by TSG | Feb 19, 2025 | attribution, fixed income attribution, Investment Performance Guy

Guest Author: Stephen Campisi, CFA, The Pensar Group A growing consensus for lower expected returns in equity is causing investors to turn to fixed income as an increasingly-attractive source of risk-adjusted returns. One survey of investment firms estimates large cap...

by TSG | Mar 11, 2022 | fixed income attribution, Performance Perspectives Newsletter, software search

VOLUME 1 – ISSUE 2 October 2003 Download PDF...

by admin | Apr 9, 2013 | bond mathematics, Campisi model, CIPM, CIPM Exam Tips & Tricks, CIPM expert, duration, fixed income attribution, performance attribution

A common question I get is what is the purpose of the “index portfolio” used in the Campisi fixed income attribution model.Before answering, let me first give an outline of the steps in calculating attribution in the Campisi framework.Step 1: ...

by admin | Sep 8, 2012 | bond prices, Campisi model, CIPM, CIPM Exam Tips & Tricks, CIPM expert, fixed income attribution, performance attribution, performance measurement, risk-free yield curve

The CIPM curriculum does not give much of an explanation of bond pricing in relation to interest rates, so here is a brief primer.Price change on bonds can be explained by how interest rates change during the period.Bonds are a lending agreement: the purchaser...

by admin | Aug 31, 2012 | Campisi model, CIPM, CIPM Exam Tips & Tricks, CIPM expert, fixed income attribution, income contribution

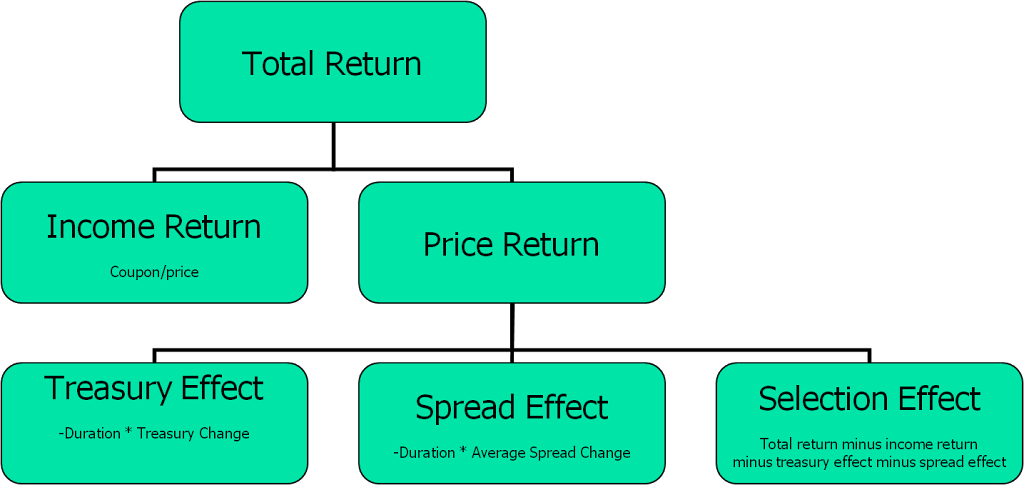

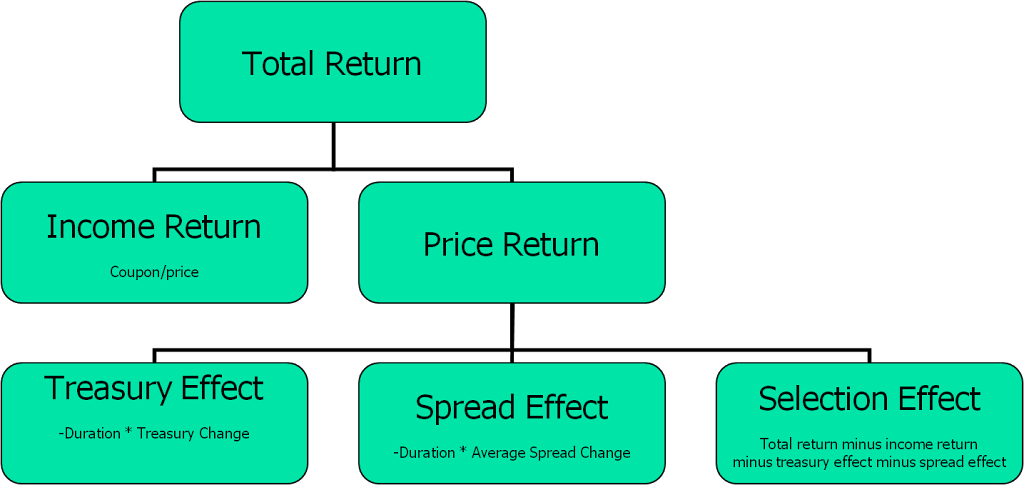

Recall from my previous posting, the steps to executing the Campisi fixed income attribution model are:Decompose the benchmark return into:- income contribution- Treasury contribution (i.e., price change due to changes in Treasury rates)- spread contribution (i.e.,...

by admin | Aug 24, 2012 | bond mathematics, Campisi model, CIPM, CIPM Exam Tips & Tricks, CIPM expert, fixed income attribution, performance attribution, performance measurement

For many CIPM Expert Level candidates, fixed income attribution is the most difficult topic. This is evident when I teach TSG’s CIPM prep classes, as we devote an entire afternoon to the subject. Among the three models that candidates are required to...