One of our GIPS(R) verification clients asked me recently about attribution and mutual funds/ETFs; whether there were special requirements for them. Some thoughts:Remember that with attribution, we align "sets" of securities in the portfolio with their...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Mutual funds, ETFs, and Attribution

Can (and why would) plan sponsors comply with GIPS?

Performance presentation standards have existed for more than 20 years now. First introduced by the Financial Analysts Federation in the mid 1980s, later taken up by the Association for Investment Management & Research, and now championed by the CFA Institute, the...

A performance conference brochure like none other (for a performance conference that is also like none other!)

This May TSG will hold its 11th annual Performance Measurement, Attribution & Risk Conference. And, for the first time it has a theme: The Superheroes of Performance MeasurementTo make the event extra special, we're doing some rather unique things, one being...

An “AdToon” about GIPS!

We, at TSG, are very excited about our first "AdToon." Chris Spaulding, our Executive Vice President of Strategy and Business Development, was responsible for this design project. It provides some great background information about GIPS(R) (Global Investment...

GIPS for the money owners

The subject of the appropriateness or ability of plan sponsors to comply with GIPS(R) (Global Investment Performance Standards) has been around since the Standards' inception; actually earlier, if we include the AIMR-PPS(R). I recall an article in Pensions &...

Where’s the puzzle?

This is not intended as an excuse, BUT, this is a very busy time of the year for us, as this is when we do most of our verifications. And so, our February newsletter got delayed. And then, it became a bit of a "rush," and I failed to remember to provide a new puzzle...

Is a golf cart an automobile?

I was chatting with one of our software certification clients recently, and we got to discussing what qualifies a system as being a "GIPS(R) (Global Investment Performance System)" system?As I often do, I searched for a metaphor (some would say, analogy), and fell...

Account minimums: when to remove accounts, when to add them, to GIPS composites?

GIPS(R) (Global Investment Performance Standards) compliant firms routinely establish minimums for accounts to be included in composites. The minimum is the threshold, below which, the account is not representative of the strategy. But when should an account that...

Nested Attribution

Reminder: there is still time to sign up for this month's TSG webinar, which is on "nested attribution" (aka, balanced attribution).Tricia Nelson, CIPM and I will discuss common challenges, and a method that works!Please contact Chris Spaulding or Steve Sobhi to...

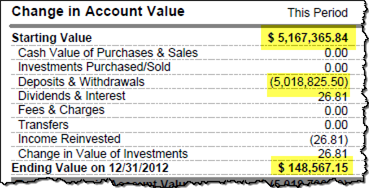

Spreadsheets as systems … not always such a good idea

I came across a recent Forbes blog post about the shortcomings of spreadsheets. This is something we've addressed here, as well, and seeing it inspired me to once again add some comments.This post mentions the apparent use of spreadsheets to calculate Value at...