Guidance Statement for OCIO Portfolios – TSG’s Key Takeaways and Summary

Author: Jennifer Barnette, CIPM

The CFA Institute has introduced a new Guidance Statement specifically for Outsourced Chief Investment Officer (OCIO) firms, providing a tailored framework designed specifically for OCIOs under the broader Global Investment Performance Standards (GIPS®). The customized nature of the framework is intended to address the unique challenges and responsibilities faced by certain OCIO firms in implementing the GIPS standards. The guidance should help OCIO firms understand how to structure composites, report performance in a GIPS report, and classify assets or asset types. All of which results in a seemingly significant step in comparability across OCIO firms.

This guidance becomes effective on December 31, 2025, and will be mandatory for firms providing OCIO services and claiming compliance with the GIPS standards. Firms claiming compliance with the GIPS standards must adhere to all relevant requirements of the GIPS Standards for Firms, as well as the applicable provisions in the Guidance Statement for OCIO Portfolios, when presenting a GIPS Report to a prospective OCIO Portfolio client. In our public comment in response to the exposure draft, we recommended the CFA Institute provide more time for implementing the guidance, but believed an effective date 12 months after the issue date would be the minimum that firms already claiming compliance with the GIPS standards would need to implement any necessary changes.

One of the key changes from the exposure draft to the final guidance is the clarification of who the guidance applies to, which was an area we thought needed clarity. The final version addresses industry feedback by clarifying the scope and specifying who is covered by the guidance, replacing “institutional investor” in the exposure draft with “asset owner” in the final guidance. Asset owner is a clearly defined term in the GIPS standards.1 The document goes a step further by explicitly stating the guidance does not apply to portfolios managed for retail clients. Overall, our concern regarding the uncertainty around the definition of the prospective client in the Exposure Draft has been adequately addressed. An OCIO Portfolio can be held by only asset owners.

An OCIO Portfolio is defined as a pool of assets of an asset owner for which a firm provides both strategic investment advice (e.g., “crafting or refining the portfolio’s long-term asset allocation strategy to align with the client’s objectives and risk tolerance or advising on the development of the Investment Policy Statement”) and investment management services. Essentially, strategic investment advice is about high-level guidance without direct management of assets. Whereas, with investment management service the emphasis is on execution and oversight of the client’s assets in line with the agreed-upon objectives. The guidance statement specifically calls out certain back-office tasks like “raising cash” and/or rebalancing as not falling under investment management services. But it does make room for a firm to classify assets as discretionary even if the firm isn’t allowed to make decisions without prior client approval for each action.

An OCIO Portfolio is not an OCIO Portfolio if the firm does not manage all asset classes representing an asset owner’s investment mandate.

When presenting to UK Pension plans, the Guidance Statement for OCIO Portfolios does not apply as those providers are following the GIPS Standards for FMP.

Composite Structure — Strategic Asset Allocation Focused on Either Liability Obligations or Capital Growth

All discretionary, fee-paying OCIO Portfolios must be included in a “Required OCIO Composite.”

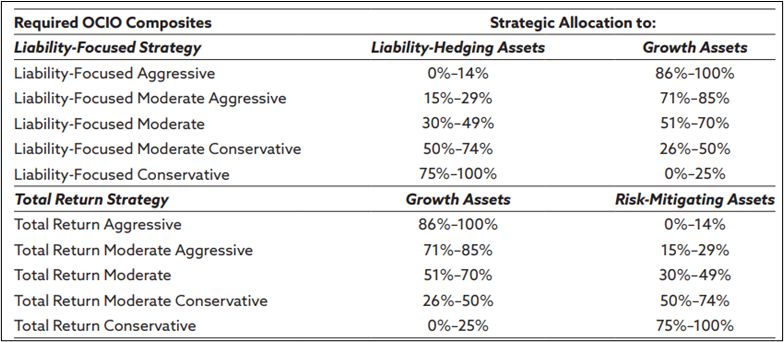

Firms must construct composites that align with the following framework, assigning OCIO Portfolios to composites based on strategic asset allocation:

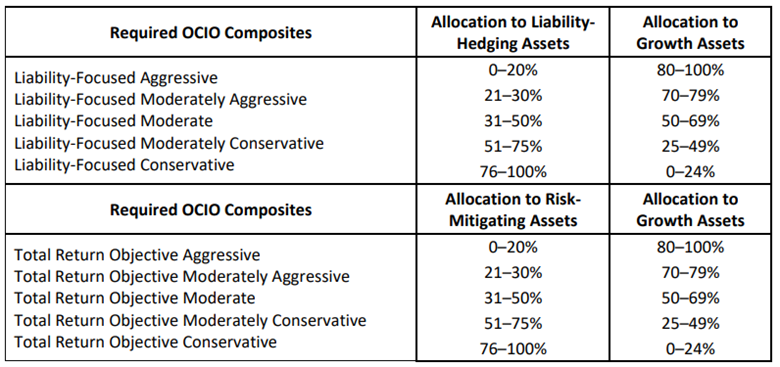

A comparison of the final strategic allocations in the table above to the ones in the Exposure Draft show meaningful changes to the ranges for Aggressive and Moderately Aggressive:

Source: CFA Institute’s EXPOSURE DRAFT GUIDANCE STATEMENT FOR OCIO STRATEGIES

In our response to the Exposure Draft, we voiced concern that firms may find this structure too prescriptive and not reflective of their actual strategies. This could lead to a scenario where firms create and maintain two sets of composites, one that the firm is required to create to be compliant, and one that reflects the firm’s actual strategies and marketing efforts.

Asset Classification – Growth, Liability-Hedging, or Risk-Mitigating

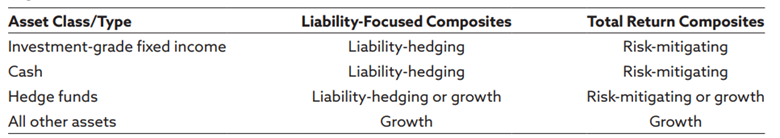

Assets are categorized as growth, liability hedging, or risk mitigating, which is intended to help clarify the portfolio’s purpose or risk profile. For liability-focused composites, assets must be classified as either liability-hedging or growth. For total return composites, they must be classified as either growth or risk-mitigating. While guidance is provided for classifying assets as growth, liability hedging, or risk mitigating, how assets are classified is determined by the firm.

Following is the recommended asset classification scheme:

Source: CFA Institute’s Guidance Statement for OCIO Portfolios

Per the Guidance Statement for OCIO Portfolios Adopting Release, for asset classification, CFA Institute applied a similar methodology to the one used in the GIPS standards for fair value by incorporating a suggested asset classification system. If a firm uses an alternative classification approach, it is required to explain how its classifications differ from the recommended scheme. Hedge funds are the exception to this rule and firms must disclose how they’ve classified them.

Legacy Assets

Options are outlined for the treatment of legacy assets within portfolios – i.e., include or exclude, and how.

Firms must “disclose information about” the legacy assets excluded from composites, but it doesn’t go as far as to say what those details need to be although a sample disclosure provided lets the reader know legacy assets exceeding 5% of a portfolio’s total asset value is excluded.

Reporting – Additional Noteworthy Items

- In their GIPS Reports for Required OCIO Composites, firms are required to present both gross-of-fees and net-of-fees time-weighted returns. Both gross and net returns must reflect the deduction of transaction costs, fees for underlying funds, and externally managed accounts. Net returns must reflect the deduction of the firm’s investment management fees. There is an exception when the firm controls the investment management fees of the underlying pooled funds when it comes to calculating gross returns

- Firms must disclose each composite’s asset class allocation as of year-end for periods ending on or December 31, 2025. For example, for liability-focused composites, firms must present the percentage of composite assets represented by liability-hedging assets and growth assets as of each annual period end.

- Firms must also present the percentage of composite assets represented by private market investments and hedge funds as of each annual period end for periods ending on or after December 31, 2025.

- In the final guidance, the treatment of the fee schedule was clarified to ensure greater transparency. Firms are required to disclose enough so that the prospective client will understand all fees the firm will earn from the client’s portfolio including the type(s) of fees earned. This allows for more consistent understanding of the costs associated with the firm’s management of OCIO portfolios, addressing concerns raised in the exposure draft about fee clarity and comparability.

- Adjustments were also made to ensure that benchmark selection reflects the unique strategies and goals of OCIO composites, emphasizing relevance, transparency, and proper disclosure.

———————————————————-

1 Per the GIPS Standards for Asset Owners, an asset owner is defined as “an entity that manages investments, directly and/or through the use of external managers, on behalf of participants, beneficiaries, or the organization itself. These entities include, but are not limited to, public and private pension funds, endowments, foundations, family offices, provident funds, insurers and reinsurers, sovereign wealth funds, and fiduciaries.”

Source: CFA Institute’s Guidance Statement for OCIO Portfolios

If you need help with GIPS or anything related to performance measurement services, contact us today.

0 Comments