By now, you've probably heard about the group of Harvard University students who were caught cheating on a take-home exam. When you learn the details, I think you have to wonder about the supposed higher intelligence of Harvard students, but that's a different...

Performance Perspectives Blog

Thoughts on performance measurement from David Spaulding and other members of our team.

Harvard students caught cheating

“Be careful out there …”

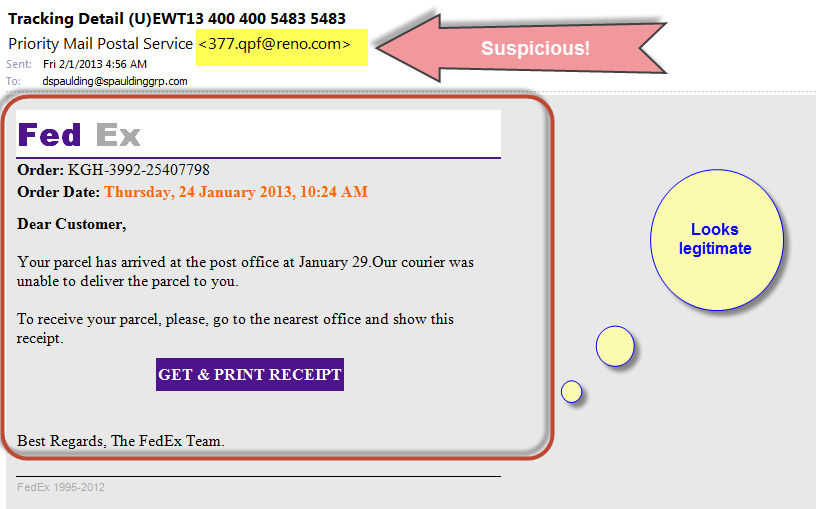

You may be old enough to recall the TV show, Hill Street Blues, where the sergeant would, at the start of each shift, tell the police officers to "be careful out there." Well, we need it said to us, too!I got an email this week with the following:I've annotated...

Spinning with GIPS, and performance in general

The concept of "spinning" is often associated with politics and the news: that is, how one spins a story, so as to alter its appearance or focus. Spinning thus is often seen in a negative light, as it may appear to be a trick to present something differently to better...

A “work around” for portability

I had a discussion this week with a firm that is thinking of bringing someone on. That person meets two of the three criteria for GIPS(R) (Global Investment Performance Standards) portability:Substantially all the decision makers are coming alongWill...

Dealing with the underfunding of pension funds

I recently interviewed Phil Page of Cardano for The Journal of Performance Measurement(r), regarding the all-too-common situation that many (most?) pension funds, both private and public, are facing: underfunding. Phil identified three possible solutions:1) increase...

Investment success: skill vs.luck

I recently finished Michael J. Mauboussin's newest book, The Success Factor: Untangling Skill and Luck in Business, Sports, and Investing, and strongly recommend it. He raises a great deal of interesting points, and I hope to interview him for The Journal of...

Belief in small numbers

Nobel prize winner Daniel Kahneman, and his long-time colleague, Amos Tversky (who would have been awarded the Nobel Prize, too, but sadly was deceased at the time the prize was awarded), wrote an article for the Psychological Bulletin in 1971 titled "Belief in...

Outcome oriented / client centered investing

The concept of orienting your investing so that it's geared to the client's requirements is getting more attention of late. P&I had an article on this subject in their November 12, 2012 issue, and Steve Campisi, CFA has addressed this at several...

Valuing a portfolio through a transition

We received an interesting question from a client, which seem appropriate to discuss here:We have an issue where we are going back and forth with our custodian regarding the proper treatment for a transition:Manager B is scheduled to receive assets from Manager A at...

Changes… the 2013 CIPM Principles Curriculum

By now you have heard that the CIPM Program curriculum has been changed - signficantly! So much so that the folks at CFA Institute have taken to calling it "The New CIPM Program!"You may be asking yourself, what *are* the new changes? I will try to give a...