It recently occurred to me how these two words, insights and perspectives, play a non insignificant (i.e., significant) role in performance measurement. I often reference both when I teach, but thought it appropriate to share some views here with you.InsightsMy...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Insights & Perspectives

What about us?

Earlier this year, the Global Investment Performance Standards (GIPS(R)) Executive Committee published a draft guidance statement which expands the reach of GIPS into the asset owner world. I have commented briefly on it here before, and wrote an article for Pensions...

Should retail accounts be shown a benchmark?

Last week, during a talk I was giving to a group of operations folks, someone asked my thoughts on showing benchmarks to retail investors; specifically, those that are non-discretionary.It's important to realize that benchmarks serve two purposes: first, as a way to...

Overselling time-weighting

For some time it's been my view that time-weighting was oversold.That is, when nearly 50 years ago (1966, to be exact) Peter Dietz published his dissertation, promoting a return method to eliminate or reduce the impact of cash flows, his idea was so powerful and...

Combining time- and money-weighting

I am in Montana this week, conducting a session titled "Current Topics in Performance Measurement" for a conference of operations folks. One individual asked about combining time- and money-weighting into a single number. I think the idea lacks merit, as it takes away...

Revaluation vs. Repricing … there IS a difference

It is quite common today to find firms revalue their portfolios for large cash flows. But what do we mean by "revalue"? Is "repricing" enough?Think about this scenario: On January 31 the portfolio holds 20 different stocks, along with some cash.On February 15, a...

Tech Survey to be Expanded

TSG has been surveying the industry for 20 years on a variety of topics. This year we focus once again on performance and risk measurement technology, with two surveys:One for the usersOne for the suppliers.Until now the suppliers' survey has been sent only to...

Cash can be your friend or enemy

I was interviewed by Julie Steinberg of the WSJ for an article that appeared this week ("These Two Funds Picked a Really Bad Day to Debut," August 5, page R1) regarding the impact contributions can have on a mutual fund's performance. While time-weighted returns...

The tentacular reach of the GIPS standards

I was recently interviewed by Pensions & Investments ("Fiduciary delegation," July 22, 2013) regarding the appropriateness of expanding the Global Investment Performance Standards (GIPS(R)) to outsourcing firms: firms that provide investment services to...

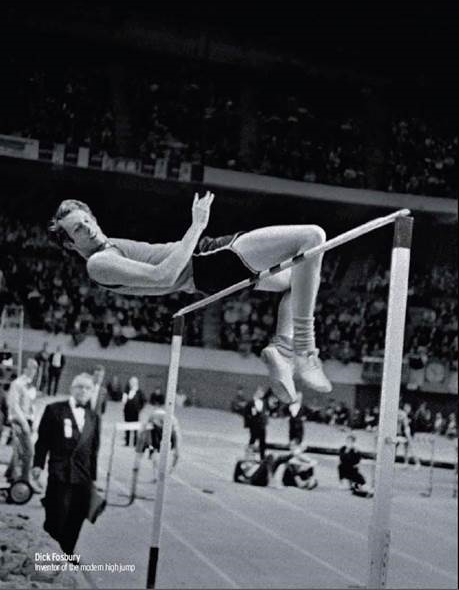

Being willing to be different and the need to challenge / confirm conventional wisdom

In this month's TSG newsletter, I wrote a bit about the high jumper Dick Fosbury, who introduced an entirely different way to scale the bar. I vividly recall watching the meet on television in which this was first publicized. Many laughed (including the announcers) at...