by admin | Feb 3, 2012 | M-squared, Modigliani, risk, risk-adjusted return, Sharpe ratio

In TSG’s January newsletter, I expanded upon a recent blog post where I introduced a couple graphics in an attempt to “make sense out of” negative Sharpe ratios. Two pillars of the investment performance community, Carl Bacon and Steve Campisi,...

by admin | Jan 17, 2012 | GIPS, Global Investment Performance Standards, M-squared, Modigliani, risk

I have been invited to join the CFA Institute’s Jonathan Boersma and Neuberger Berman’s Leah Modigliani to speak on the subject of risk, at an evening event at the NYSSA (New York Society of Security Analysts). The program takes place at 6...

by admin | Jan 25, 2011 | M-squared, risk, Standard Deviation, tracking error

I was teaching our Fundamentals of Performance Measurement course yesterday and came upon a metaphor to use to justify the need for multiple views on risk: John Godfrey Saxe’s poem about the blind men and the elephant. You are no doubt familiar with the story,...

by admin | Jul 23, 2009 | Dietz, M-squared, Modigliani, risk, risk-adjusted return, time-weighting

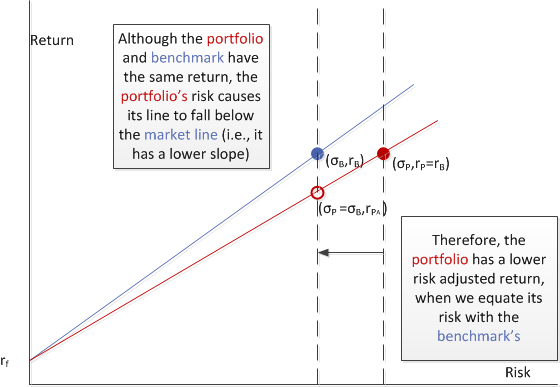

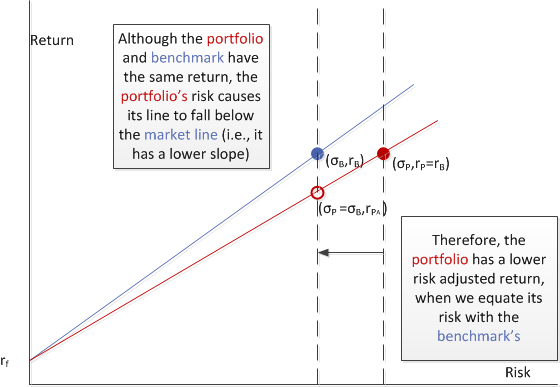

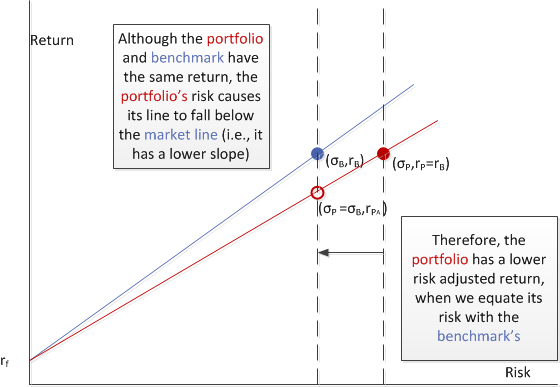

While I doubt that they were aware of it, when Franco and Leah Modigliani developed their risk-adjusted return measure, M-squared, they were extending an idea first promulgated by Peter Dietz in his 1966 thesis, from which we obtained the notion of time-weighting and...