Mixed Treatment of Cash Flows

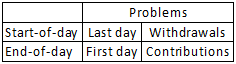

Today marks the third day of our three-part installment on handling cash flows. The first part saw us treat cash flows as end-of-day events and the second had flows as start-of-day events. To quickly summarize the challenges with both, I’ve constructed this table:  We detailed these problems earlier; hopefully they were convincing. And so, we see that whether we do start- or end-of-day as our default position for cash flow treatment, we’re going to have some problems. Yes, we can construct “work arounds,” but is that the best we can do? I think not. A “mixed treatment of cash flows” is, I believe, the best “default position.” I JUST coined this term, “mixed treatment,” so if you “Google it,” chances are you won’t find much. But, I think it is a succinct way to describe what I have in mind, though I’m definitely open to other ideas:

We detailed these problems earlier; hopefully they were convincing. And so, we see that whether we do start- or end-of-day as our default position for cash flow treatment, we’re going to have some problems. Yes, we can construct “work arounds,” but is that the best we can do? I think not. A “mixed treatment of cash flows” is, I believe, the best “default position.” I JUST coined this term, “mixed treatment,” so if you “Google it,” chances are you won’t find much. But, I think it is a succinct way to describe what I have in mind, though I’m definitely open to other ideas:

- treat inflows as if they occurred at the start-of-day

- treat outflows as if they occurred at the end-of-day.

Employing a mixed treatment of cash flows approach

Let’s revisit the problems we saw earlier, and see if this “mixed treatment of cash flows” idea has any merit.

Problem #1: What occurs on the first day of trading with end-of-day treatment as the default

Well, we already suggested a “work around” for this, right? We showed how the first day could be problematic, because there is no starting value, meaning our result will be “undefined.” The way many firms deal with this is to make these flows start-of-day. Well, at least in this case those firms recognize that start-of-day for inflows at least has some merit. Unfortunately, some don’t classify this as a shift to start-of-day treatment, but instead explain that on this day, they’ll substitute their cash flow as the initial value. While I recognize that it’s just in the Algebra, there is a clear distinction. In these cases, our weight shifts from zero (end-of-day) to one (start-of-day). It works!

Problem #2: Mis-assigning unrealized gains / losses during the day to the starting value (end-of-day treatment)

When an inflow occurs and is immediately put to work, a gain or loss can result; however, if we ignore the flow until the next day, any gain or loss will be applied entirely to the starting value, meaning an overstated gain or loss: makes no sense. The alternative (you guessed it!) is to treat these flows as if they took place at the start-of-day; consequently the math works and we get a meaningful result.

Problem #3: What occurs on the last day of an account’s life, when all the remaining funds are withdrawn (start-of-day treatment)

If a withdraw of all remaining funds occurs, and that amount equals what you began the day with, then both the numerator and denominator will be zero (an “indeterminate” result), when you assume a start-of-day approach. A simple way to deal with this is to treat this withdraw as an end-of-day event. And so, we again see an “override” applied, which should be the standard practice: withdrawals get treated as end-of-day events.

Problem #4: Mis-assigning realized gains/losses to the starting value following the withdraw of a sale’s proceeds (start-of-day treatment)

A realized gain/loss results from the sale of an asset; if those funds are removed, the base of the return formula will shrink; any gain/loss resulting from the sale will cause an overstatement (i.e., too high or too low). Delaying the removal of the funds (in the return formula will avoid this problem).

Haven’t we heard this before?

If you’ve been reading my material for awhile, you may have encountered prior discussions on this topic: I confess! What’s different are the four examples I provided, which add further credence to my believe that SOD for inflows and EOD for outflows makes the most sense, most of the time.

Monthly newsletters’ discussion on mixed treatment of cash flows

This month’s newsletters will touch on this topic even further, with a few other examples.