Getting quoted

I spent about eight years in politics, from 1996 to 2004. In 1996 I ran for my township’s council, and lost. I was encouraged to run again, and the next year was elected by a “landslide.” Two years later, I ran for mayor, and again prevailed by a significant margin. During that time I was frequently interviewed. I’d occasionally be disappointed that after spending 30 minutes or more discussing a topic with a reporter, only one sentence would be attributed to me in the resulting piece.

Commenting on the SEC’s case against Navellier

Earlier this month I was interviewed about the SEC’s case against Navellier & Associates (go here for details). It appears that Navellier, like several other investment advisors, in a sense were victims [a term I used guardedly] of F-Squared’s false claims. I was on the phone with the reporter for, I’d guess, about 30 minutes. But, as is often the case, only a small portion of my comments made it to print: I have no objection to this, however I’m less than thrilled with the way the message came across. Go here for the article.

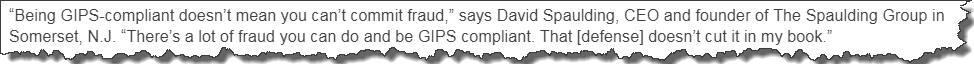

The segment I’m troubled by is this:

My statement essentially says that firms that are compliant can, at the same time commit fraud. But was that the message I wanted to convey? Not really.

Occasionally a reporter will send me the text they plan to run, in order to ensure it’s worded properly; in other cases, I may be called and read the text, to allow me to make adjustments, if necessary. Neither occurred in this case. And so, I want to provide a bit of clarity on this subject.

The GIPS Standards and Fraud: what is actually written?

This clearly raises a question about the Global Investment Performance Standards (GIPS(R)) and fraud.

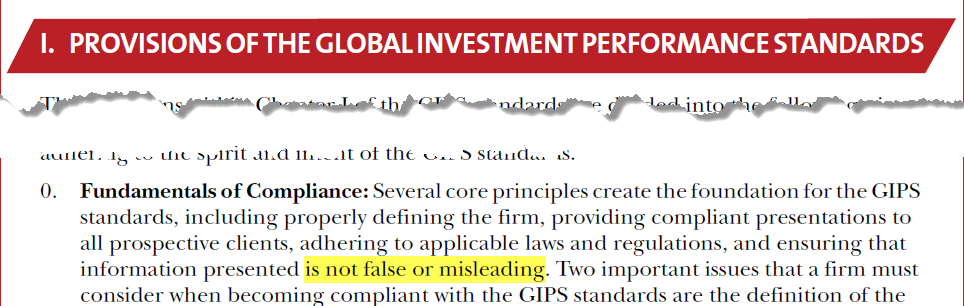

Let’s begin with the Standards themselves: what does it say about fraud?

Nothing. Absolutely, nothing. At least not by name. However, it hints at it; e.g.,

This statement appears again in provision 0.A.3:

To provide false information is equivalent to fraud, is it not?

The GIPS Standards and Fraud: what the Handbook has to say

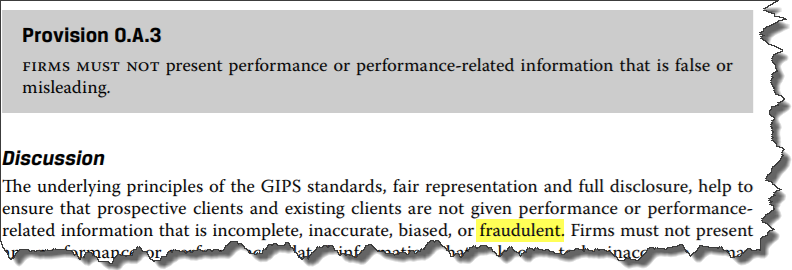

If we turn to the GIPS Handbook we discover that “fraud” or “fraudulent” appears five times.

The first instance (“fraudulent”) provides a bit of clarity around provision 0.A.3 which we just saw:

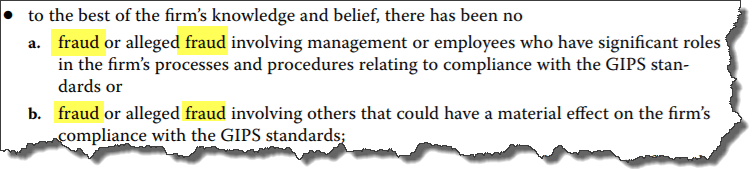

The last four occurrences, all with the word “fraud,” appear within the section that discusses the required “rep” (representation) letter a firm must provide its verifier:

Being compliant and claiming to be compliant: not always the same thing

I explained to the reporter that there’s a difference between a claim of compliance and actually being compliant. I have encountered many cases where firms that claimed compliance were, in fact, not. Often my findings go many pages.

Furthermore, just because a manager or asset owner has been verified does not mean that they are, in fact, compliant. I have encountered several cases where managers who had previously been verified by another firm were not actually compliant.

In Navellier’s case, they are apparently using both their claim of compliance and the fact that they’ve been verified for several years as a major part of their case; it sounds like “how can we have committed fraud if we were compliant with GIPS?”

Several years ago we became aware of a couple firms who had been caught committing fraud, and both had claimed compliance and been verified. I recall that someone from the CFA Institute stated that “verification isn’t designed to detect fraud.” Just because the verifier didn’t discover it, and just because the firm signed a rep letter stating that they didn’t commit it, they still might commit fraud (and add to that their false claims within their signed rep letter).

Can a firm be compliant and commit fraud?

I think this is an interesting question. While I obviously stated that it can, my intent was more to the claim than the actual state of being compliant. But the question can still be considered.

We could argue, perhaps, that if the fraud was done somewhere exogenous to the GIPS composites and materials involved with the firm’s compliance, that they could, in fact, both commit fraud and comply.

Note that the wording in the rep letter speaks of fraud in relationship to “compliance with the GIPS standards.”

In Navellier case, I understand that they provided information from F-Squared, which was later determined to have been fraudulent. I believe these materials were separate and apart from GIPS materials.

Why bring GIPS up?

What struck me as odd is that Navellier brought up GIPS, since the SEC didn’t; in fact, it doesn’t appear that the SEC is even dealing with GIPS, except where it applies to F-Squared’s claims, which has since been settled.

Perhaps compliance is seen as a sort of “safe haven.”

Clarifying the relationship between the GIPS standards and fraud

Perhaps more needs to be stated regarding the relationship between the GIPS standards and fraud. Can a firm commit fraud somewhere within the bowels of the firm and still be compliant? In principle, I’d like to say “no.” But in reality?

What say you?