Question #15 from the Expert Level Sample Exam is with respect to the data in the table shown above, and reads:

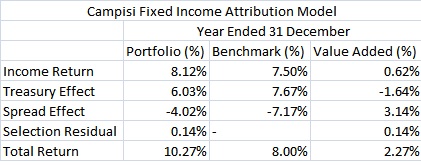

15. Tom Styles, the head of performance measurement at Signal Investment Management, uses a sector allocation/security selection attribution model for both equity and fixed-income portfolios. The bond portfolio managers ask Styles to make his department’s fixed-income attribution analysis more meaningful. Styles uses the Campisi methodology to analyze the performance of a portfolio that contains US Treasury notes and bonds, corporate bonds, and high yield bonds. He prepares Exhibit 1 for the fixed-income portfolio managers’ review.

Which statement is most accurate? Over the evaluation period, the yield curve:

A. fell, and the portfolio’s duration was longer than the benchmark’s duration.

B. fell, and the portfolio’s duration was shorter than the benchmark’s duration.

C. rose, and the portfolio’s duration was longer than the benchmark’s duration.

There are two things you need to determine here:

- Did interest rates rise or fall, which would cause a price change that was negative or positive, respectively?

- Did the portfolio have a better yield curve positioning than the benchmark, given the change in interest rates?

You can tell that interest rates fell because the Treasury return is positive (for both the portfolio and benchmark). The Treasury return is the portion of the price return that is due to changes in Treasury interest rates. The fact that this is a positive number means that Treasury interest rates declined during the period, making existing Treasuries look more attractive, resulting in their prices going up, and affecting a positive return. This concept is covered in the second reading in Study Session VI, which covers the Campisi attribution model.

The fact that the benchmark’s Treasury effect is higher than the portfolio’s Treasury effect means that the benchmark was better positioned (from a duration standpoint) to respond to the changes in Treasury interest rates over the period than the portfolio. From the first reading in Study Session VI, which covers the Fong-Pearson-Vasicek model, candidate should understand that holding long duration portfolios during periods of decreasing interest rates will add value, as will holding short duration portfolios during periods of increasing interest rates. Thus, the benchmark’s higher Treasury effect while interest rates decreased is a sign that the portfolio’s duration was less than (shorter than) the benchmark’s.

Thus, the correct answer is B.