This is the time of year when many pension funds report their returns for the prior fiscal year. And often, the reported returns were calculated using a time-weighted method. But, is this appropriate? Or, perhaps, is more needed? In my way of thinking, pension funds, as well as other asset owners, should have two targets, not one.

This is a post I’ve been wanting to write for some time. I’ve engaged in discussions on this subject with asset owners in our Asset Owner Round Table, as well as in other settings. I’m taking some risks here, as I believe typical approaches are well established, and suggesting that something else is needed might raise the ire of some: hopefully not.

What’s the process?

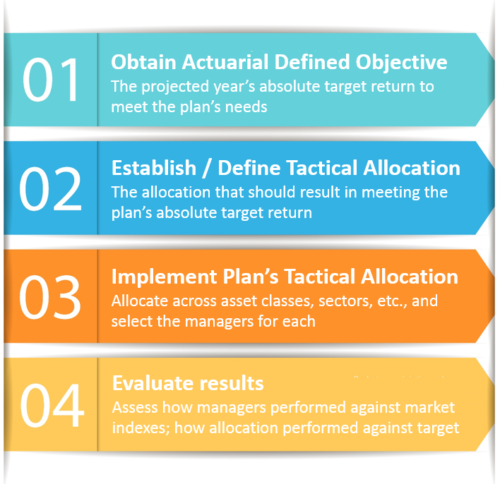

The following schematic captures and summarizes what I believe is, at least to some extent, a common approach used by pension funds, to make investment decisions:

Pension funds have projected in- and outflows. The outflows include anticipated payments to pensioners. They often employ actuaries who take this information and project a required return. This is, in my view, the plan’s target objective. Let’s say for our example that it’s only 1 percent.

The CIO (Chief Investment Officer), along with other members of his/her team, take this objective and makes allocation decisions that are projected to meet it. By assessing the various markets, the economy, and other information, they seek to come up with the appropriate allocation.

They next implement this allocation, by adjusting how much is being invested across the various asset classes, sectors, sub-sectors, etc. They also decide what managers to use.

After the year closes, it’s time to assess how well everything worked. That’s really the point of this post.

Note: I realize that this is an oversimplification of the process. But hopefully, it’s not too far off and captures the necessary points to make my case, that is outlined below.

Two+ targets for the pension fund to evaluate

What is frequently done is to report the overall plan’s time-weighted rate of return. Does this have value? Well, yes, it does. If we compare it against the appropriate market index, which presumably is a blending of the underlying indexes that align with the various sectors, sub-sectors of the allocation, it will tell us how well the managers performed, overall. This can be extended further, by looking at each manager and they’re benchmark, to see how they performed individually.

But how did the plan do in meeting the actuarial objective?

I believe an equally important, if not more than equally important, evaluation is needed relative to the objective: did the allocation that was done meet the objective, the target return, as established by the actuaries?

Recall that this was our starting point; and so, does it not make sense to “circle back” and see if that objective was met?

And how best to do that? With a money-weighted return, of course!

Comparing the pension fund’s time- and money-weighted rates of return

And so, in our example, the overall target was established as 1 percent. How did we do?

In the portfolio I constructed (which will be revealed in the July newsletter), we beat the target! Our overall time-weighted return was 1.02 percent.

But wait a minute! That’s the time-weighted return. We should be using that to compare against the overall blended benchmark. For our purposes, we’ll make something up: let’s say it was 0.98 percent, meaning that we did beat it. And so, we can pat ourselves on the back, because we did, in fact, beat the market index.

Recall that we also want to know how we did against the target (1%).

Drum roll please …

Our internal rate of return for the year was -0.04 percent.

When we look at our gain/loss for the year, we see that we lost $21,000. You might remember that there are times when we can have a positive return and a yet lose money; on rarer occasions, we can have a negative return and make money. Despite our +1.02 TWRR, we actually lost money. Our IRR does a better job reflecting this, does it not?

This was, of course, an extreme example. More often than not, the TWRR won’t be positive and the plan lose money. But I chose this as a way to add some drama. Hopefully, it didn’t diminish the point that the IRR has a role to play in the evaluation.

What does this mean?

We might interpret this scenario as a case where the projected allocation and/or selection of managers was not adequate to meet the objective. At least we should have some discussion about it, right?

The Global Investment Performance Standards (GIPS®) recommends that asset owners report the internal rate of return, despite the fact that they may not control all of the flows. And, there’s very good reason for this: this is a way to assess how the plan actually did, relative to its target return.

A time-weighted return is not usually the right return to compare with the absolute return, as it eliminates the effect of cash flows. And while this is clearly appropriate when evaluating managers, it isn’t when assessing how a plan performed.

Does this make sense?

Please: chime in! Let me know what you think. Thanks!!!