“Those who dance are considered insane by those who cannot hear the music.”

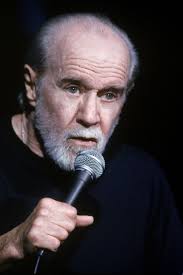

Having never been a George Carlin fan, I must confess that I’m a bit surprised to be quoting him, but this line recently appeared on Facebook, and it immediately resonated with me, relative to money-weighting. We can alter the words just a bit:

“Those who value money-weighting are considered insane by those who simply don’t get it,”

and it fits quite well with what’s been going on in our industry.

A few of us (most notably, Steve Campisi, CFA and Stefan Illmer, PhD) have been championing the cause of money-weighting for more than ten years, with little to show for our efforts…

Until now! money-weighted rates of return

In just the past couple years we’ve seen three monumental regulatory or close-to-regulatory steps to enhance the importance of money-weighting:

- GASB (the U.S. Government Accounting Standards Board) now requires public pension funds to report their rates of return using money-weighting (specifically, the internal rate of return) on an annual basis.

- CRM2 is a Canadian government requirement mandating the reporting of returns to clients of asset owners and custodians beginning in 2016.

- GIPS(R) recommends the use of money-weighted returns by asset owners who choose to comply with GIPS.

A Forum topic money-weighted rates of return

We took this topic up at the recent meetings of the Performance Measurement Forum and the Asset Owners’ Performance Measurement Roundtable in San Diego. Our goal has been to educate performance measurement professionals about the differences in these methods, and the unique role each plays. It’s my view that we have it backwards: today, time-weighting dominates, but in reality, money-weighting should.

These recent regulatory initiatives demonstrate that our message is being heard. We are excited by this, and expect more to follow.

I’ll have more to say on this topic in next month’s newsletter. To subscribe (it’s free!), simply go here!