by admin | Feb 8, 2012 | client reporting, GIPS, Global Investment Performance Standards

Leave it to my friend, Philip Lawton, PhD, CFA, CIPM, to find a way to link a philosopher with client reporting. In a recent blog post, he did just that, commenting on the initiative spearheaded by Stefan Illmer, to develop client performance reporting standards...

by admin | Feb 7, 2012 | GIPS, Global Investment Performance Standards, verification

In conducting research studies, we often want to introduce a degree of randomness, to avoid the potential bias that might creep in if we select our cases directly. There are random number generators available to assist us, although many of them have been challenged...

by admin | Feb 6, 2012 | Sharpe ratio

Bill Sharpe read my recent blog post on addressing negative Sharpe ratios, and offered the following:Your blog post seems fine.About the only alternative I can offer is this:The (original) Sharpe ratio in effect compares two alternative combinations of treasury...

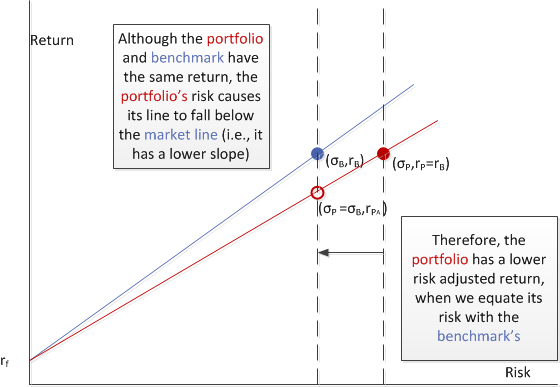

by admin | Feb 3, 2012 | M-squared, Modigliani, risk, risk-adjusted return, Sharpe ratio

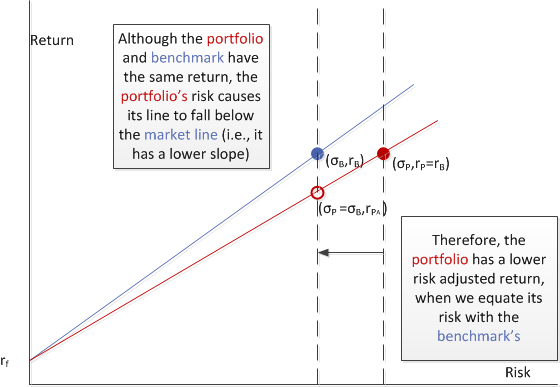

In TSG’s January newsletter, I expanded upon a recent blog post where I introduced a couple graphics in an attempt to “make sense out of” negative Sharpe ratios. Two pillars of the investment performance community, Carl Bacon and Steve Campisi,...

by admin | Jan 31, 2012 | Investment Performance Guy, News

Excuse me for once again commenting on the subject of trust, but I just learned that Claremont Mckenna College, a prestigious California institution, has admitted to inflating SAT scores to improve it’s ranking. There seems to be almost an epidemic in such...