by admin | Jul 28, 2009 | risk, value at risk

This past week I spent a day dealing with the single topic of Value at Risk (VaR). This was in a class I’m taking in my doctoral program. Our professor, Aron Gottesman, did a fantastic job showing how VaR isn’t nearly has challenging as one might think. As...

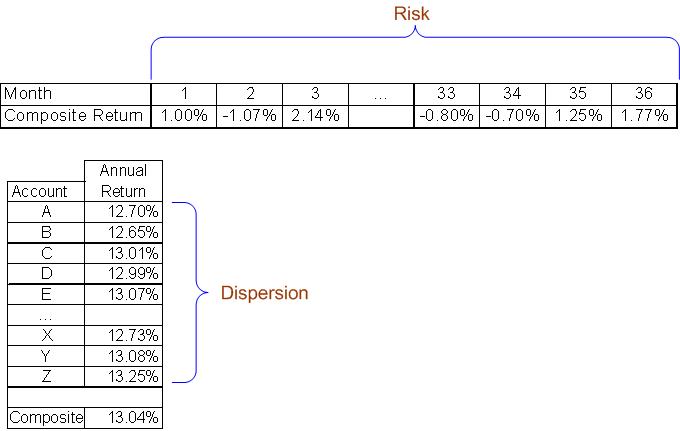

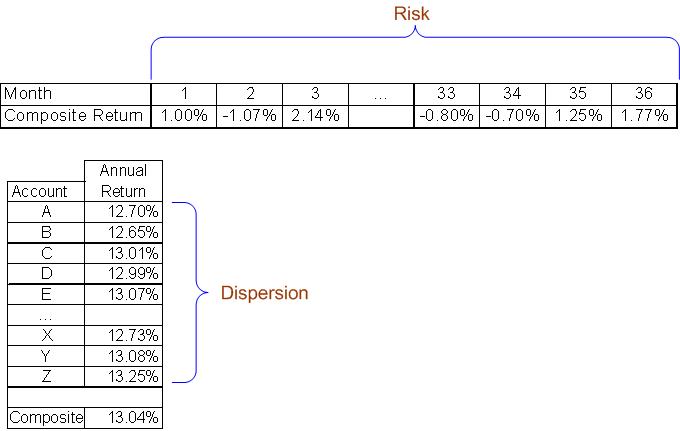

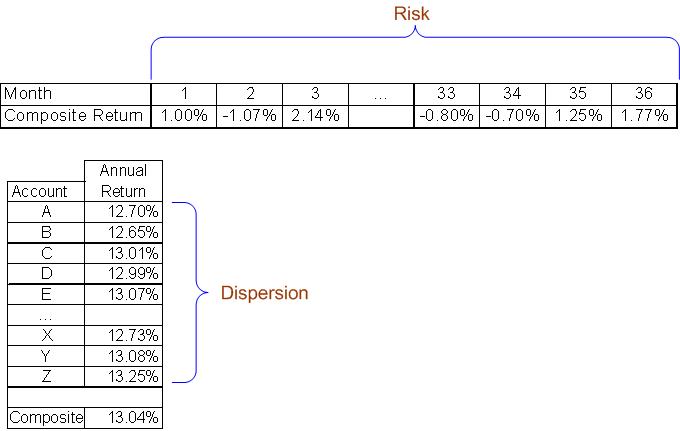

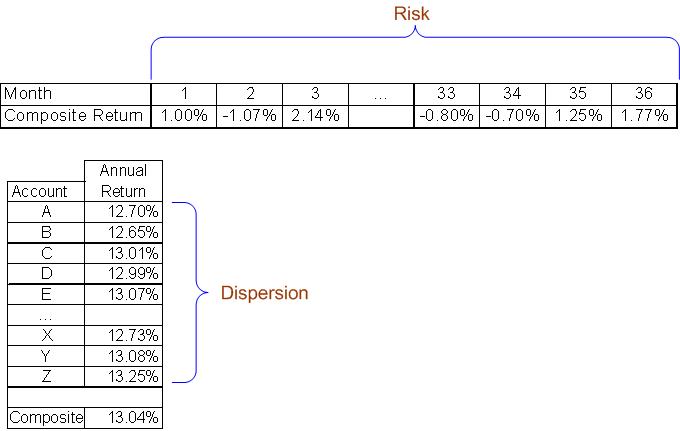

by admin | Jul 24, 2009 | GIPS, risk, Standard Deviation

Standard deviation is a commonly used statistic, well known by many long before they enter the world of performance measurement, which serves multiple purposes and thus engenders confusion.The GIPS 2010 draft proposed a requirement that a 36-month annualized standard...

by admin | Jul 23, 2009 | Dietz, M-squared, Modigliani, risk, risk-adjusted return, time-weighting

While I doubt that they were aware of it, when Franco and Leah Modigliani developed their risk-adjusted return measure, M-squared, they were extending an idea first promulgated by Peter Dietz in his 1966 thesis, from which we obtained the notion of time-weighting and...

by admin | Jul 17, 2009 | risk

Last night I had the privilege to participate in a panel discussion, organized by Rutgers University Professor Jim Bicksler, at the Dow Jones facility in Princeton, NJ, titled “Investment Principles Revisited.” You’re no doubt not surprised that the...

by admin | Jul 16, 2009 | GIPS, risk, Standard Deviation

Continuing our discussion on some of the key findings from the feedback to the proposed changes to GIPS(r) …Recall that the Executive Committee proposed a new recommendation, 0.B.2, that compliant firms provide their existing clients with a copy of their...

by admin | Jul 15, 2009 | risk, Sharpe ratio

In our newsletter I’ve commented on the perceived problem with negative Sharpe ratios: that the results appear to be counter intuitive. When excess returns are positive, if the portfolio did a better job of managing risk, it will show a higher Sharpe ratio;...