by admin | Dec 28, 2024 | GIPS, Global Investment Performance Standards, risk, risk-adjusted return, Sharpe ratio, Standard Deviation

Standard deviation is a much misunderstood measure, in spite of its common use. First, is it a risk measure? It depends on who you ask. It’s evident that Nobel Laureate Bill Sharpe considers it to be one, since it serves this purpose in his eponymous...

by TSG | Jul 21, 2016 | Performance Perspectives Newsletter, risk-adjusted return

VOLUME 13 – ISSUE 6 July 2016 Download PDF...

by admin | Feb 3, 2012 | M-squared, Modigliani, risk, risk-adjusted return, Sharpe ratio

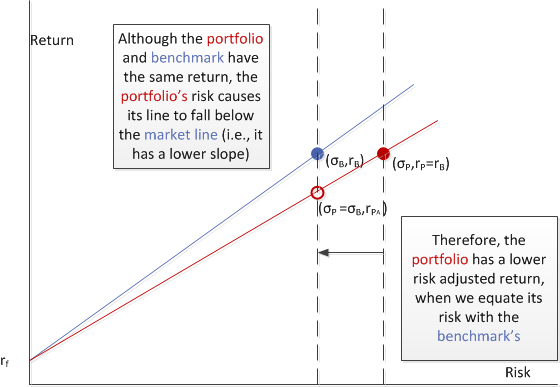

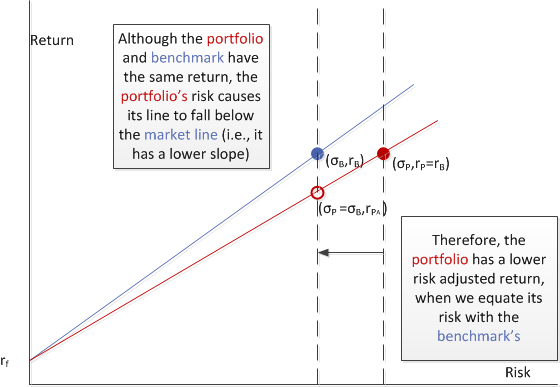

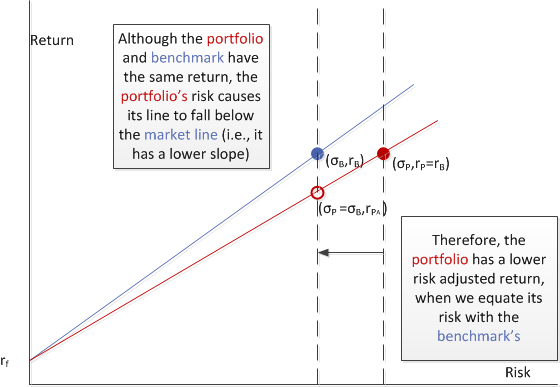

In TSG’s January newsletter, I expanded upon a recent blog post where I introduced a couple graphics in an attempt to “make sense out of” negative Sharpe ratios. Two pillars of the investment performance community, Carl Bacon and Steve Campisi,...

by admin | Aug 19, 2009 | IRR, money-weighting, risk-adjusted return

Most academic articles that deal with “returns” are actually dealing with risk-adjusted returns. In the course of writing an article on this subject I came across countless such articles. In The Journal of Performance Measurement we’ve tackled both...

by admin | Jul 23, 2009 | Dietz, M-squared, Modigliani, risk, risk-adjusted return, time-weighting

While I doubt that they were aware of it, when Franco and Leah Modigliani developed their risk-adjusted return measure, M-squared, they were extending an idea first promulgated by Peter Dietz in his 1966 thesis, from which we obtained the notion of time-weighting and...