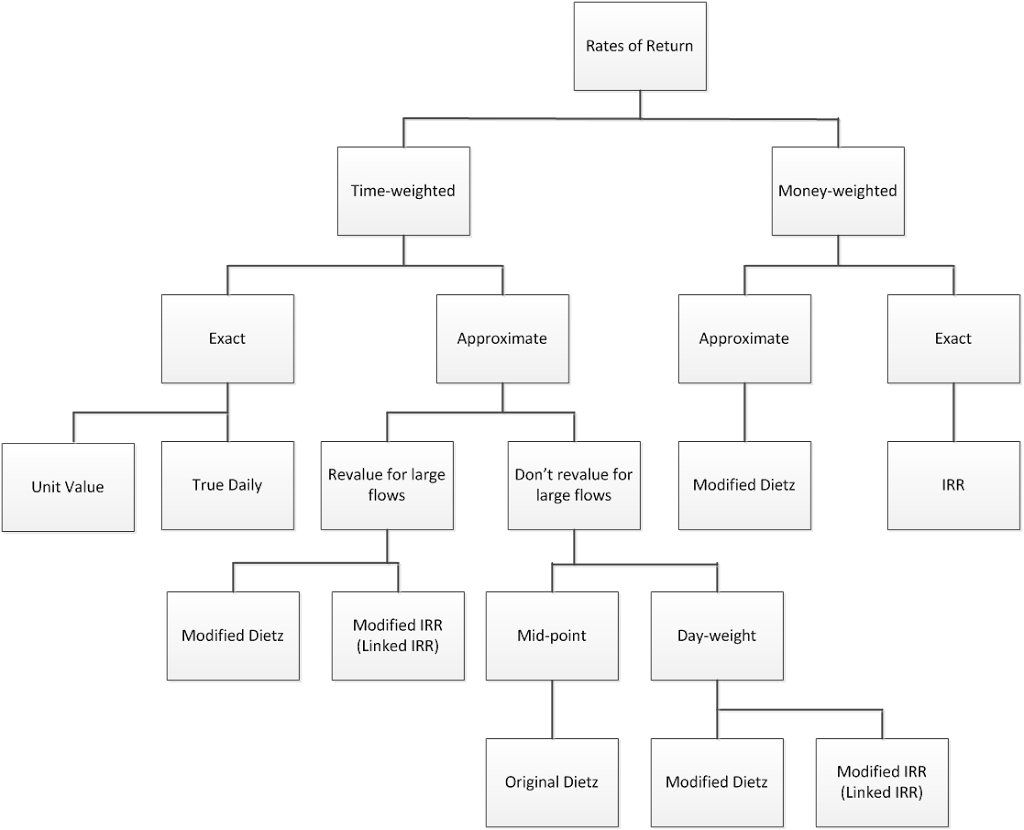

It occurred to me that we could spend some focused time on the issue of time (pun intended). Let us begin with rates of return.One of the ironies of performance measurement is that the term “time-weighting” has really nothing to do with the weighting of...

by admin | Oct 8, 2013 | Investment Performance Guy, News

I occasionally describe the formulas we use as a series of bifurcations, starting with time- and money-weighting. And, sometimes I begin with a graphical representation. Well, this morning, I decided to take that graphic to its nth degree, and solicited input from my...