Issue Contents:

Performance Attribution: A Look Back at a Timeless Article

Summary: Patrick W. Fowler

Original article by David Spaulding, DPS, CIPM

The 2009 article “Performance Attribution: An Introduction” by David Spaulding continues to provide a comprehensive overview of performance attribution, a key tool in investment performance measurement. The article helps performance and attribution professionals understand and communicate the effectiveness of their strategies.

Introduction to Performance Attribution

Performance attribution is an essential analytical tool for investment managers. Its purpose is to break down the sources of portfolio returns, allowing portfolio managers to determine what decisions contributed to outperformance or underperformance relative to a benchmark. This analysis becomes crucial in client communications and portfolio reviews, offering transparency on the outcomes of investment strategies.

Attribution itself isn’t a new concept; it is something professionals in many fields perform. For example, police officers and fire officials conduct causal investigations after accidents or fires, and sports teams review game strategies post-performance. Similarly, in the investment world, portfolio managers implement strategies and later assess their effectiveness, which is the core of attribution analysis.

Types of Attribution: Relative vs. Absolute

David distinguishes between relative attribution and absolute attribution, also referred to as “contribution.”

- Relative attribution involves reconciling to the excess return, defined as the portfolio’s return minus the benchmark return. This analysis seeks to understand the sources of relative outperformance or underperformance.

- Absolute attribution, on the other hand, focuses on the total return, examining what contributed to the overall performance of the portfolio, rather than its performance relative to a benchmark.

In practice, relative attribution is more commonly used by portfolio managers, especially when their performance is benchmarked against a market index. Absolute attribution may be more useful for highlighting specific investments or strategies that performed exceptionally well or poorly, without the comparative context of a benchmark.

Analyzing Portfolio Effects: Allocation and Selection Decisions

Investment strategies can typically be categorized as top-down or bottom-up approaches:

- Top-down managers begin by analyzing macroeconomic data and political events to predict how various sectors or industries might perform. They make allocation decisions based on their expectations of which sectors will outperform or underperform, by adjusting the portfolio’s sector weightings compared to the benchmark sector weightings accordingly.

- Bottom-up managers, in contrast, focus primarily on selection decisions of individual securities based on their fundamental qualities. Although these managers do not necessarily make explicit allocation decisions, differences in portfolio weightings relative to a benchmark can still impact returns. Therefore, even bottom-up managers should consider the effects of their allocation choices.

Performance attribution models help analyze two primary effects: allocation and selection. Allocation effects measure the impact of over- or under-weighting certain sectors relative to the benchmark. Selection effects assess the effectiveness of picking securities within those sectors.

Attribution Models: Brinson-Hood-Beebower (BHB) and Brinson-Fachler (BF)

Two of the most widely used models for equity attribution are the Brinson-Hood-Beebower (BHB) model and the Brinson-Fachler (BF) model. Both models offer frameworks for attributing excess returns to allocation and selection decisions, though they differ in key aspects.

- BHB Model: Developed in 1986, this model calculates attribution using three effects: allocation, selection, and interaction. The allocation effect is derived by multiplying the difference in portfolio and benchmark weights by the benchmark return for each sector. The selection effect, meanwhile, focuses on the portfolio manager’s skill in picking better-performing securities relative to the benchmark. The interaction effect accounts for situations where a manager’s allocation decision interacts with their selection decision.

- BF Model: The BF model, differs in how it calculates the allocation effect. The selection and interaction effects are identical in both models. Rather than using the sector’s benchmark return in the calculation, the BF model uses the sector’s benchmark return relative to the overall portfolio’s benchmark return. This approach may lead to significant differences in the allocation effect, especially when sectors perform poorly but still outperform the benchmark. The BF model rewards overweighting sectors that outperform the portfolio’s benchmark, regardless of whether their absolute return is positive or negative. The interaction effect accounts for situations where a manager’s allocation decision interacts with their selection decision.

Example Application of BHB and BF Models

Dave provides mathematical examples in the original paper demonstrating how these models operate. For instance, if a portfolio manager over-weights the technology sector and that sector outperforms, the BHB model would show a positive allocation effect. If the sector underperforms, the allocation effect would be negative.

The BF model, however, would consider the performance of the overall benchmark. If the technology sector performed poorly but still outperformed the overall benchmark, the BF model produces a positive allocation effect, rewarding the manager for their relative foresight. This divergence in results highlights the importance of understanding the model used, as different models can yield significantly different interpretations of the same investment strategy.

Challenges and Considerations

- Interaction Effect: One controversial aspect of attribution is the interaction effect, which results from the combination of allocation and selection decisions. Some argue interaction effect should be merged with selection or allocation, arguing that it complicates the analysis without adding meaningful insights. Others prefer it to be reported separately.

- Holdings-Based vs. Transaction-Based Attribution: Holdings-based models use the portfolio’s starting weights for the period, ignoring any transactions (such as buys, sells, or dividends) that occurred during the period. Transaction-based models account for these activities, providing more accurate and reconcilable results. Transaction-based attribution is preferred by most firms for its precision, especially in portfolios with high turnover.

Conclusion

The article emphasizes that performance attribution is not just a reporting tool but a critical part of the investment management process. It helps portfolio managers understand which decisions contributed to their performance and allows them to refine their strategies. Whether using the BHB or BF model or opting for holdings-based versus transaction-based attribution, it’s crucial to choose the model that best aligns with the investment philosophy and strategy of the portfolio manager. Additionally, maintaining clean data and ensuring reconciliation with official records are vital for producing accurate attribution results.

Performance attribution provides a powerful framework for ongoing portfolio analysis, enabling investment professionals to better understand and communicate the value of their decisions to clients and stakeholders.

Have an opinion? Please share it with Patrick Fowler.

GIPS is a registered trademark owned by CFA Institute.

Quote of the Month

“The first person to live to 150 is probably alive today.”

– Aubrey de Grey

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “Performance Analytics Technology” by Alex Shafran, CFA; Ian Thompson, Ph.D.; and Shankar Venkatraman, CFA, FRM, which was published in the Summer 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

The objective of this article is to explore the evolution of performance systems and how they can help performance professionals maximize their use of technology. By examining key aspects such as solution ownership, the scope of change, possible operating models, and necessary skills, the article aims to provide insights into how performance teams can utilize technology to address requirements such as compressed timelines, precision, transparency, and distribution of performance information to all stakeholders both within and outside their firm. The reader is encouraged to consider the questions posed throughout the article through the lens of their own experience with technology and to ask their own questions as they continue to advance in their performance career.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

Agendas Announced for Fall Meetings of

The Performance Measurement Forum

November 7-8, 2024 – Barcelona, Spain (In-person/Hybrid option)

November 21-22, 2024 – Charleston, SC (In-person/Hybrid option)

The Performance Measurement Forum has met 105 times over the past 25 years, and our next meetings are scheduled for November in Barcelona, Spain and Charleston, SC.

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

Contact Patrick Fowler if you would like information about how you can be part of this dynamic group.

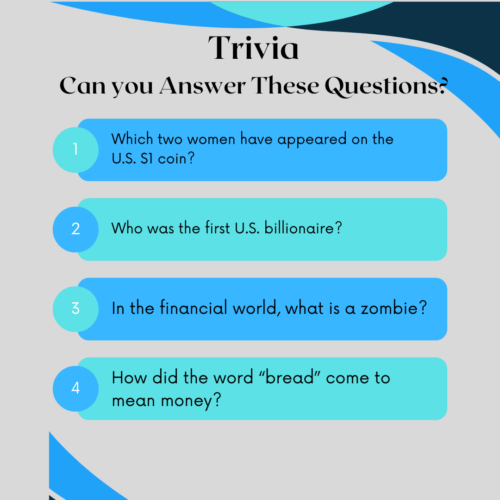

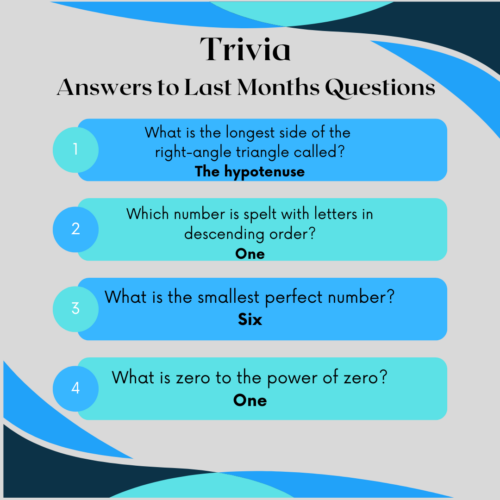

TRIVIA TIME

Here’s This Month’s Trivia Questions; Answers In The Next Issue!

Please submit your trivia solution or puzzle ideas to Patrick Fowler.

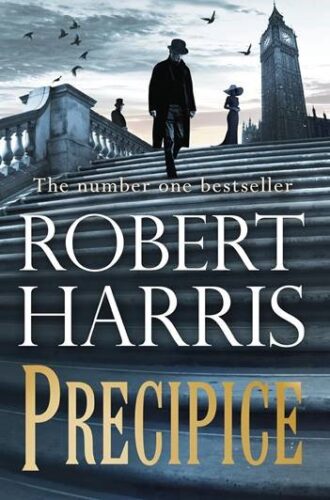

Book Review

Precipice, by Robert Harris

Review by David D. Spaulding, DPS, CIPM

I was recently in London for a TSG event. And, as I typically do, I made a pilgrimage to Jermyn Street, for a bit of shopping, and then to Hatchard’s on Piccadilly. I’ve been shopping at this book store for years, and enjoy seeing their latest collection, that typically includes signed copies. They’ve been around a long time: founded in 1797.

Robert Harris’s recent novel, Precipice, was given special attention, with a display in the window. And while waiting for the shop to open, I read enough about it to know it would appeal to my interests, and it did.

This historical novel is about an affair between Venetia Stanley and the U.K. Prime Minister H.H. Asquith. While I had heard of Asquith, I new nothing about him; and knew nothing about Venetia. Wikipedia’s page on her states that her “occupation” was “socialite”: never saw that before.

The book takes place just before and during World War I. It describes how Asquith freely shared highly confidential materials with Venetia, often giving her actual documents. It appears that Asquith was not a particularly good PM, besides his recklessness.

The book touches on many historical figures of the time, including Winston Churchill, who the author seems to not favor [or should I write, favour, as the book I purchased is the UK version, and it’s about British history]. Churchill was ousted as the First Lord of the Admiralty, and does seem to have not made very good decisions or recommendations at the time. Fortunately, his actions during the second World War were much better.

While the author takes some liberties with certain things [e.g., letters from Venetia to Asquith], he also includes many actual letters from Asquith to Venetia, which reveal not only how smitten he was with her, but some of the confidential details he wrote her.

Extremely well written, with a bit of intrigue, I think it’s well worth recommending to you.

Performance Attribution: A Look Back at a Timeless Article

Summary: Patrick W. Fowler

Original article by David Spaulding, DPS, CIPM

The 2009 article “Performance Attribution: An Introduction” by David Spaulding continues to provide a comprehensive overview of performance attribution, a key tool in investment performance measurement. The article helps performance and attribution professionals understand and communicate the effectiveness of their strategies.

Introduction to Performance Attribution

Performance attribution is an essential analytical tool for investment managers. Its purpose is to break down the sources of portfolio returns, allowing portfolio managers to determine what decisions contributed to outperformance or underperformance relative to a benchmark. This analysis becomes crucial in client communications and portfolio reviews, offering transparency on the outcomes of investment strategies.

Attribution itself isn’t a new concept; it is something professionals in many fields perform. For example, police officers and fire officials conduct causal investigations after accidents or fires, and sports teams review game strategies post-performance. Similarly, in the investment world, portfolio managers implement strategies and later assess their effectiveness, which is the core of attribution analysis.

Types of Attribution: Relative vs. Absolute

David distinguishes between relative attribution and absolute attribution, also referred to as “contribution.”

- Relative attribution involves reconciling to the excess return, defined as the portfolio’s return minus the benchmark return. This analysis seeks to understand the sources of relative outperformance or underperformance.

- Absolute attribution, on the other hand, focuses on the total return, examining what contributed to the overall performance of the portfolio, rather than its performance relative to a benchmark.

In practice, relative attribution is more commonly used by portfolio managers, especially when their performance is benchmarked against a market index. Absolute attribution may be more useful for highlighting specific investments or strategies that performed exceptionally well or poorly, without the comparative context of a benchmark.

Analyzing Portfolio Effects: Allocation and Selection Decisions

Investment strategies can typically be categorized as top-down or bottom-up approaches:

- Top-down managers begin by analyzing macroeconomic data and political events to predict how various sectors or industries might perform. They make allocation decisions based on their expectations of which sectors will outperform or underperform, by adjusting the portfolio’s sector weightings compared to the benchmark sector weightings accordingly.

- Bottom-up managers, in contrast, focus primarily on selection decisions of individual securities based on their fundamental qualities. Although these managers do not necessarily make explicit allocation decisions, differences in portfolio weightings relative to a benchmark can still impact returns. Therefore, even bottom-up managers should consider the effects of their allocation choices.

Performance attribution models help analyze two primary effects: allocation and selection. Allocation effects measure the impact of over- or under-weighting certain sectors relative to the benchmark. Selection effects assess the effectiveness of picking securities within those sectors.

Attribution Models: Brinson-Hood-Beebower (BHB) and Brinson-Fachler (BF)

Two of the most widely used models for equity attribution are the Brinson-Hood-Beebower (BHB) model and the Brinson-Fachler (BF) model. Both models offer frameworks for attributing excess returns to allocation and selection decisions, though they differ in key aspects.

- BHB Model: Developed in 1986, this model calculates attribution using three effects: allocation, selection, and interaction. The allocation effect is derived by multiplying the difference in portfolio and benchmark weights by the benchmark return for each sector. The selection effect, meanwhile, focuses on the portfolio manager’s skill in picking better-performing securities relative to the benchmark. The interaction effect accounts for situations where a manager’s allocation decision interacts with their selection decision.

- BF Model: The BF model, differs in how it calculates the allocation effect. The selection and interaction effects are identical in both models. Rather than using the sector’s benchmark return in the calculation, the BF model uses the sector’s benchmark return relative to the overall portfolio’s benchmark return. This approach may lead to significant differences in the allocation effect, especially when sectors perform poorly but still outperform the benchmark. The BF model rewards overweighting sectors that outperform the portfolio’s benchmark, regardless of whether their absolute return is positive or negative. The interaction effect accounts for situations where a manager’s allocation decision interacts with their selection decision.

Example Application of BHB and BF Models

Dave provides mathematical examples in the original paper demonstrating how these models operate. For instance, if a portfolio manager over-weights the technology sector and that sector outperforms, the BHB model would show a positive allocation effect. If the sector underperforms, the allocation effect would be negative.

The BF model, however, would consider the performance of the overall benchmark. If the technology sector performed poorly but still outperformed the overall benchmark, the BF model produces a positive allocation effect, rewarding the manager for their relative foresight. This divergence in results highlights the importance of understanding the model used, as different models can yield significantly different interpretations of the same investment strategy.

Challenges and Considerations

- Interaction Effect: One controversial aspect of attribution is the interaction effect, which results from the combination of allocation and selection decisions. Some argue interaction effect should be merged with selection or allocation, arguing that it complicates the analysis without adding meaningful insights. Others prefer it to be reported separately.

- Holdings-Based vs. Transaction-Based Attribution: Holdings-based models use the portfolio’s starting weights for the period, ignoring any transactions (such as buys, sells, or dividends) that occurred during the period. Transaction-based models account for these activities, providing more accurate and reconcilable results. Transaction-based attribution is preferred by most firms for its precision, especially in portfolios with high turnover.

Conclusion

The article emphasizes that performance attribution is not just a reporting tool but a critical part of the investment management process. It helps portfolio managers understand which decisions contributed to their performance and allows them to refine their strategies. Whether using the BHB or BF model or opting for holdings-based versus transaction-based attribution, it’s crucial to choose the model that best aligns with the investment philosophy and strategy of the portfolio manager. Additionally, maintaining clean data and ensuring reconciliation with official records are vital for producing accurate attribution results.

Performance attribution provides a powerful framework for ongoing portfolio analysis, enabling investment professionals to better understand and communicate the value of their decisions to clients and stakeholders.

Have an opinion? Please share it with Patrick Fowler.

GIPS is a registered trademark owned by CFA Institute.

Industry Dates and Conferences

- November 7-8 – Autumn EMEA Meeting of the Performance Measurement Forum – Barcelona, Spain

- November 20 – Fall Meeting of the Asset Owner Roundtable (AORT) – Charleston, SC

- November 21-22 – Fall North American Meeting of the Performance Measurement Forum – Charleston, SC

For information on the 2024 events,

please contact Patrick Fowler at 732-873-5700.

2025 Events Announcement

- April 23 – Spring Asset Owner Roundtable (AORT) – North America

- April 24-25 – Spring Meeting of the Performance Measurement Forum – North America

- May 20 – Women in Performance Measurement in-person meeting – The Heldrich Hotel, New Brunswick, NJ, U.S.A.

- May 21-22- PMAR North America – The Heldrich Hotel, New Brunswick, NJ, U.S.A.

- June 19-20 – Spring EMEA Meeting of the Performance Measurement Forum

- September 17-18 – PMAR Europe – London

- November 6-7 – Fall EMEA Meeting of the Performance Measurement Forum

- December 3 – Fall Asset Owner Roundtable (AORT) – North America

- December 4-5 – Fall Meeting of the Performance Measurement Forum – North America

Institute / Training

Access TSG’s Online Training

Content With One Pass

Additional Comment:

With respect to the defined terms and the glossary, we believe this guidance should be consistent with other GIPS guidance, where defined terms that can be found in the glossary are denoted with small capital letters. The use of an initial capital letter for defined terms is confusing.

We hope you found these comments helpful.

That’s a Good Question

I wanted to double check something that I think is implicit in these two bullets:

- Presenting more than one net return stream is acceptable.

- The model fee used to calculate net returns should be the highest fee, specifically stating it should not be the average.

Taken between the two, “the highest fee” seems like it would have to be the highest fee appropriate to the investor, and not the highest fee that anyone in the strategy was paying, right? i.e – if you have a composite with a combination of institutional/subadvisory accounts and direct/private wealth accounts, and have different fee schedules for the different classes, then you could still use a lower institutional schedule with institutional investors, a higher private wealth fee with private wealth investors, and potentially (though I don’t know why you would choose to do this) use the same GIPS Report for both by just showing a Net – Institutional and Net – Private Wealth column on the report, right? And that it just has to be the highest fee for each class used as a model, rather than the highest fee actually assessed to a composite account, even if that’s a private wealth account in a composite that’s also pitched to lower-fee institutional investors?

That’s always been my understanding under GIPS 2020, but I wanted to double check!

Response:

To satisfy SEC requirements, the net returns presented should reflect the deduction of a model fee that is equal to the highest fee charged to the intended audience to whom the advertisement is disseminated. The SEC’s Marketing Rule states if the fee to be charged to the intended audience is anticipated to be higher than the actual fees incurred by accounts represented in composite performance, the adviser must use a model fee that reflects the anticipated fee to be charged in order to not violate the rule’s general prohibitions. So, you are correct in your assessment that the highest fee can be based on the targeted audience, and reporting should be adjusted accordingly.

However, when firms use a model fee to calculate net returns, the GIPS Standards, permit a net return that is equal to or lower than what net returns would have been had actual fees incurred been used to calculate net returns; therefore, depending on what the accounts were charged throughout the track record, the GIPS Standards could be in conflict with the SEC requirements. In certain cases – e.g., when initial performance reflects a discounted fee – the Standards seem to have a lower bar, IMO, because they allow a net return that does not reflect the current fee schedule. IMO, when the SEC Marketing Rule was issued, the GIPS governing body addressed the conflict by advising firms to present more than one net return – one that met the SEC requirements and one that met the GIPS requirements – but I think that was in dispute for a while as some thought presenting more than one net return would be confusing. So, during last week’s conference, when the SEC panelist said that it was okay to present more than one net return, I considered it a key point.

I believe I’ve answered your questions but let me know if I can be of further assistance.

Please submit your questions to Patrick Fowler.

Potpourri

In The News

From David Spaulding, DPS, CIPM

In the August issue, we reviewed a book on Pete Rose, and had a poll regarding whether he should be admitted to the Baseball Hall of Fame.

Pete died on Monday, September 30, at the age of 83. This article, from the Wall Street Journal, suggests it’s time for him to be admitted. https://www.wsj.com/opinion/pete-rose-is-dead-now-reinstate-him-baseball-player-sports-betting-62ea02ff?st=paoEeQ&reflink=desktopwebshare_permalink

When I learned of his death, I thought it would not be appropriate, as it might be deemed an insult to wait for his death. However, perhaps the writer is correct. It’s at least something to think about, yes? Only time will tell.

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: January 13, 2025

Spring Issue: March 10, 2025

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.