by admin | Jun 22, 2012 | alternative investments, GIPS, Global Investment Performance Standards, private equity, rates of return, real estate, risk

At this week’s European Performance Measurement Forum meeting, we touched on the subject of alternative investments. We hear this term bandied about quite a bit; so much so, that it often causes one to grimace when they hear it, because of the fear it can...

by TSG | May 15, 2012 | GIPS, Performance Perspectives Newsletter, risk

VOLUME 9 – ISSUE 8 May 2012 Download PDF...

by admin | Feb 24, 2012 | rates of return, Returns, risk

Yesterday, TSG held a luncheon in NYC, where Jed Schneider, CIPM, FRM reviewed some of the findings from our recent Performance Attribution survey. As with all of these research projects, some very interesting insights can be drawn. And since this...

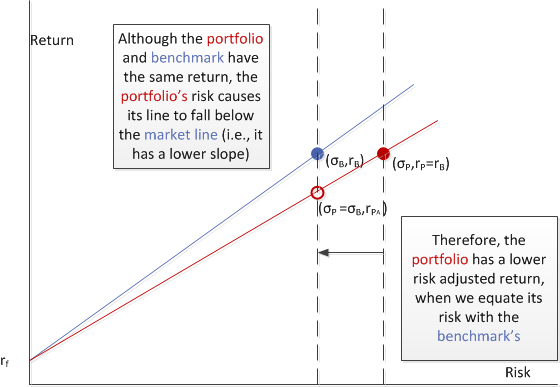

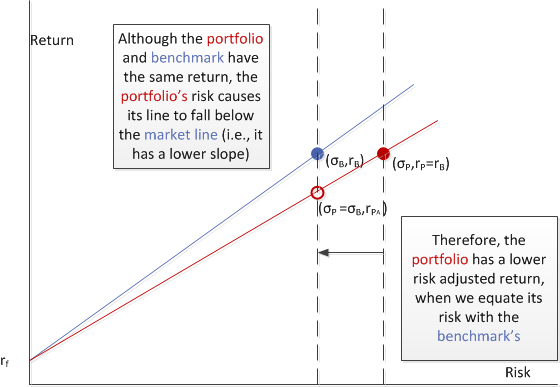

by admin | Feb 3, 2012 | M-squared, Modigliani, risk, risk-adjusted return, Sharpe ratio

In TSG’s January newsletter, I expanded upon a recent blog post where I introduced a couple graphics in an attempt to “make sense out of” negative Sharpe ratios. Two pillars of the investment performance community, Carl Bacon and Steve Campisi,...

by admin | Jan 25, 2012 | GIPS, Global Investment Performance Standards, risk, Sharpe ratio, Standard Deviation

The Global Investment Performance Standards (GIPS(R)) now require compliant firms to include the 3-year, annualized standard deviation for the composite and its benchmark. And while this was a somewhat controversial move, it’s here, so we live with it. But, why...

by admin | Jan 19, 2012 | GIPS, Global Investment Performance Standards, risk, Standard Deviation

Confusion abounds when it comes to standard deviation. Some of the issues include:Equal-weighted or asset-weighted?Divide by “n” or “n-1”?Is it a measure of variability, volatility, or dispersion?Is it a measure of risk?What’s the best...