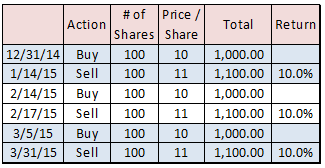

I’ve opined on the subject of linking across gaps in the past. Recently, I’ve had discussions with a client who wants to be able to link the returns of securities, which were held at various times during a period. I think this is okay, as it would show the client how they did overall in holding the security. Consider the following:

We’ve held a security for three different periods during the first quarter of 2015. Many investors would like to see these “linked,” so that they can understand how they did, overall, with their investments in this security, even though they were broken up.

Linking across gaps: geometric or arithmetic?

In the past I’ve spoken of linking in the context of crossing gaps as we do whenever we link returns: that is, geometric linking. However, I’m beginning to think that this would be incorrect in these cases. Why? Well, consider the reason we geometrically link in the first place: to compound the returns. This is because the return in period two benefits from the increase that occurred in period one, and the return in period three benefits from the returns in periods one and two; and so, we build upon them. But in the above case, the holdings are terminated and then reestablished: there is no benefit in latter periods to the prior period(s). Therefore, I’m thinking that arithmetic linking would be more appropriate.

Arithmetically linking these three subperiod returns is quite simple: add them; the result is 30.00 percent. If we geometrically link them we get 33.10 percent. But we know this is wrong by simply looking at our gains: we earned $100 three times during the quarter on investments of $1,000 each time. And so, if we add the three gains together, we get $300; and dividing this by $1,000 gives us 30.00 percent.

Linking across gaps… making sense of it

The idea of “crossing gaps” is controversial: not everyone agrees with it. But many would like to see it available and reported on. Consequently, I favor making it an option, but with the caveat that it be reported with disclosures to make it quite clear what the returns represent.

Take the above example. If one were to show the 30.00% for the security, it would be incorrect to represent it as a first quarter return, per se. We should see that it was the return for the security during the first quarter, but not for the first quarter; in addition, including language to indicate that the security was held during three separate periods would add even more clarity.

Could we compare this to the security’s performance itself during the first quarter? Probably. It’s clear from this example that the security rose and fell in value. To learn that the security itself had a return for the quarter of just 10% (which mathematically it did, given what’s shown above) and that the investor knew when to buy and knew when to sell is valuable information.

Linking across gaps: time- or money-weighting?

A bigger question, perhaps, is whether we should even be attempting to link time-weighted returns, but rather employing a money-weighted return that spans the gap(s). This, too, is a topic I’ve taken up in the past, but will save further comment on it for our newsletter.

More thought and discussion are needed on this topic

Showing such performance at the security level has less credibility, perhaps, than showing it at the asset class or sector level, but still can have value, I believe. I think this topic is worth further discussion and thought. “What say you?”