by admin | Sep 27, 2012 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, HP 12C, internal rate of return, money-weighted return, MWR, performance measurement, since inception internal rate of return, TSG

In a previous post, I covered an internal rate of return sample exam question, and I covered the keystrokes used on one of the calculators that may be used on the CIPM exam, the Texas Instruments Business Analyst II Plus (TI-BA II Plus).There is, of course, another...

by admin | Sep 25, 2012 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, CIPM Q and A

Tomorrow, I will be hosting an open Q & A (question and answer) session for CIPM candidates. This is a chance for you to ask questions as you are (hopefully) doing your final studying for October’s exams! The session is open to both Principles...

by admin | Sep 12, 2012 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, duties to employer, employee loyalty to employer, ethics, loyalty, Standards of Professional Conduct, whistle-blowing

There was good news in the media this morning, as the United States Internal Revenue Service (IRS) awarded a former UBS employee in the amount of $104 million USD for “whistle-blowing” regarding activities at UBS that assisted some of the firm’s...

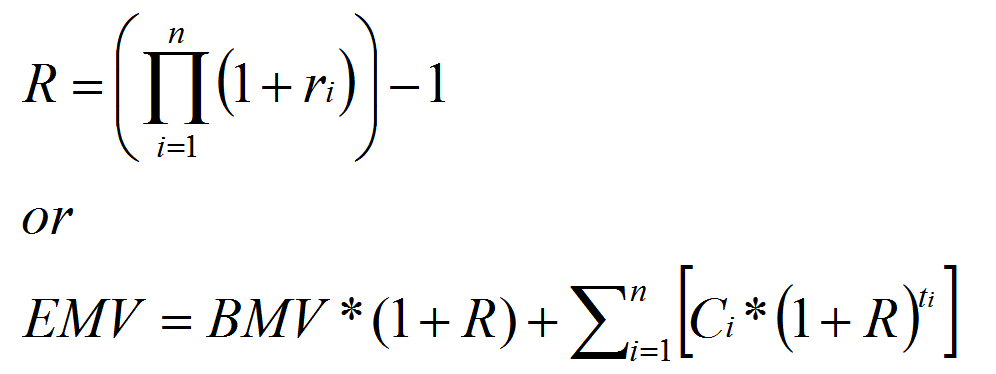

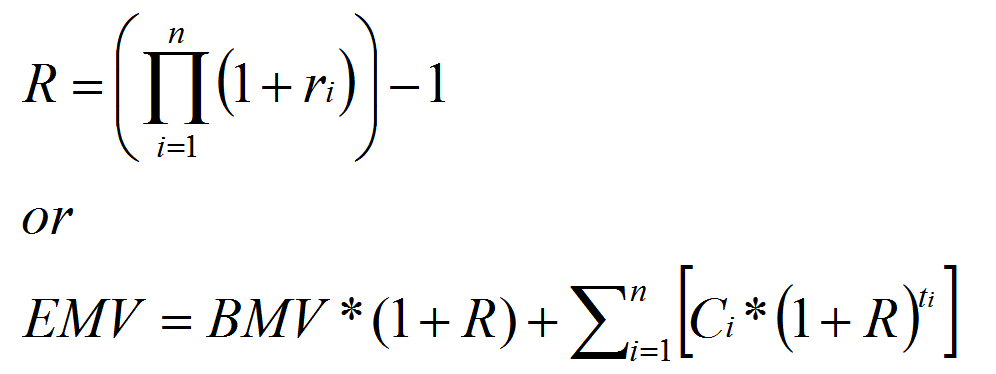

by admin | Sep 10, 2012 | CIPM, CIPM expert, GIPS, internal rate of return, performance measurement, SI-IRR, since inception internal rate of return, time-weighted return

CIPM Expert Level candidates must know what return calculations are required by the Global Investment Performance Standards (GIPS(r)), and in which circumstances. Most of the time, time-weighted return (TWR) is required, but in some cases a since inception...

by admin | Sep 8, 2012 | bond prices, Campisi model, CIPM, CIPM Exam Tips & Tricks, CIPM expert, fixed income attribution, performance attribution, performance measurement, risk-free yield curve

The CIPM curriculum does not give much of an explanation of bond pricing in relation to interest rates, so here is a brief primer.Price change on bonds can be explained by how interest rates change during the period.Bonds are a lending agreement: the purchaser...

by admin | Aug 31, 2012 | Campisi model, CIPM, CIPM Exam Tips & Tricks, CIPM expert, fixed income attribution, income contribution

Recall from my previous posting, the steps to executing the Campisi fixed income attribution model are:Decompose the benchmark return into:- income contribution- Treasury contribution (i.e., price change due to changes in Treasury rates)- spread contribution (i.e.,...