Issue Contents:

Key Takeaways from CFA Institute’s Annual GIPS® Standards Conference

By: Jennifer Barnette, CIPM

The CFA Institute’s 28th Annual Global Investment Performance Standards (GIPS) Conference was held in San Diego, CA on September 17-18. One of the highlights of attending is the chance to reconnect with colleagues, industry contacts, and old friends. I find the real value in the relationships strengthened and conversations sparked during the event. Networking and catching up with fellow professionals are what makes the conference so rewarding, and it’s always refreshing to exchange ideas and discuss the latest trends with peers in the field. I would like to thank the speakers who participated in the panels and shared their valuable insights. Here are a few key takeaways from this year’s conference:

Ongoing Discussions on the SEC Marketing Rule

Firms and professionals are still adapting and debating the rule’s implications on investment performance advertising. The following points were made by two SEC panelists:

- Tend to see contribution as performance, not attribution.

- When presenting net and gross returns for private funds, both must be calculated the same way – e.g., you are not allowed to report a gross return that excludes a subscription line of credit and then a net return that includes it. You must disclose the effect of leverage, and it must specify what the drag will be when using subscription lines of credit; you cannot simply state that the return will be lower.

- Carve-outs vs. Extracted Performance. Hypothetical performance is “performance that no specific account received”, and firms must be ready to defend why they’ve classified performance as hypothetical or extracted, as applicable.

- An unclear response with respect to performance of funds/investments not previously held: is it hypothetical?

- Presenting more than one net return stream is acceptable.

- The model fee used to calculate net returns should be the highest fee, specifically stating it should not be the average.

- Recommend including a benchmark.

Additionally, per a CFAI panelist, when netting down sector returns, you must deduct from each sector the pro rata monthly rate, you cannot allocate the monthly rate according to each sector’s market value.

AI in Investment Performance Reporting

The adoption of AI in performance measurement, reporting, and auditing will “shift the role of the human.” Jobs focused on data gathering, linking, and cleaning will be the first roles to be replaced by AI. However, the audit function and training AI will be human for quite some time.

Updates on the GIPS Standards

Attendees were introduced to recent updates in GIPS guidelines, particularly those affecting OCIOs – the Guidance Statement for OCIO Strategies will be released by year-end – and BDPFs – the Guidance Statement on Firms Managing Only BDPFs was effective July 1, 2024. It was indicated that the GIPS Technical Committee will be forming a working group to tackle the subject of after-tax reporting. For now, they recommend you refer to the USIPC After-Tax Performance Standards, which were issued in 2011. Also, since they believe there is little consensus on how to calculate private fund returns, they plan to provide guidance on this subject – “hopefully.”

These insights highlight the evolving landscape of investment performance reporting and the crucial role that a mastery of the domestic regulatory requirements and the GIPS standards plays in ensuring transparency and consistency in the financial industry.

GIPS Standards: Important Updates and New Guidance

By: Ashley Reeves, CIPM

The Global Investment Performance Standards (GIPS) continue to evolve, with several important updates provided during the GIPS Standards Update session at the 28th Annual GIPS Standards Conference held on September 17-18, 2024, in San Diego, CA.

As of July 31, 2024, 1,785 organizations in 51 markets, claim compliance with the GIPS standards. Among these, 85 of the top 100 global firms, and 25 of the top 25, adhere to the GIPS standards for some or all of their assets. The top five markets are US, UK, Canada, Switzerland, and Japan, and 2024 a new market entrant in Brazil.

New Guidance – Guidance Statement on Firms Managing Only Broad Distribution Pooled Funds (BDPFs)

With the release of the Guidance Statement, firms that manage only BDPFs now have more flexibility in reporting. These firms are not required to provide GIPS Reports to prospective investors. The new guidance outlines how firms handle reporting to consultant databases or responding to requests for proposals (RFPs) without preparing GIPS Reports or GIPS Advertisements. The guidance also clarifies that generally the requirements for input data and return calculations apply, but composite construction and GIPS report distribution would not apply unless the firm chooses to prepare GIPS Reports. If the firm chooses to prepare GIPS Reports, then the firm would not follow this Guidance Statement, but would comply with all of the applicable requirements of the GIPS Standards for Firms. The Guidance Statement is effective for periods beginning on or after July 1, 2024.

This flexibility is a significant step for firms managing BDPFs, allowing them to balance compliance with operational efficiency. Firms choosing verification will also have a reduced scope if they do not prepare GIPS Reports or GIPS Advertisements, as key components normally verified, such as report distribution, may not exist in these cases.

Changes for Outsourced Chief Investment Officer (OCIO) Portfolios

OCIO portfolios, where a firm provides both strategic investment advice and investment management services, are also receiving focused guidance. Due to the unique nature of OCIOs, such as bespoke portfolio management, discretionary considerations, and legacy assets, the existing GIPS standards are not always a good fit for OCIOs. It was determined that OCIO-specific guidance was needed to address these considerations and improve consistency, transparency, and comparability in performance presentation and fees.

The draft Guidance Statement included some key concepts, such as a new required OCIO composite structure, based on the allocation of liability-hedging versus growth assets, or growth versus risk-mitigating assets. Additionally, both gross-of-fees and net-of-fees returns will need to be presented for these composites. This guidance was open for public comment and CFA Institute received over 30 comment letters, including one from TSG. The guidance is expected to be finalized by December 2024.

Streamlined Benchmark Disclosure – Portfolio-Weighted Custom Benchmark Q&A

A portfolio-weighted custom benchmark is one that is created from the benchmarks of the individual portfolios that participate in the composite. Firms that use portfolio-weighted custom benchmarks, particularly in complex strategies like liability-driven investing (LDI) or multi-asset strategies, now have more options when disclosing benchmark components.

When using this type of benchmark, the following must be disclosed:

- That the benchmark is rebalanced using the weighted average returns of the benchmarks of all of the portfolios included in the composite

- The frequency of the rebalancing

- The components that constitute the portfolio-weighted custom benchmark, including the weights that each component represents, as of the most recent annual period end

- That the components that constitute the portfolio-weighted custom benchmark, including the weights that each component represents, are available for prior periods upon request

These custom benchmarks can lead to lengthy disclosures when there are a significant number of underlying components. While the Guidance Statement on Benchmarks for Firms provided some relief by not requiring disclosure for smaller benchmark components, new guidance was recently released in a Q&A to provide more relief.

Instead of listing every individual benchmark, firms can now determine how best to disclose the components given the strategy and can now provide aggregated component information based on criteria such as individual benchmarks, regions or asset classes, or other relevant criteria important to the management of the portfolios, e.g., duration groupings for LDI.

This adjustment addresses concerns about the increasing length of benchmark disclosures, which could overwhelm prospective clients. Firms are still required to offer detailed component data upon request, maintaining transparency while allowing for more concise reporting.

Upcoming Guidance and Resources

Several new tools and resources are in development to help firms navigate these updates. A Guide for Creating a GIPS Standards Policies and Procedures Manual for Firms Managing Only BDPFs was issued in July 2024. An SEC Marketing Rule Survey Report was issued in August 2024. Additional resources, such as whitepapers on attribution reporting and trade errors, will be issued for public comment soon. And CFA Institute appears to be considering additional guidance for calculating after-tax returns and addressing performance-based fees.

Upcoming guidance initiatives include:

- Draft GIPS Standards for Verifiers verification guidance specific to asset owners

- Draft GIPS Standards for Verifiers verification guidance specific to fiduciary managers

- Handbook for GIPS Standards for Verifiers

As the GIPS Standards expand their reach and adapt to industry needs, these changes are designed to help firms meet regulatory requirements while enhancing flexibility and transparency for asset owners, fiduciary managers, and OCIO portfolios.

If you need help with GIPS or anything related to performance measurement services, contact us today.

Have an opinion? Please share it with Patrick Fowler.

GIPS is a registered trademark owned by CFA Institute.

Quote of the Month

“This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

– Winston Churchill, following an early British victory in WWII.

GIPS® Tips

Experience “White Glove” GIPS Standards Verification With TSG

Are you tired of being treated like just another number by your GIPS verifier? At TSG, we prioritize your satisfaction and success above all else.

Partnering with us means gaining access to a team of seasoned GIPS specialists dedicated to delivering unparalleled service and exceptional value. Whether you’re seeking a new verifier, preparing for your initial verification, or just starting to explore GIPS compliance, TSG is the best choice.

Why Choose TSG?

Unmatched Expertise: Our experienced team brings unmatched proficiency in the GIPS standards, ensuring thorough and efficient (not “never-ending”) verifications.

Personalized Support: We understand that the journey toward GIPS compliance is complex. That’s why we offer ongoing support and guidance as needed, as well as access to a suite of exclusive proprietary tools, designed to make compliance and verification as easy as possible for you and your firm.

Actionable Insights: When you choose TSG, you will work with ONLY highly experienced senior-level GIPS and performance specialists. Their expertise translates into actionable advice, helping you navigate the complexities of the Standards in the most ideal way for your firm.

Hassle-Free Experience: At TSG, we guarantee your satisfaction and we do not lock our clients into long-term contracts.

Ready to Experience the TSG Difference?

Take the first step toward a better GIPS standards verification. Schedule a call or request a no-obligation proposal today at GIPSStandardsVerifications.com.

The Journal of Performance Measurement®

This month’s article brief spotlights “The Performance and Risk of AI: More than a Choice of Prepositions” by Dan diBartolomeo, which was published in the Summer 2024 issue of The Journal of Performance Measurement. You can access this article by subscribing (for free) to The Journal (link here).

This article examines three aspects of the current heightened interest in “artificial intelligence” (AI) methods within the financial services sector. We begin with a review of the philosophical and conceptual timeline that has brought forward the use of autonomous analytical processes for investments. Secondly, we discuss a few applications that have already emerged in relation to the analysis of investment performance and risk, and the communication of such information to stakeholders. Finally, we close with comments on the emerging business risks that arise from the use of AI methods, and how such risks can be mitigated through sensible governance and expanded regulation.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

To confirm your email address, click the graphic below. If you’re a subscriber but haven’t received a link to the current issue, please reach out to Doug Spaulding at DougSpaulding@TSGperformance.com.

ATTN: TSG Verification Clients

As a reminder, all TSG verification clients receive full, unlimited access to our Insiders.TSGperformance.com site filled with tools, templates, checklists, and educational materials designed to make compliance and verification as easy as possible for you and your firm.

Contact CSpaulding@TSGperformance.com if you have any questions or are having trouble accessing the site.

TSG Milestones

Agendas Announced for Fall Meetings of

The Performance Measurement Forum

November 7-8, 2024 – Barcelona, Spain (In-person/Hybrid option)

November 21-22, 2024 – Charleston, SC (In-person/Hybrid option)

The Performance Measurement Forum has met 105 times over the past 25 years, and our next meetings are scheduled for November in Barcelona, Spain and Charleston, SC.

The Performance Measurement Forum and Asset Owner Roundtable are interactive networking and practical information exchanges where performance measurement professionals examine important topics in an atmosphere conducive to dialogue, knowledge sharing, and networking. Members engage with global industry leaders to explore a variety of performance and risk topics, implementation strategies, management challenges, and policy solutions that directly apply and influence their proficiencies and effectiveness.

These one-of-a-kind learning and information exchange environments provide the capabilities and resources to give today’s performance measurement professionals the knowledge necessary to benefit themselves and their organizations.

Contact Patrick Fowler if you would like information about how you can be part of this dynamic group.

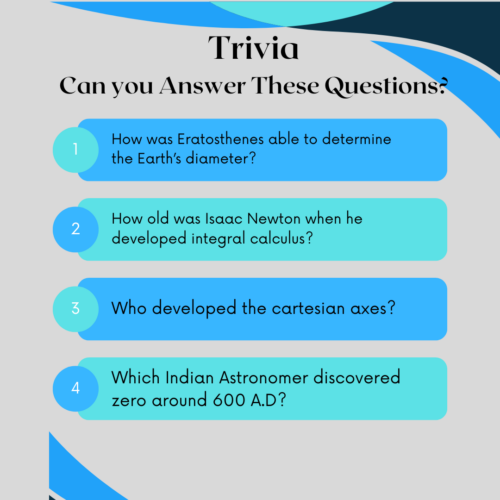

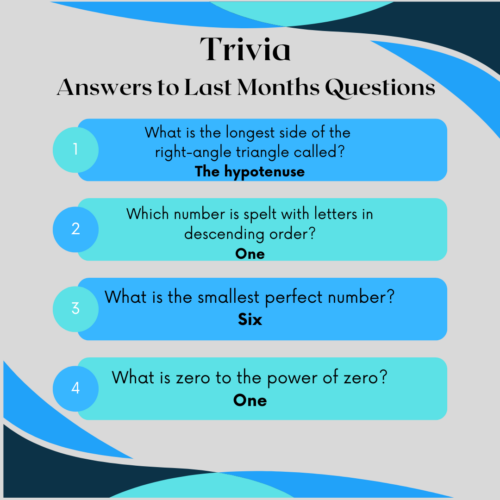

TRIVIA TIME

Here’s This Month’s Trivia Questions; Answers In The Next Issue!

Submit your responses to: PFowler@TSGpeformance.com

Please submit your trivia solution or puzzle ideas to Patrick Fowler.

Book Review

Faster Cures, by Michael Milken

Review by David D. Spaulding, DPS, CIPM

I read this book with great interest and enthusiasm. I had come to know a bit more about Michael Milken, formerly known as the “junk bond” king, in a book by one of his colleagues, Richard Sandler (Witness to a Prosecution: The Myth of Michael Milken). Prior to founding TSG in 1990, I worked for Integrated Resources Asset Management, a firm that had a long history with Milken’s former firm, Drexel Burnham, and Milken himself.

It’s fairly well known that Milken was diagnosed with prostate cancer several years ago; and, perhaps, that it was deemed terminal. In this book, Milken describes his, what could be called, “full court press” to get the disease under control and absent from his body. Well, he succeeded. And, he has devoted several decades to healthcare, in general, with an emphasis on cancer.

I was struck by this quote: “In the 1967 movie The Graduate, Dustin Hoffman stars as a twenty-one-year-old who’s unsure about his career path. An older man pulls him aside and says ‘I just want to say one word to you. Just one word. Are you listening? Plastics! There’s a great future in plastics.’ If a new version of the Academy Award-winning comedy were being made today, that line would have to be updated. The one word would be ‘performance measurement.’”* Who knew he held our industry in such high regard?

Okay, I lied; that’s not what Milken wrote. The “one word” he used is “bioscience.” Recall I was a politician, and so, at times, prone to lying. But, I digress …

He covers a lot of ground, including discussing several of the breakthroughs that have occurred in medicine and treatment.

The book provides quite a bit of detail on Milken, his family, and his life, but with much devoted to the book’s main focus: finding faster cures; accelerating the future of health.

In its penultimate chapter, Milken wrote: “Shocking statistics … make it clear that your zip code is more important that your genetic code when it comes to enjoying a long life.” Examples cited include “In Baltimore’s inner city, a man’s life expectancy is sixteen years, not far away, in the Greater Roland Park/Poplar neighborhood, it’s eighty-three.” Many of us can achieve longer lifespans because of the zip code we were born in and/or live in; but, of course, it’s also, to a large extent, based on the decisions we make.

Many of us have lost loved ones and friends to disease [personally, the ones that hit me the hardest were my mother, in 1964, to breast cancer, and my first wife, to idiopathic pulmonary fibrosis (IPF) in 2020]. Cancer isn’t under control, but hearing the “c” word today shouldn’t bring the same level of fear as it once did; there at least seems a degree of hope. As for IPF, I’m unaware of anything major, though know research continues.

I was particularly struck by the final chapter, “The Blessing of Meaningful Lives.” Even before beginning its first chapter, the title grabbed me. Should it not be a goal to have what might be termed a “meaningful life”? Maybe something to reflect upon, to see where we each stand, and how we might take steps to achieve this. And, its final section is titled “Summing up the Blessings.” Reflecting on this personally, I realize I have been so very blessed in many, many ways. I should take some time to consider what I can do to achieve a “meaningful life,” as well as to summarize my many blessings.

The book is quite well written, and I recommend it. You may benefit in many ways from what Milken shares.

Key Takeaways from CFA Institute’s Annual GIPS® Standards Conference

By: Jennifer Barnette, CIPM

The CFA Institute’s 28th Annual Global Investment Performance Standards (GIPS) Conference was held in San Diego, CA on September 17-18. One of the highlights of attending is the chance to reconnect with colleagues, industry contacts, and old friends. I find the real value in the relationships strengthened and conversations sparked during the event. Networking and catching up with fellow professionals are what makes the conference so rewarding, and it’s always refreshing to exchange ideas and discuss the latest trends with peers in the field. I would like to thank the speakers who participated in the panels and shared their valuable insights. Here are a few key takeaways from this year’s conference:

Ongoing Discussions on the SEC Marketing Rule

Firms and professionals are still adapting and debating the rule’s implications on investment performance advertising. The following points were made by two SEC panelists:

- Tend to see contribution as performance, not attribution.

- When presenting net and gross returns for private funds, both must be calculated the same way – e.g., you are not allowed to report a gross return that excludes a subscription line of credit and then a net return that includes it. You must disclose the effect of leverage, and it must specify what the drag will be when using subscription lines of credit; you cannot simply state that the return will be lower.

- Carve-outs vs. Extracted Performance. Hypothetical performance is “performance that no specific account received”, and firms must be ready to defend why they’ve classified performance as hypothetical or extracted, as applicable.

- An unclear response with respect to performance of funds/investments not previously held: is it hypothetical?

- Presenting more than one net return stream is acceptable.

- The model fee used to calculate net returns should be the highest fee, specifically stating it should not be the average.

- Recommend including a benchmark.

Additionally, per a CFAI panelist, when netting down sector returns, you must deduct from each sector the pro rata monthly rate, you cannot allocate the monthly rate according to each sector’s market value.

AI in Investment Performance Reporting

The adoption of AI in performance measurement, reporting, and auditing will “shift the role of the human.” Jobs focused on data gathering, linking, and cleaning will be the first roles to be replaced by AI. However, the audit function and training AI will be human for quite some time.

Updates on the GIPS Standards

Attendees were introduced to recent updates in GIPS guidelines, particularly those affecting OCIOs – the Guidance Statement for OCIO Strategies will be released by year-end – and BDPFs – the Guidance Statement on Firms Managing Only BDPFs was effective July 1, 2024. It was indicated that the GIPS Technical Committee will be forming a working group to tackle the subject of after-tax reporting. For now, they recommend you refer to the USIPC After-Tax Performance Standards, which were issued in 2011. Also, since they believe there is little consensus on how to calculate private fund returns, they plan to provide guidance on this subject – “hopefully.”

These insights highlight the evolving landscape of investment performance reporting and the crucial role that a mastery of the domestic regulatory requirements and the GIPS standards plays in ensuring transparency and consistency in the financial industry.

GIPS Standards: Important Updates and New Guidance

By: Ashley Reeves, CIPM

The Global Investment Performance Standards (GIPS) continue to evolve, with several important updates provided during the GIPS Standards Update session at the 28th Annual GIPS Standards Conference held on September 17-18, 2024, in San Diego, CA.

As of July 31, 2024, 1,785 organizations in 51 markets, claim compliance with the GIPS standards. Among these, 85 of the top 100 global firms, and 25 of the top 25, adhere to the GIPS standards for some or all of their assets. The top five markets are US, UK, Canada, Switzerland, and Japan, and 2024 a new market entrant in Brazil.

New Guidance – Guidance Statement on Firms Managing Only Broad Distribution Pooled Funds (BDPFs)

With the release of the Guidance Statement, firms that manage only BDPFs now have more flexibility in reporting. These firms are not required to provide GIPS Reports to prospective investors. The new guidance outlines how firms handle reporting to consultant databases or responding to requests for proposals (RFPs) without preparing GIPS Reports or GIPS Advertisements. The guidance also clarifies that generally the requirements for input data and return calculations apply, but composite construction and GIPS report distribution would not apply unless the firm chooses to prepare GIPS Reports. If the firm chooses to prepare GIPS Reports, then the firm would not follow this Guidance Statement, but would comply with all of the applicable requirements of the GIPS Standards for Firms. The Guidance Statement is effective for periods beginning on or after July 1, 2024.

This flexibility is a significant step for firms managing BDPFs, allowing them to balance compliance with operational efficiency. Firms choosing verification will also have a reduced scope if they do not prepare GIPS Reports or GIPS Advertisements, as key components normally verified, such as report distribution, may not exist in these cases.

Changes for Outsourced Chief Investment Officer (OCIO) Portfolios

OCIO portfolios, where a firm provides both strategic investment advice and investment management services, are also receiving focused guidance. Due to the unique nature of OCIOs, such as bespoke portfolio management, discretionary considerations, and legacy assets, the existing GIPS standards are not always a good fit for OCIOs. It was determined that OCIO-specific guidance was needed to address these considerations and improve consistency, transparency, and comparability in performance presentation and fees.

The draft Guidance Statement included some key concepts, such as a new required OCIO composite structure, based on the allocation of liability-hedging versus growth assets, or growth versus risk-mitigating assets. Additionally, both gross-of-fees and net-of-fees returns will need to be presented for these composites. This guidance was open for public comment and CFA Institute received over 30 comment letters, including one from TSG. The guidance is expected to be finalized by December 2024.

Streamlined Benchmark Disclosure – Portfolio-Weighted Custom Benchmark Q&A

A portfolio-weighted custom benchmark is one that is created from the benchmarks of the individual portfolios that participate in the composite. Firms that use portfolio-weighted custom benchmarks, particularly in complex strategies like liability-driven investing (LDI) or multi-asset strategies, now have more options when disclosing benchmark components.

When using this type of benchmark, the following must be disclosed:

- That the benchmark is rebalanced using the weighted average returns of the benchmarks of all of the portfolios included in the composite

- The frequency of the rebalancing

- The components that constitute the portfolio-weighted custom benchmark, including the weights that each component represents, as of the most recent annual period end

- That the components that constitute the portfolio-weighted custom benchmark, including the weights that each component represents, are available for prior periods upon request

These custom benchmarks can lead to lengthy disclosures when there are a significant number of underlying components. While the Guidance Statement on Benchmarks for Firms provided some relief by not requiring disclosure for smaller benchmark components, new guidance was recently released in a Q&A to provide more relief.

Instead of listing every individual benchmark, firms can now determine how best to disclose the components given the strategy and can now provide aggregated component information based on criteria such as individual benchmarks, regions or asset classes, or other relevant criteria important to the management of the portfolios, e.g., duration groupings for LDI.

This adjustment addresses concerns about the increasing length of benchmark disclosures, which could overwhelm prospective clients. Firms are still required to offer detailed component data upon request, maintaining transparency while allowing for more concise reporting.

Upcoming Guidance and Resources

Several new tools and resources are in development to help firms navigate these updates. A Guide for Creating a GIPS Standards Policies and Procedures Manual for Firms Managing Only BDPFs was issued in July 2024. An SEC Marketing Rule Survey Report was issued in August 2024. Additional resources, such as whitepapers on attribution reporting and trade errors, will be issued for public comment soon. And CFA Institute appears to be considering additional guidance for calculating after-tax returns and addressing performance-based fees.

Upcoming guidance initiatives include:

- Draft GIPS Standards for Verifiers verification guidance specific to asset owners

- Draft GIPS Standards for Verifiers verification guidance specific to fiduciary managers

- Handbook for GIPS Standards for Verifiers

As the GIPS Standards expand their reach and adapt to industry needs, these changes are designed to help firms meet regulatory requirements while enhancing flexibility and transparency for asset owners, fiduciary managers, and OCIO portfolios.

If you need help with GIPS or anything related to performance measurement services, contact us today.

Have an opinion? Please share it with Patrick Fowler.

GIPS is a registered trademark owned by CFA Institute.

Industry Dates and Conferences

- November 7-8 – Autumn EMEA Meeting of the Performance Measurement Forum – Barcelona, Spain

- November 20 – Fall Meeting of the Asset Owner Roundtable (AORT) – Charleston, SC

- November 21-22 – Fall North American Meeting of the Performance Measurement Forum – Charleston, SC

For information on the 2024 events,

please contact Patrick Fowler at 732-873-5700.

Institute / Training

Access TSG’s Online Training

Content With One Pass

Additional Comment:

With respect to the defined terms and the glossary, we believe this guidance should be consistent with other GIPS guidance, where defined terms that can be found in the glossary are denoted with small capital letters. The use of an initial capital letter for defined terms is confusing.

We hope you found these comments helpful.

That’s a Good Question

I wanted to double check something that I think is implicit in these two bullets:

- Presenting more than one net return stream is acceptable.

- The model fee used to calculate net returns should be the highest fee, specifically stating it should not be the average.

Taken between the two, “the highest fee” seems like it would have to be the highest fee appropriate to the investor, and not the highest fee that anyone in the strategy was paying, right? i.e – if you have a composite with a combination of institutional/subadvisory accounts and direct/private wealth accounts, and have different fee schedules for the different classes, then you could still use a lower institutional schedule with institutional investors, a higher private wealth fee with private wealth investors, and potentially (though I don’t know why you would choose to do this) use the same GIPS Report for both by just showing a Net – Institutional and Net – Private Wealth column on the report, right? And that it just has to be the highest fee for each class used as a model, rather than the highest fee actually assessed to a composite account, even if that’s a private wealth account in a composite that’s also pitched to lower-fee institutional investors?

That’s always been my understanding under GIPS 2020, but I wanted to double check!

Response:

To satisfy SEC requirements, the net returns presented should reflect the deduction of a model fee that is equal to the highest fee charged to the intended audience to whom the advertisement is disseminated. The SEC’s Marketing Rule states if the fee to be charged to the intended audience is anticipated to be higher than the actual fees incurred by accounts represented in composite performance, the adviser must use a model fee that reflects the anticipated fee to be charged in order to not violate the rule’s general prohibitions. So, you are correct in your assessment that the highest fee can be based on the targeted audience, and reporting should be adjusted accordingly.

However, when firms use a model fee to calculate net returns, the GIPS Standards, permit a net return that is equal to or lower than what net returns would have been had actual fees incurred been used to calculate net returns; therefore, depending on what the accounts were charged throughout the track record, the GIPS Standards could be in conflict with the SEC requirements. In certain cases – e.g., when initial performance reflects a discounted fee – the Standards seem to have a lower bar, IMO, because they allow a net return that does not reflect the current fee schedule. IMO, when the SEC Marketing Rule was issued, the GIPS governing body addressed the conflict by advising firms to present more than one net return – one that met the SEC requirements and one that met the GIPS requirements – but I think that was in dispute for a while as some thought presenting more than one net return would be confusing. So, during last week’s conference, when the SEC panelist said that it was okay to present more than one net return, I considered it a key point.

I believe I’ve answered your questions but let me know if I can be of further assistance.

Please submit your questions to Patrick Fowler.

Potpourri

In The News

From David Spaulding, DPS, CIPM

In the August issue, we reviewed a book on Pete Rose, and had a poll regarding whether he should be admitted to the Baseball Hall of Fame.

Pete died on Monday, September 30, at the age of 83. This article, from the Wall Street Journal, suggests it’s time for him to be admitted. https://www.wsj.com/opinion/pete-rose-is-dead-now-reinstate-him-baseball-player-sports-betting-62ea02ff?st=paoEeQ&reflink=desktopwebshare_permalink

When I learned of his death, I thought it would not be appropriate, as it might be deemed an insult to wait for his death. However, perhaps the writer is correct. It’s at least something to think about, yes? Only time will tell.

Article Submissions

The Journal of Performance Measurement® Is Currently Accepting Article Submissions

The Journal of Performance Measurement is currently accepting article submissions on topics including performance measurement, risk, ESG, AI, and attribution. We are particularly interested in articles that cover practical performance issues and solutions that performance professionals face every day. All articles are subject to a double-blind review process before being approved for publication. White papers will also be considered. For more information and to receive our manuscript guidelines, please contact Douglas Spaulding at DougSpaulding@TSGperformance.com.

Submission deadlines

Winter Issue: January 13, 2025

Spring Issue: March 10, 2025

GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.