As I recently mentioned, occasionally I go exploring to look at other blogs. And I came across Steve Hsu’s blog. And although Steve is a physics professor at the University of Oregon, he feels comfortable to opine on the investment industry. (Recall that Jose Menchero, too, was a Physics professor and now develops risk models for BARRA). He offered his views on the future, in response to a question that was posed to him.

The question “do you think now would be a good time for someone to consider beginning a career as a quant?” engendered the following from Steve: “A sea change is coming: more regulation, higher risk aversion, more aversion to math.

“On CNBC you can already hear non-mathematical industry types trying to blame it all on models.

“Nevertheless the long term trend is still to greater securitization and more complex derivatives — i.e., more quants! But hopefully people will be much more skeptical of models and their assumptions. Personally I think it is the more mathematically sophisticated types (or, more specifically, perhaps those who come from physics and other mathematical but data driven subjects 😉 who are likely to be more skeptical about a particular model and how it can fail. People who don’t understand math have to take the whole thing as a black box and can’t look at individual moving parts.”

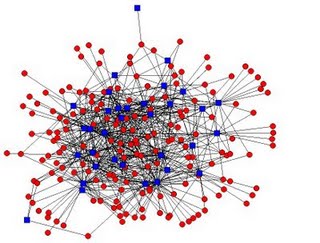

If you visit Steve’s blog you’ll see the graphic I’ve included (with his permission) above. He suggests that it resembles the rather complex network of CDS (Credit Default Swap) contracts. He uses this, and the relationships that existed, to describe the systematic risk which resulted.

He introduces a concept which I found quite interesting: “some entities are too connected to fail, as opposed to too BIG to fail. Systemic risk is all about complexity.”

I also have to say that I’m intrigued with his “aversion to math” statement. Finance and investing is all about math. But perhaps the complexity of some of the deals IS too extensive and perhaps needs to be toned back a bit. Will it, though? Only time will tell.