A client sent us a question that I am a bit surprised hasn't been asked before: which country's risk-free rate should be used when investing across countries? For example, if a US domiciled investor has a Japan-based asset, when we calculate the Sharpe ratio, should...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Which risk-free rate to use when investing in other countries?

It’s time for a Guidance Statement on Sunset Provisions

Recall that the GIPS(R) (Global Investment Performance Standards) Executive Committee (EC) issued a "Q&A" that introduces a change to the Standards, allowing firms to remove disclosures of composite name changes after five years. During the recent EC open meeting...

When defining the word “benchmark,” don’t forget to include “confusing”

Of late, my colleagues and I have been involved in numerous conversations on the subject of benchmarks; in fact, I'm about to conduct a focused study for a client on their benchmark construction policies and procedures. I conducted a GIPS(R) (Global Investment...

What triggers a benchmark rebalance?

We received an inquiry recently regarding the appropriateness to rebalance a benchmark when the portfolio has a 10% flow. I discussed this with my colleagues, and we were all a bit surprised by the question. Now, perhaps there are loads of firms that do this, and...

The meaningfulness of statistical measures

When we conduct GIPS(R) verifications, it is not uncommon to see a footnote appear on a presentation where the number of accounts in the composite are five or fewer. The Global Investment Performance Standards do not require firms to disclose the number of accounts or...

A HUGE reason why performance attribution is critically important

I delivered a talk earlier this week for the CFA Society of St. Louis on performance attribution. One of the attendees asked "what's the point?" I.e., why should an asset manager be doing performance attribution? My initial response was "every party has a pooper,...

Contrasting “for” and “during” in your performance reporting

Although not common, I still occasionally run into situations like the following: a period is selected to report performance that extends beyond (at the start, end, or both) the actual period a portfolio or asset was being managed or held, and yet a return is...

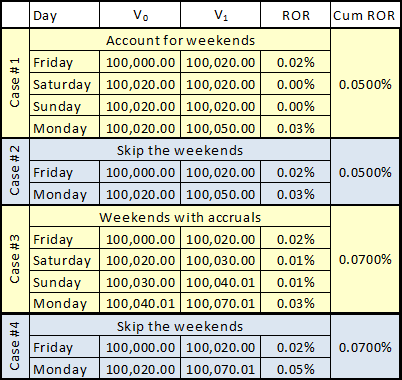

Returns across weekends

A Linkedin colleague sent me a note about the idea of calculating returns across weekends. There really is no need to do this, except when the month-end date occurs on the weekend and you're accruing for income. The following paints four cases: In Case #1, we...

What does flying have to do with investment risk?

Chuck Yeagar is perhaps best known as the first pilot to officially go beyond the speed of sound. You may recall that he was portrayed by Sam Shepard in the movie, The Right Stuff. In his autobiography he wrote "all pilots take chances from time to time, but knowing...

Announcing the first ever, “black tie optional” performance measurement conference

This year's Performance Measurement, Attribution & Risk (PMAR) conferences will be "black tie optional." A bit unusual, right? And so, why would we do this? Well, the theme of the events is "the secret agents of performance measurement," and when we think "secret...