You no doubt have run into cases where returns don’t seem to make sense. Well, the same thing can occur with excess returns.

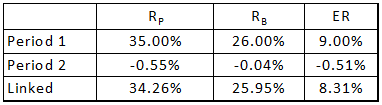

What’s wrong with this table; specifically, the excess return?

Last week I was contacted by one of our GIPS verification clients, regarding a return series that looked something like this:

Period 1 is essentially year-to-date, and period 2 was a day’s return. The table also shows the returns linked.

Can you guess what the concern was?

Well, until Period 2, the portfolio was showing an excess return of 9.00%. They then experienced a single day with a relative difference of negative 51 basis points. But when we link the returns, we see that the excess return isn’t off by 51 bps, but rather 69! Why would this have occurred?

The portfolio manager raised this issue with the individual responsible for performance. As you might imagine, he was quite perplexed. I can imagine the comments being something like: “If I was up by 900 bps through Thursday, and we tack on one more day where I was below the benchmark by 51 bps, how could my excess be showing a drop of 69 bps, not 51? Makes no sense!”

The simple answer is compounding. Notice that the portfolio’s return dropped by 74 basis points as a result of the 55 bp drop, not 55. If we were using arithmetic linking, then we’d simply subtract the 55 bps from the 35, and gotten 34.45% as the linked return; but we need to take into account compounding.

Excess returns do not compound; this is the reason why arithmetic attribution requires a “smoothing model” to link attribution effects across time.

This same issue arises with gross vs. net-of-fee returns: that is, if we deduct fees quarterly and link our monthly returns, our annual return differences will typically not equal the annual fee.

I’ll have more to say on this in our monthly newsletter. Feel free to chime in in the mean time!