Our colleague and friend, Marshall Smith, CIPM of First Rate, recently posted the question that appears above, “Isn’t Performance Measurement Just Math?,” on LinkedIn. This, in turn takes you to their blog, where Marshall addresses this topic.

I offered a brief response on LinkedIn (“Yes, but it has to be the right math”), and expound upon it here.

Performance Measurement is about the right math

I’ve noticed that many folks who work in performance measurement have math backgrounds, which probably isn’t surprising. My colleague, John Simpson, CIPM, for example, earned his bachelor’s degree in applied math from UCLA. My undergrad degree is in pure math (from Temple University), my MS is in systems management (operations research) from USC, my MBA is in Finance (University of Baltimore), and my doctorate is in finance/international economics (Pace University), all math-based subjects. This is probably why I enjoy our field so much: it gets me to tinker around with math a bit: granted, not particularly high levels of math, but math, nonetheless.

But again, it’s very important that we get the math right!

Over the years I’ve encountered numerous cases where the math just isn’t right; e.g.,

- improper weighting of cash flows,

- nonsensical handling of equity dividends,

- annulization using trade, not calendar, days,

- formulas that are simply bizarre.

When I designed my first performance system in the mid 1980s, there wasn’t much available on what formulas to use. In fact, my first formula seemed logical but upon further reflection turned out to be invalid. Fortunately, someone passed me something that Peter Dietz had written, and this formed the basis of our system. Today, there is no excuse for not doing the math right, since there are countless books available (e.g., mine, Carl Bacon’s, Bruce Feibel’s,…).

What we discover when we do a software review

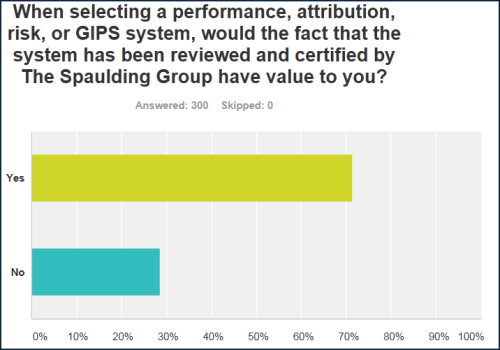

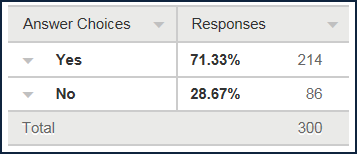

We recently conducted a survey asking if having software certified by TSG would have value. We were quite pleased that 300 individuals participated, and over 71% said that it would:

This, to us, clearly demonstrates the value that consumers place on having such an investment on their part being certified.

For some time now TSG has been offering a “software certification” service. And to date, we’ve conducted reviews for about 10 firms covering roughly 20 different systems. We developed criteria for the following functional areas:

- rates of return

- GIPS Basic

- GIPS Real Estate

- GIPS Private Equity

- equity attribution

- fixed income attribution

- ex post risk.

In addition, if the client has a system that doesn’t necessarily fit into one of these categories, we can probably review that, too (so far we’ve done this for two firms).

During these reviews we frequently find issues with calculations. For example:

- a vendor that services the asset owner space, but fails to provide the internal rate of return

- a firm that doesn’t always use the real start and end dates, but instead move the dates up; this results in incorrect returns.

- a system that doesn’t acknowledge the existence of “gaps” within the reporting period

- a system that doesn’t revalue for large cash flows.

Because performance measurement is “just math” is probably why I’m still at it; ensuring that it’s the right math is an ongoing effort on our part.

Want to learn more about software certification? Please contact Christopher Spaulding (CSpaulding@tsgperformance.com; 732-873-5700).